Last Chance for Late Filers to become a Filer in 2025: Since the deadline for filing returns for tax year 2025 has passed, which was previously set for September 30, 2025 and later extended to October 31, 2025. Many people have a question that if they have missed the filing date of their tax return, will their name be included in the late filer? And if it has, how can it be changed to an active filer? First, let us understand what is the difference between all these terms.

Filer

The person who has filed his Income tax return (ITR) before the Due Date i.e before the October 31, 2025.

Non-filer

Who has not filed a tax return at all.

Late Filer

If a person who has filed his return after the due date in any of the last three years. In this case, his name will be listed as a “Late Filer”.

Earlier, this period was three years, but later the FBR changed it to two years. That is, if a person who has submitted a ITR after the due date for any of the tax year 2024 or 2025 then he will be called a “Late Filer”.

Who will most effected with the status of being a “Late Filer”

If a person who has filed their annual ITR late after the due date, how will the tax impact be on him?

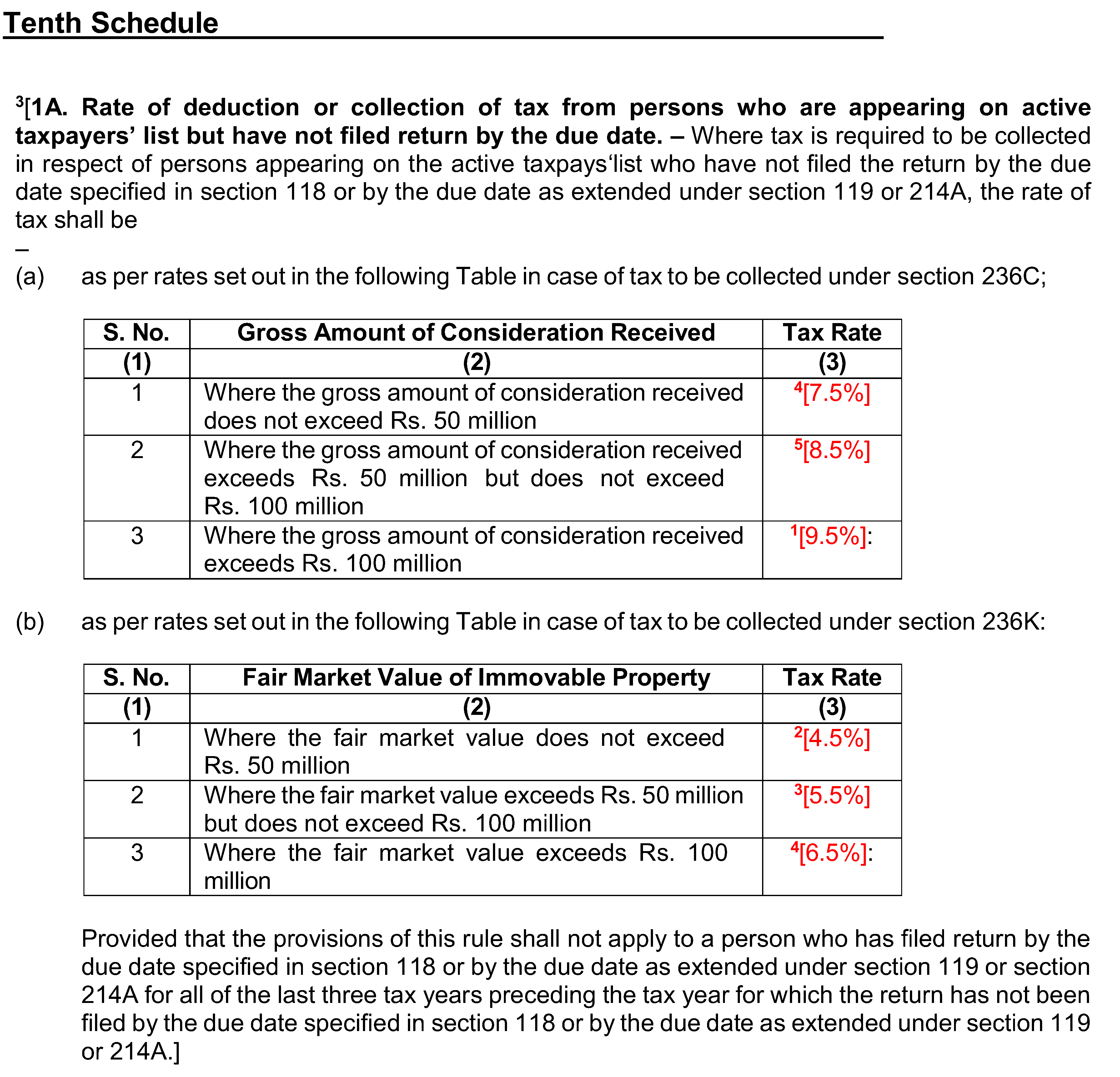

According to the FBR notification If a person buys or sells their property and their status is ‘Late Filer’, the tax on the sale or purchase of the property will have to pay double tax. This does not affect any other transactions. If you plan to buy or sell property in the future, it is better to file your tax return before 15 November 2025 so that your status remains ‘active’ and you can avoid double taxation.

The original text of clause 1A of Schedule 10 of the Income Tax Ordinance 2001 is as follows:

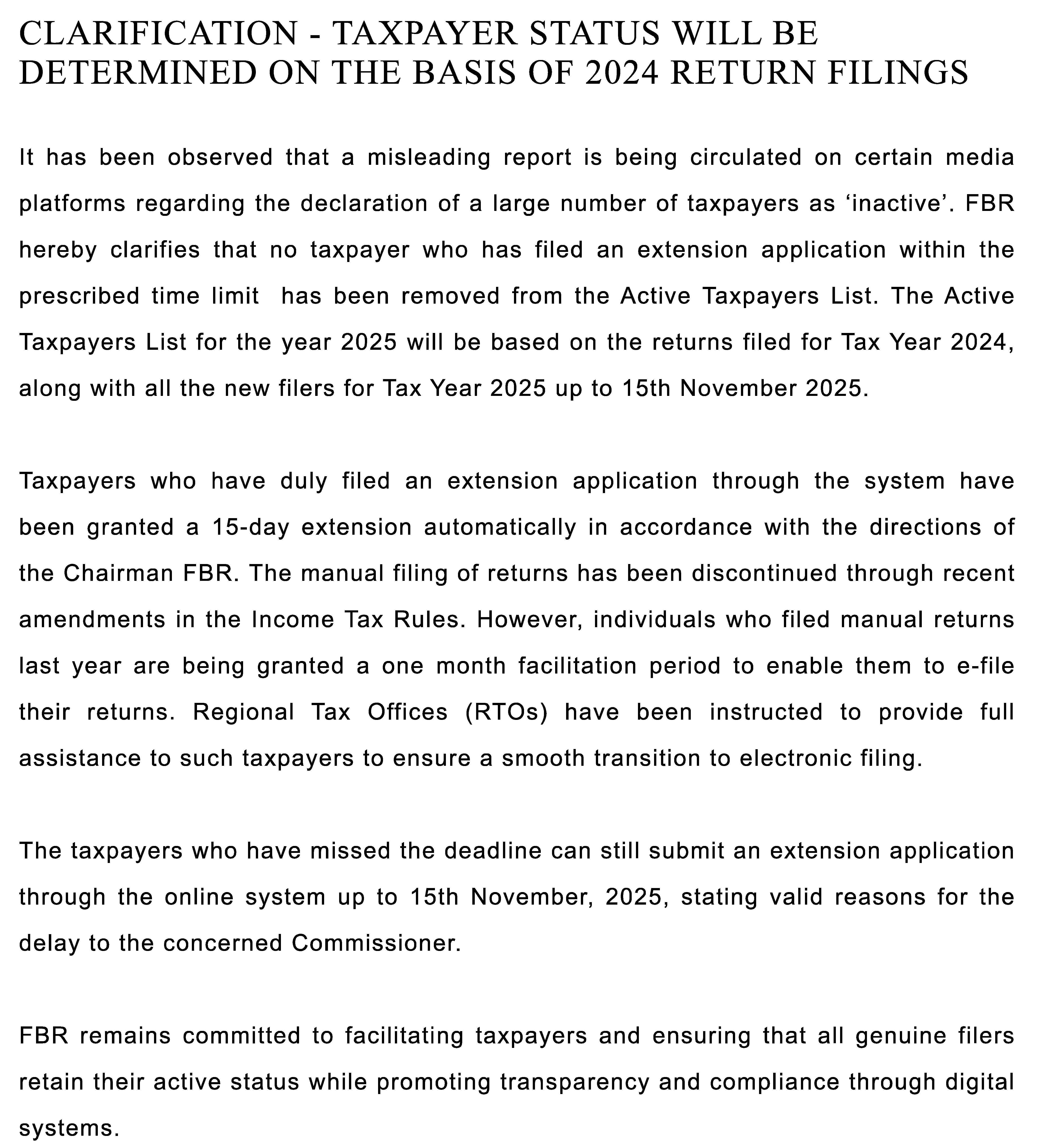

Last Chance for Late Filers to become a Filer in 2025: FBR Press Release November 3, 2025

