Ultimate 2025 Guide to Calculate Capital Gain Tax in Pakistan: Capital Gain Tax is on the profit or gain earned from the disposal of a capital asset.

Capital asset is the property of any kind including both movable or immovable property.

Movable Property:

Movable property all valuable things including gold, paintings, sculptures, drawing, other works of art, jewellery, rare manuscript, folio, postage stamp, first-day cover, coin, medallion, or antique.

Immovable Property:

Immovable property includes agricultural, residential, or commercial property land and buildings, house or flat.

Other Examples of capital assets

· Shares (Ordinary, Right, Bonus)

· Certificates ( Modaraba, Musharika)

· PTC Vouchers, Goodwill, Patent, Copyrights

Meaning of disposal

“Disposal” means the act by which a person transfers ownership of an asset to another person or gives up an asset. This includes selling, exchanging, transferring or distributing the asset, as well as situations where the asset is cancelled, redeemed, abandoned, destroyed, lost, liquidated or surrendered.

Asset Disposal Cases

- If an asset is transferred by succession or will, the transfer will be considered to be disposal of the asset by the deceased.

- if a business asset is taken for personal use, it will also be considered to be disposal of the asset.

- Where a business asset is lost or ceases to be used in the business, it will also be considered to be disposed of.

Which assets are exempt from capital gains tax upon their disposal?

- Cash

- Stock-in-trade (held for business or trade)

- Depreciable assess for which deprecation or amortisation is allowed.

- Bank balances

- Assets held for personal use

No profit or loss on transfer of assets (Non-recognition rules Sec 79)

There will be no gain or loss on the disposal in the following cases:

- Transfer of assets under a separation agreement between spouses

- Transfer of assets to heirs on the death of a person

- Gift of assets to a relative

- Transfer of assets by a company to its shareholders on the dissolution of the company.

- Distribution of assets to members on the dissolution of an association of persons in proportion to their interests in the capital.

Meaning that If a person has acquired property as an inheritance or gift, or through others way then capital gains tax is not applicable

However, if the same property is later sold to another person, capital gains tax will be applicable on that sale.

How will the cost of property acquired through gift or inheritance be determined?

The important question is that when the property is acquired through gift or inheritance, how to correctly calculate the gain on sale because in such a case, acquisition cost is not included in the transaction, i.e. the recipient of the gift or inheritance did not pay any money.

