Which Is Better for Your Business in Pakistan-Private Limited or Sole Proprietorship? Many people get confused with the same question: Should you register your business as a Sole Proprietorship or a Private Limited Company?

Whether you are a freelancer, run an online store, own a shop, service provider, doctor, engineer, factory owner, manufacturer, wholesaler, distributer or lawyer, most people do not understand which category is right for them.

In which structure you have to pay less tax? In which there is less risk? or in which business growth is faster?

What is Sole Proprietorship?

A ‘sole trader’ is actually an individual who is running his own business. The law only recognized the individual who managed the business not the business itself. i.e if Mr. Aslam running a business as ‘’Aslam General Store’’, The law knows only the Mr. Aslam but no concern with ‘’Aslam General Store’’. So all the liabilities, obligations and any legal violations of the business are personal to that individual.

What is a Company?

On the other hand, a company has its own separate legal status. It is considered a separate legal person from the owner of the business.

For example, ABC Private Limited is a company and its director is Mr. A. Mr. A is a separate legal person and ABC Private Limited is also considered a separate legal person.

Artificial and Natural Legal Person: Understanding Business Structures:

A simple example is that if ‘’ABC (Pvt.) Ltd.’’ is fined, the entity itself will pay the fine. The directors of the company, such as Mr. A, will not pay anything from their own pockets.

This is the real difference between ‘’Aslam General Store’’ and ‘’ABC Private Limited’’ in one the liability is unlimited while in the other the liability is limited.

The entity itself is liable for the liability of the entity, the director is not personally liable.

The main difference between the two is that a company is an artificial legal person while an individual is a natural person. But under the law, both are treated as one legal person.

Sole Proprietorship Registration is Simple

- This is the simplest and easiest business structure in Pakistan:

- You are the sole owner

- There are no partners, directors or shareholders

- You can start your business just by getting an NTN from FBR

- Compliances are very low and filing is very easy

- Bank account is also opened comfortably in the name of your business

- Low cost, less documentation, and fast registration

The Company Must Be Registered Separately

- is required to be Register with SECP

- The corporation and you are considered two separate persons

- The assets, liabilities, debts of the corporation are all separate from the directors

- There can be two or more shareholders

- But remember! Single Member Company (SMC) is also available, meaning one person can form a company only one nominee is required

Which Is Better for Your Business in Pakistan-Private Limited or Sole Proprietorship? Tax Implications

There is a clear difference between individual and corporate taxation.