- The FBR issued a clarification press release on November 3 stating that the “Active Payer List” status will be determined based on the ITR filing of both 2024 and along with new filers for the year 2025.

- That is, if a person has filed the 2024 tax return on time, he will be considered in the “Active Payer List”, even if the 2025 return has not been filed yet.

- And if someone who has filed the 2024 return late but filed the 2025 on time, his status will also change from late filer to active filer.

If you have not filed your return yet

- If you have not filed your return yet, then there is no need to worry the FBR has clearly stated that:

- First, file an extension application (will usually be approved automatically within 48 hours)

- File your income tax return immediately or after approval of extension.

- If you have already filed your return but have not applied for an extension, then submit the application now.

- Once the extension is approved, your status will automatically change to Active Filer.

- According to the FBR, it is mandatory to apply by November 15.

- If you apply for an extension before November 15 and also file your return, your name will be included in the Active Taxpayer List (ATL) on November 16.

If the extension is rejected

- If your initial extension request is rejected, you will have to file a new application manually by visiting your relevant RTO, since this process is not available online.

- In your application, citing the press release of the Chairman FBR, take the position that you should be granted a fresh extension as per the existing guidelines so that your return can be considered as filed on time.

- If the first application is rejected or a further extension is required for example, the taxpayer is abroad and the bank statement cannot be issued without his presence a request for the second time can be filed. The Chief Commissioner may approve the extension after reviewing all the supporting documents.

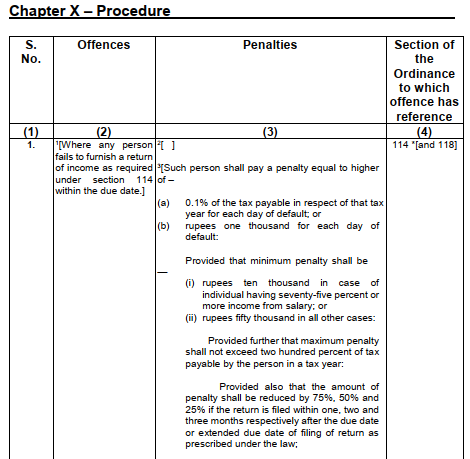

Penalty for Being a Non-Filer

- It is not just a matter of status if a person does not file their return on time, there are penalties under Section 182 of the Income Tax Ordinance:

- A minimum of Rs 10,000 for salaried individuals

- Rs 50,000 or more for other individual taxpayers

- So if you file both the application and the return before November 15, you will not only get out of the late filer status but also avoid potential penalties and avail Last Chance for Late Filers to become a Filer in 2025.

Manual Returns

Extraction has also been issued for those taxpayers who were filing returns manually for previous years and manual finalization of returns has been stopped. Now all taxpayers will have to file online.

If you have previously submitted tax returns manually, how do you file tax returns online now?

- The procedure is that you go to your nearest RTO office, get the facility available there, create your account and file your return online with login/password.

- The mobile number should be in the name of the taxpayer, write all other details from CNIC correctly.

- If you do not want to visit the RTO office, this online facility can be availed using IRIS.

- And if you cannot file it yourself and not willing to pay the consultant fee, then the FBR has also provided the facility that their returns will be filed without any fee.

Conclusion

- The FBR has given a clear opportunity that those who file extensions and returns before November 15 will be included in the active taxpayer list again.

- File your returns immediately, apply for extensions, and get yourself out of the late filer status.

- The FBR is now actively sending messages and stiff penalties are expected for late filing in the future, so take action now to avoid any problems later.

- If you need tax return filing services and want to avail Last Chance for Late Filers to become a Filer in 2025 please get in touch with us through our website by filling out the Contact Us form, or reach out via our social media accounts.