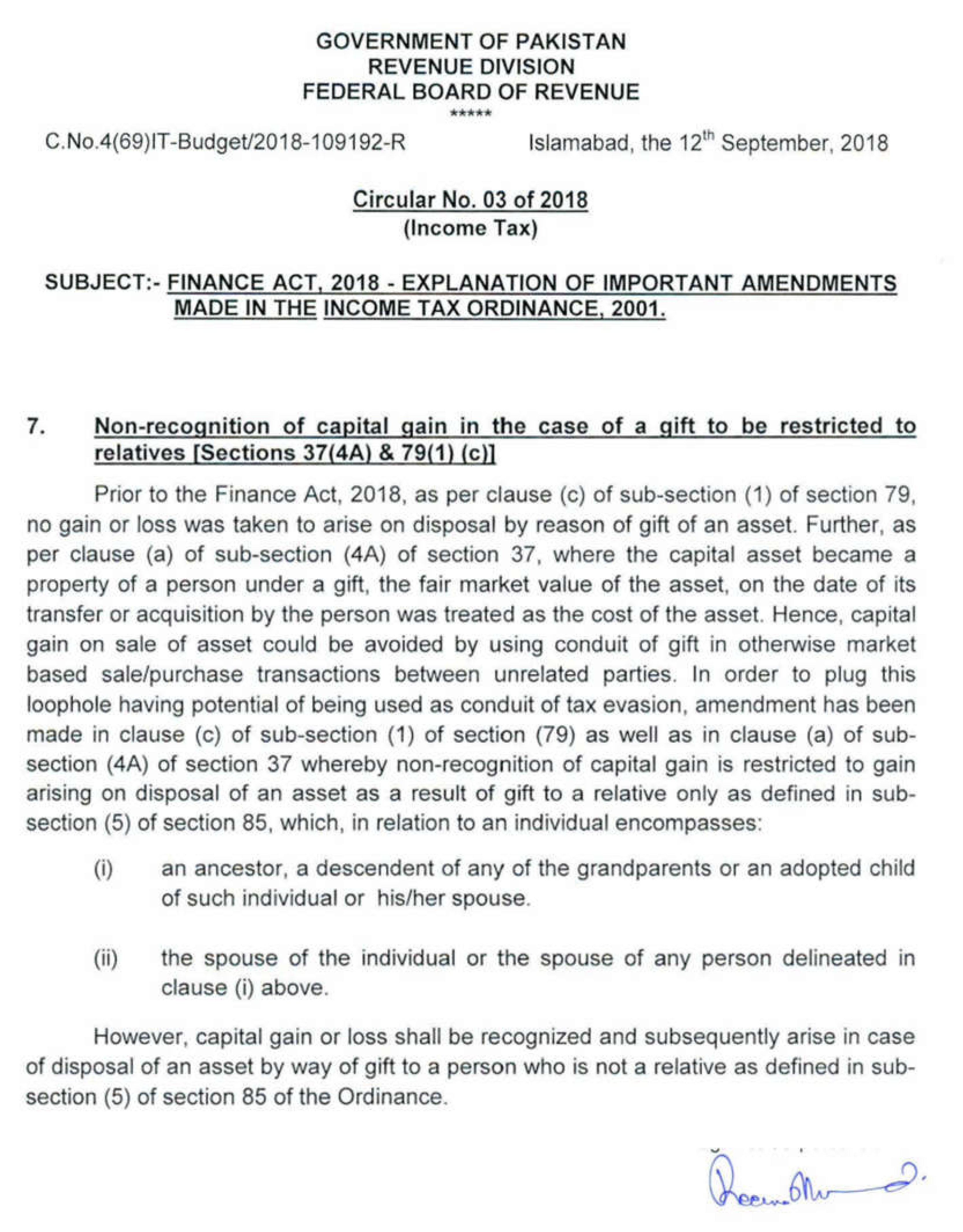

In the past, fair market value was allowed to be used as the cost of acquisition at date of gift or inheritance.

Now, the cost of the property will be considered to be the price at which the Donor or Predecessor has brought the property.

Example:

Suppose a person received a property as a gift on July 1, 2023, which was later sold for Rs. 2,000,000

If the donor had purchased this property in 2003 for Rs. 150,000, the gain would be calculated as follows:

Rs. 2,000,000 – 150,000 = Rs. 1,850,000 (taxable capital gain)

If the old rule (fair market value) had been applied, and the fair value of the property at that time was considered to be Rs. 1,500,000, then the gain would have been only Rs. 500,000

Therefore, removing the fair market value now results in the taxpayer paying more capital gains tax

Ultimate 2025 Guide to Calculate Capital Gain Tax in Pakistan: The Formula

The profit earned on the sale of an asset or property is calculated using the following formula:

A – B

Where:

A = Sale Price

B = Cost or Purchase Price of the Property

Capital Gain Taxes is calculated according to prevailing rates, which differ for movable and immovable properties.

Immovable Property: Applicable Rates for Fiscal Year 2025-26

If the property purchased before 30th June 2024, the rates of capital gain tax are as under.

| Tax on properties acquired on or before 30th day of June, 2024 | Tax on properties acquired on or after 1st day of July, 2024 | |||

| Open Plot | Constructed | Flat | ||

| Sold within 1 year of purchase | 15% | 15% | 15% | 15% for Filer and progressive rates for Non-Filer |

| Sold after 1 year but before 2 years of purchase | 12.5% | 10% | 7.5% | |

| Sold after 2 years but before 3 years of purchase | 10% | 7.5% | 0% | |

| Sold after 3 years but before 4 years of purchase | 7.5% | 5% | 0% | |

| Sold after 4 years but before 5 years of purchase | 5% | 0% | 0% | |

| Sold after 5 years but before 6 years of purchase | 2.5% | 0% | 0% | |

| Sold after 6 years of purchase | 0% | 0% | 0% | |

The taxes decreases gradually as the holding period increases, meaning the longer you hold the property, the lower the taxes liability. The government’s objective is to promote long-term investment in this sector.