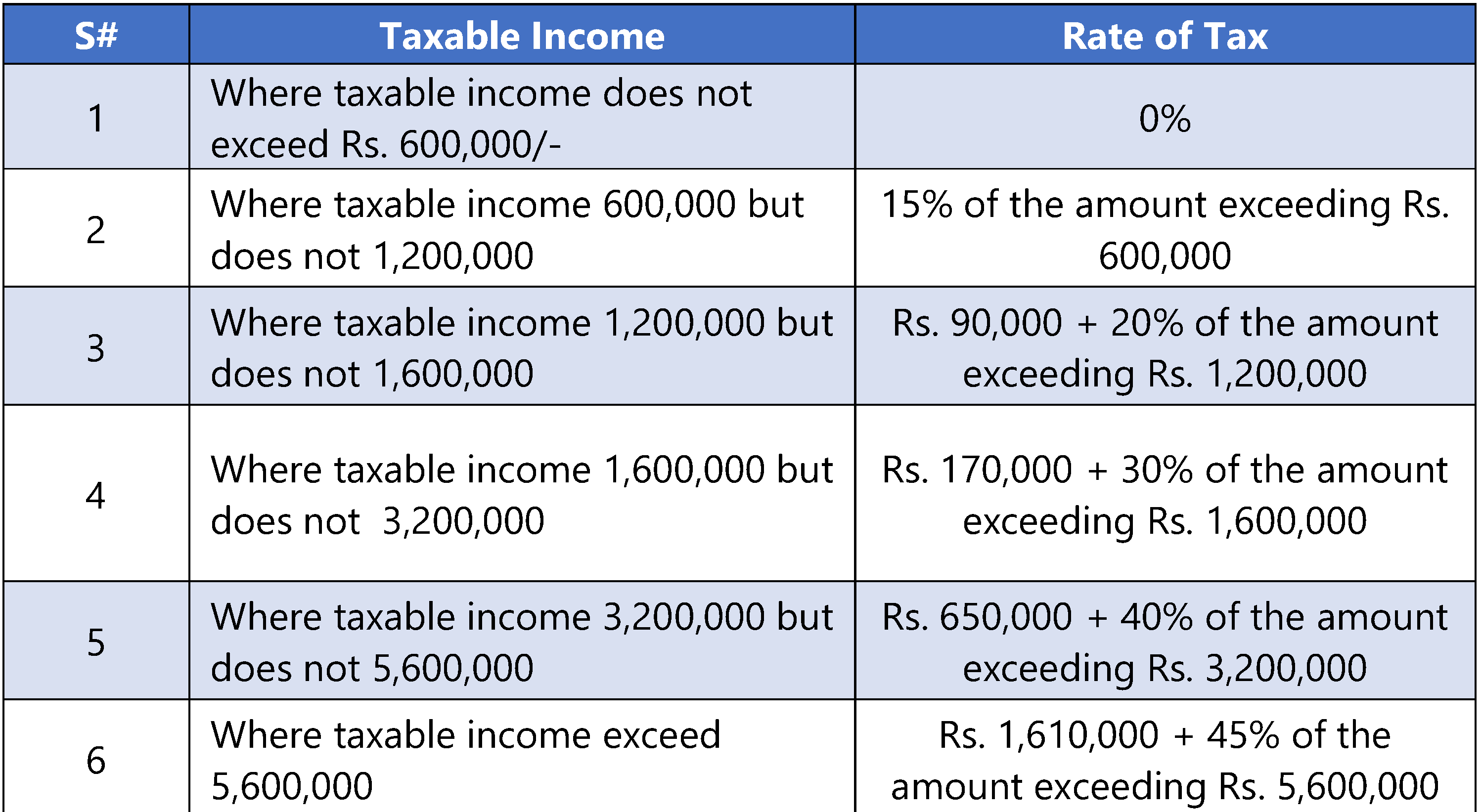

The tax rate for individuals is progressive, meaning the higher the profit, the higher the rate will be applicable. Currently, the individual tax rate starts from 15% and goes up to a maximum of 45%.

On the other hand, there is a fixed rate for companies. The Small companies are taxed at 20%, and a small company is one whose annual turnover does not exceed Rs. 250 million. Whereas other companies will be taxed at 29%.

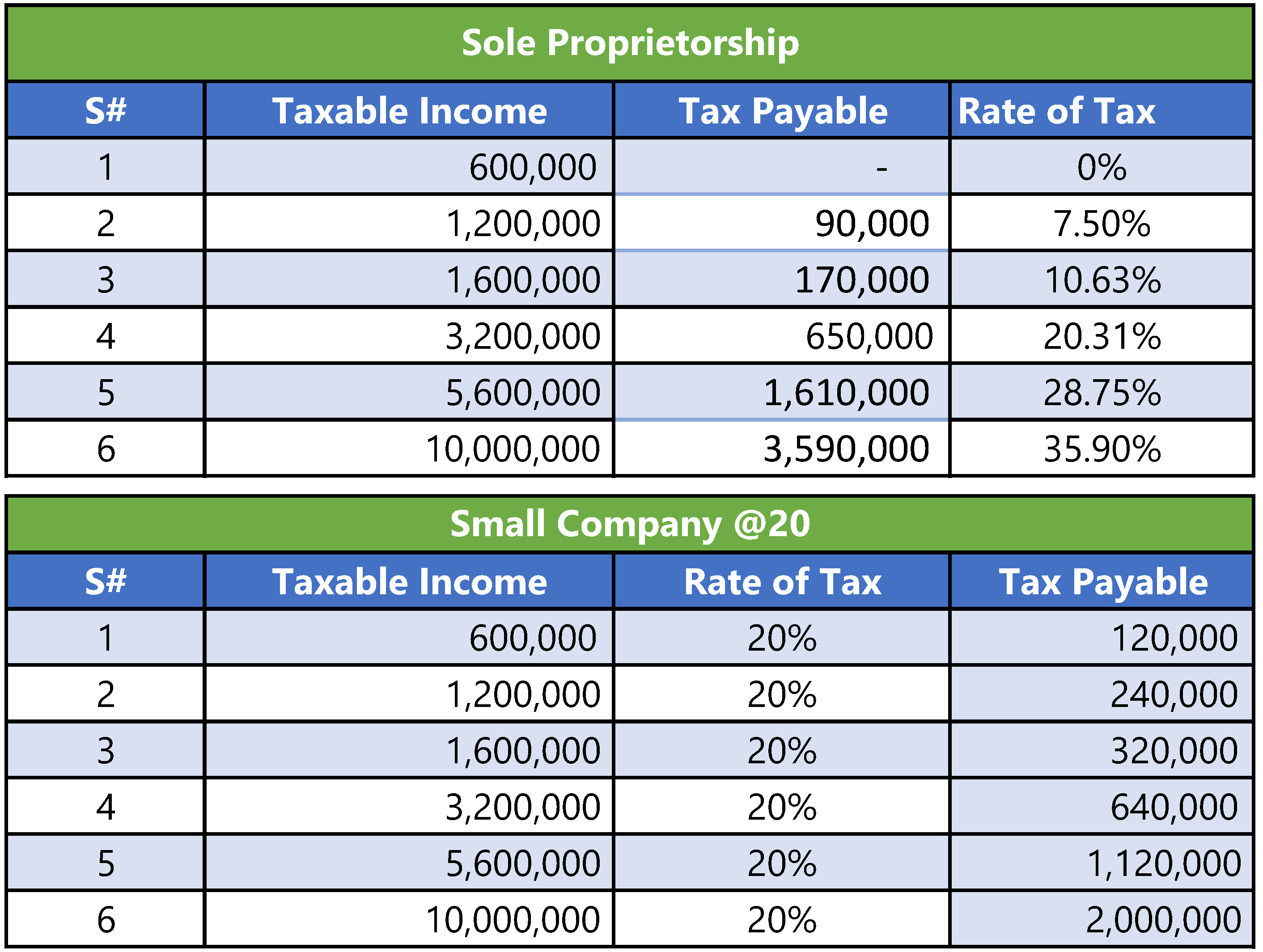

Tax Comparison of Sole Proprietorship and Private Limited Company On Different Profits

If the annual profit of a business is Rs. 5.6 million:

Then in case of individual business, it can be taxed at a rate of up to 35%, the tax that will be pay is 1,610,000.

