How Non Resident Pakistanis Save Property Taxes in 2025: If you are a non-resident Pakistani and want to buy or sell property in Pakistan, you can not only save advance tax on the purchase and sale of property but also avoid capital gains tax.

Three Basic Taxes Applicable to Property in Pakistan

Whenever a property is purchased or sold, there are generally three taxes involved in the transaction:

- Section 236K –Paid by the Purchaser.

- Section 236C –Paid by the Seller.

- Section 37 – Capital Gain Tax is levied on the profit or gain earned by selling the property.

Withholding or Advance Tax Applicable On Buying and Selling of the Property

Withholding Under Section 236K

The taxes that the buyer pays under Section 236K depends on:

- How much is the value of the property, and

- Whether the buyer is a filer, non-filer or late filer.

The rates are as follows:

| Fair Market Value of the Property | Filer | Late-Filer | Non-Filer |

| Does not exceed Rs. 50 M or 5 Crore | 1.50% | 6% | 12% |

| Exceeds Rs. 50 million but does not exceed Rs 100 million | 2% | 7% | 16% |

| Exceeds Rs. 100 M or 10 Crore | 2.50% | 8% | 20% |

Withholding Under Section 236c

Similarly, when you sell a property, you are liable to tax under section 236C.

The rates are as follows:

| Gross Consideration Received | Filer | Late-Filer | Non-Filer |

| Does not exceed Rs. 50 M or 5 Crore | 4.50% | 6% | 10% |

| Exceeds Rs. 50 million but does not exceed Rs 100 million | 5% | 7% | 10 |

| Exceeds Rs. 100 M or 10 Crore | 5.50% | 8% | 10% |

These rates are slightly higher than those for purchase as the government collects more revenue at the time of sale.

What is Capital Gains (CGT)

Let’s take a simple example to understand the meaning of Capital Gain.

Suppose, if you bought a property for Rs 1,000,000 and later sold it for Rs 1,500,000 then you have a gain of Rs 500,000.

The amount payable depends on when you bought and sold the property, i.e. the holding period. The longer you hold the property; the less tax you have to pay.