In the case of flats, there is zero percent tax if the flat is sold after two years of purchase.

Similarly, constructed properties are exempt from capital gains taxes if sold after four years.

Properties Purchased after 1st July 2024

If a property is brought and sold within one year of acquisition, capital gains tax shall be charged at the rate of minimum rate of 15%.

However, if the seller is a non-filer and his name is not included in the Active Taxpayers List (ATL), then progressive rates will apply. This means that the higher the profit, the higher the tax will be paid — but the rate will not be less than 15%.

For example, if an individual makes a profit of Rs 2.5 million on the sale of a house and he is a non-filer, the tax payable will be approximately Rs 4.4 million, which is equivalent to 17.6%.

Ultimate 2025 Guide to Calculate Capital Gain Tax in Pakistan: Movable Property?

Capital gains on movable property are added to the person’s total income.

If the total income exceeds Rs. 600,000, Capital Gain Taxes will apply as per the applicable slab rates.

If the total income is Rs. 600,000 or less, no tax is payable.

Example:

If a salaried person earns Rs. 550,000 annually and also earns Rs. 200,000 as profit from the sale of gold, the total income will be Rs. 750,000. Since it exceeds the threshold, it will be subject to tax.

There are no separate rates for profits earned on movable properties; the tax shall be calculated according to the applicable income tax slab