Corporate tax will be levied at a rate of 20%, which amounts to 1,120,000.

| Sole Proprietorship @ Progressive Rates | Private Limited @ 20% | ||

| Annual Profit | 5,600,000 | 1,610,000 | 1,120,000 |

Another Practical Example

If your annual profit is Rs 10 million:

1. Sole Proprietorship

Progressive tax rate applies.

Approximately 45% tax is levied on this income.

That is, the tax amount will be approximately Rs 3,590,000.

2. Private Limited Company

Fixed tax rate applies.

At a rate of 20%, the tax will be only Rs 2,000,000.

Difference

In case of Sole Proprietorship the business has to pay 1,590,000 more than a company.

Individuals vs. Companies: Summary of Tax Differences on Profit Growth

If we compare company and individual (civil proprietorship), it is clear that if your annual profit is up to about Rs. 32 lakh, then as an individual, the rate on you can reach 20%. Above this, the individual tax rate increases further.

While in comparison, the maximum rate for a company is 29%. Therefore, if your profit is above the 5,600,000 i.e. the high slab, then you as an individual may have to pay tax up to 45%.

Choosing the Best Tax Structure Based on Profit

The result is that if your profit is between Rs. 2.5 to 3 lakh per month (about Rs. 30–36 lakh per year), then it is better for you to work in civil proprietorship.

But if you are earning more than this, your tax burden will be higher due to the increase in individual slabs, and in that case, a company structure may be more beneficial. Here is Comparative Analysis of Tax Rates for both Companies & Sole Proprietorship

Deduction of withholding taxes:

A company automatically becomes a withholding agent from the day it registers. On the other hand, a sole proprietorship (sole proprietorship) becomes a withholding agent when its annual turnover exceeds Rs 100 million on average in the last three years.

The company’s primary responsibility is to deduct and deposit taxes as per the rules laid down by the FBR. It does not pay any taxes out of its own pocket, but is required to deduct and deposit taxes on any payment made whether it is rent, payment to a supplier, purchase of goods, or salary to an employee wherever the taxes are applicable.

Turnover Tax Requirements and Exemptions for Individual Businesses:

A company is also required to pay turnover tax on its sales revenue, even if the company is not making a loss. However, the minimum turnover tax rate varies for different businesses. For example:

Pharmaceutical distributors have a minimum tax rate of 0.25%,

Poultry feed has a rate of 0.75%,

while all other businesses have a minimum turnover tax rate of 1.25%.

This tax can be adjusted later in subsequent years, but it is mandatory to pay.

There is a turnover tax exemption for individual businesses (Individual / Sole Trader). If the annual revenue is less than 100 million (10 crores), then the individual business does not have to pay this tax.

Legal Compliances of a Company (SECP Filing):

If you form a company, then legal compliance and filing responsibilities increase with it. For an individual business, only filing a tax return is sufficient, while for a company:

- Each director will file his annual income tax return separately

- The company is required to file its annual filing with the SECP

- Appointment of an auditor (if required by law)

- Appointment of a legal advisor (where necessary)

- Other corporate mandatory documents and returns also have to be filed

Cost of SECP Filing:

Now the problem is that Corporate compliance costs are high. The bigger your corporation the more legal requirements you have, the more your costs will increase.

You have to appoint an auditor and pay his fees, get the annual accounts audited. You will have to submit the corporation’s annual returns (FBR) and other annual filings (SECP).

Therefore, the compliance cost for a company is relatively high.

On the contrary, there are no major filing or legal requirements for an Individual/ Sole Proprietor. He only has to file income tax once a year.

Choosing Registration According to Business Needs: Which Structure Is Better?

It depends on your business.

If you are running a Start-up or small business, with few employees, less income and low turnover, it is better for you to remain in civil proprietorship. No need to register a company.

But if your business requires a lot of investment, or you want to start a big project for example, a manufacturing unit and you have more than two partners involved, then registering a company is a more appropriate and safer option.

Why Registration Is Necessary for Large Companies?

- Because big companies mostly like to do business with a Corporation.

- It is easy to open a Corporation ‘s bank account, maintain its status. Getting a bank loan for a Corporation is also relatively easy.

- Many government loan schemes are only for companies, to participate in it, it is necessary to have a company.

- There are also some other businesses where it is necessary to have a registered company that is at least two years old.

- Therefore, if your goal is a big business, having a company is beneficial for you.

- If you need any information about Which Is Better for Your Business in Pakistan — Private Limited or Sole Proprietorship? please contact us or reach out via our social media accounts.