Different Slab Rates for Salaried and Non-Salaried Individuals

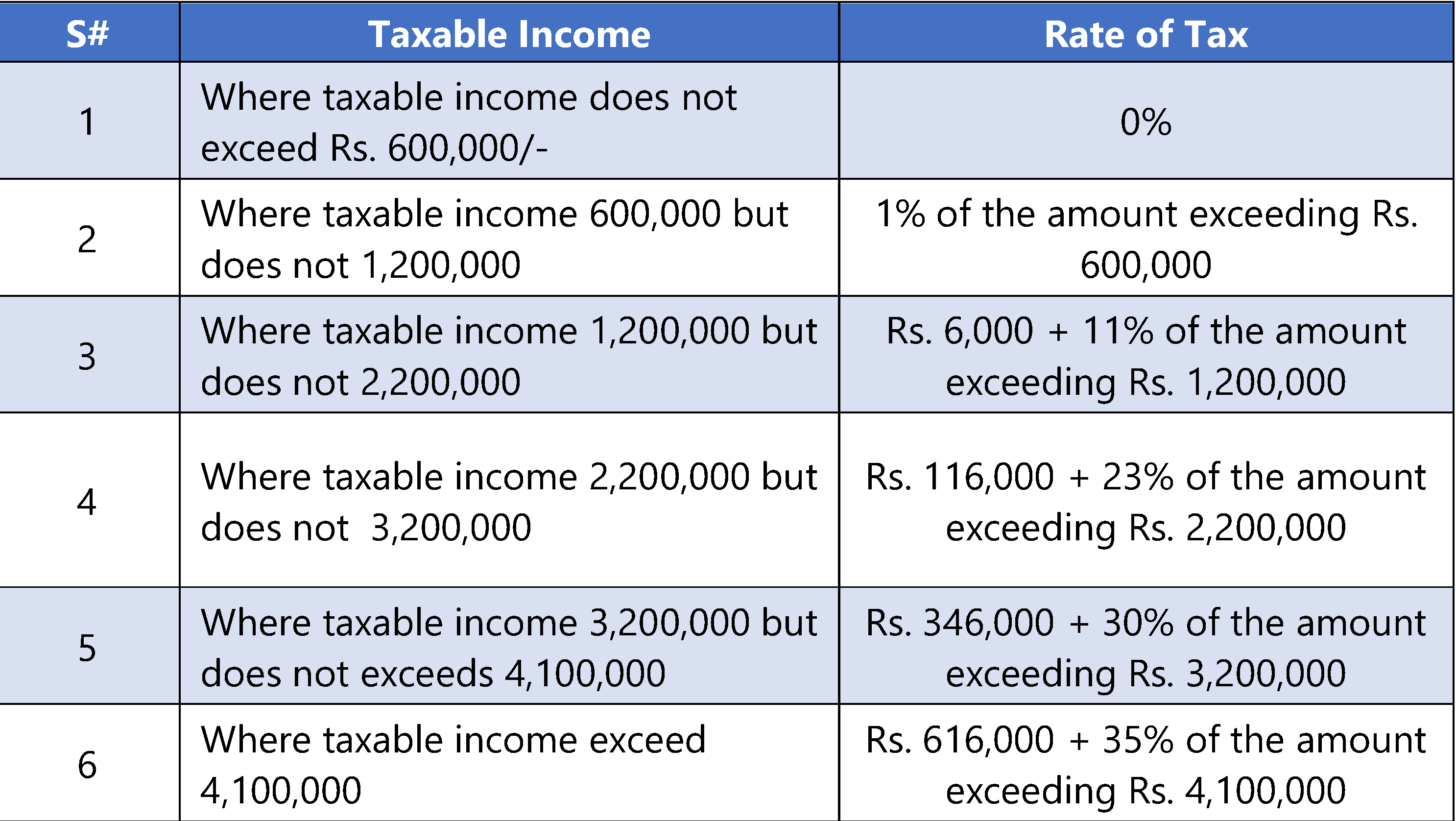

Salaried Individuals (Section 149)

(Applicable where salary income constitutes more than 75% of the total taxable income)

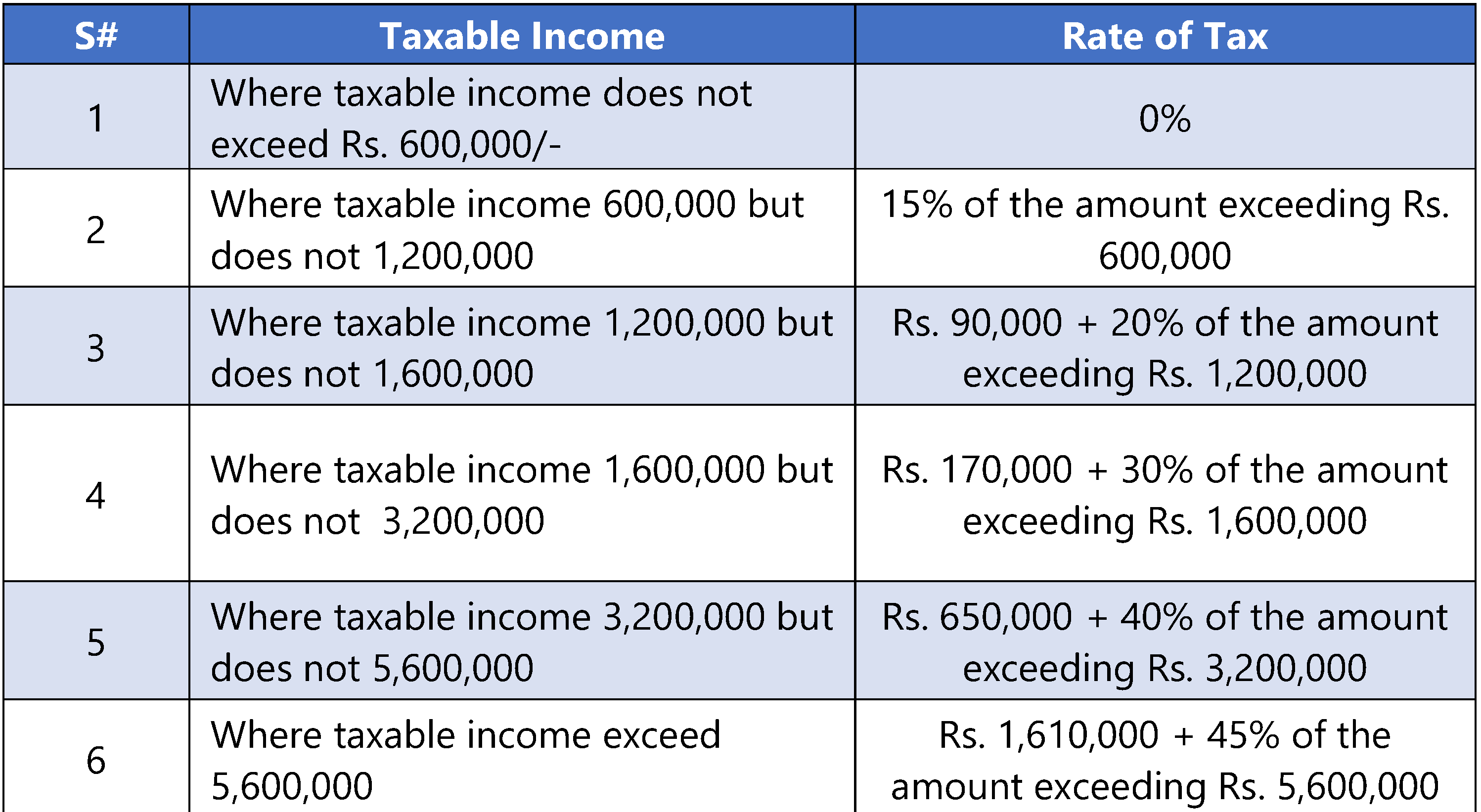

Non-Salaried Individuals and AOPs

(Business persons or individuals with less than 75% income from salary)

Ultimate 2025 Guide to Calculate Capital Gain Tax in Pakistan: Examples?

Personal Use Asset (No Taxes Applicable):

Mr. A purchased a dining table set for Rs. 60,000 on 15 March 2010 for personal use and sold it for Rs. 80,000 on 25 May 2023.

Since the dining table was used for personal purposes, no taxes is payable on this gain.

Taxable Movable Asset (Taxes Applicable):

Mr. A has a stamp collection comprising 2,000 stamps from various countries and occasions.

Cost of stamps: Rs. 200,000

Sale price: Rs. 1,000,000

Profit Earned: Rs. 800,000

This profit is taxable as Mr. A’s total income exceeds Rs. 800,000 the tax payable is 30,000.

Ultimate 2025 Guide to Calculate Capital Gain Tax in Pakistan: Purchase Of Assets Through Bank

Another important condition is that the purchase and sale of assets should be done only through the bank. That is, the payment should be transferred from one bank account to another through cross cheque, demand draft, pay order or digital means. This requirement applicable in the following cases:

(a) Immovable property with a fair value of more than five million rupees.

(b) Any other asset with a fair value of more than one million rupees.

If the payment for the purchase of these assets is made in cash, cash amount will not be acceptable as a cost.

Example

If a property was purchased for Rs. 8,000,000 but the entire payment was made in cash, and later sold for Rs. 12,000,000, the profit would normally be:

12,000,000 – 8,000,000 = 4,000,000

But since the payment was not made through the bank, the cost will not be recognized and will be considered zero.

The gain would therefore be: 12,000,000 – 0 = 12,000,000, the whole amount is now taxable.

If capital gains tax is levied on it at the rate of 15%, the tax payable would be Rs. 1,800,000. Whereas if the entire payment was made through the bank, the tax would be only Rs. 600,000.

Ultimate 2025 Guide to Calculate Capital Gain Tax in Pakistan; Key Points for Understanding

- Capital Gains Tax (CGT): Applicable on profit earned from sale of property or asset.

- Movable property: Gold, jewellery, art, coins etc.

- Immovable property: Land, house, flat, commercial and agricultural land.

- Exemption: Cash, bank balance, personal use assets, business stocks, depreciable assets.

- Gift or inheritance:

- No tax on gift or inheritance.

- Tax will be applicable on subsequent sale.

- Cost will be considered as the one at which the original owner purchased it.

Immovable property (2025-26):

- Sale in 1 year – 15% tax.

- Sale after 6 years – 0% tax.

- Non-filer: Progressive rate, minimum 15%.

Movable property:

- Profit included in total income.

- Income below Rs. 600,000 – No tax.

Payment method:

- Purchase property (more than Rs. 50 lakh) or asset (more than Rs. 10 lakh) only through bank.

- Cost will not be accepted in case of cash payment.

- Important point: Holding property for a long time reduces tax.

For more information about Ultimate 2025 Guide to Calculate Capital Gain Tax in Pakistan, please reach out to us through our website by filling out the “Contact Us” form, or get in touch via our social media accounts.