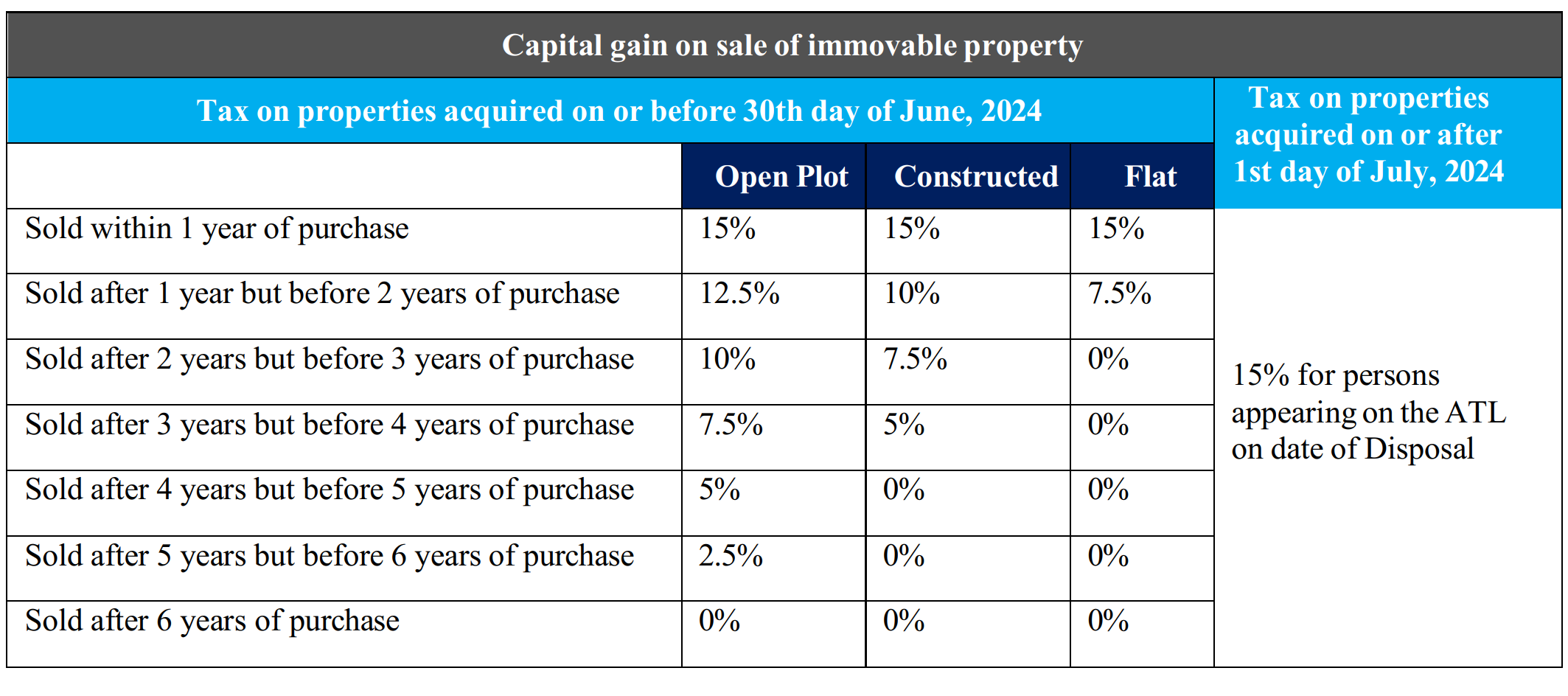

If you bought the property before June 30, 2024:

Then the gain will be applicable to you based on the holding period:

Plot: Exempted if held for more than 6 years.

Building: Exempted after 4 years.

Flat: Exempted after 2 years.

What Will Be CGT If Property Brought After 2024

However, if you have bought the property after 1 July 2024, the holding period rule will not apply, whether it is a plot or a house in this case, a flat rate tax of 15% will apply.

Special exemption for non-resident Pakistanis

If you are a Non-Resident Pakistani (N.R.P) then then you can save both advance taxes and capital gain tax if properly brought after July 1, 2024 this will be 15% tax you can save this double taxes.

To avail this exemption, you have to fulfil the following three conditions:

Proof of Overseas Pakistanis or Non Residency Status

You must have one of the following identity documents:

- POC (Pakistan Origin Card)

- NICOP (National Identity Card for Overseas Pakistanis)

- CNIC (Computerized National Identity Card)

The presence of any one of these fulfils the first condition.

Mode of Payment

When you purchased the property, you must have made the payment through one of the following accounts:

Foreign Currency Value Account (FCVA)

Non-Resident Rupee Value Account (NRVA) also commonly known as Roshan Digital Account (RDA).

If you made the payment from a regular rupee account, then this condition is not fulfilled.

Advance Tax Exemption for Overseas Pakistanis

How Non Resident Pakistanis Save Property Taxes in 2025 Non Residents are not subject to double taxes when buying or selling immovable property like land or house in Pakistan. This exemption has been provided by the Government of Pakistan under a circular to facilitate overseas Pakistanis and save them from unnecessary financial burden.

How to Get This Exemption?

For this, it is necessary that you apply for the exemption available under sections 236K and 236C so that the double taxes are not levied. The procedure is simple:

Go to the IRIS web portal of the FBR and apply online for this certificate as it is available online according to official notification.

How Non Resident Pakistanis Save Property Taxes in 2025

There are two types of exemptions (rebates) for overseas Pakistanis in the taxation laws.

The first exemption is available when overseas Pakistanis buy or sell a property. The advance tax deducted on this occasion is exempted to overseas Pakistanis.

That is, even if they are not filers, they are not double taxed the same rates which are applicable to them as to a filer.

However, it should be noted that this is not a complete exemption (zero tax).

This is where most of the misunderstanding arises many people think that overseas Pakistanis do not have to pay any taxes at all, although this is not the case.

Exemption from Capital Gains Tax

The second exemption is related to Capital Gains Tax.

If an overseas Pakistani sells a property, the advance tax that has been deducted on sale of property under section 236C is counted as capital gains tax, and no further tax has to be paid.

This is a beneficial facility, especially for those who have sold the property after some time specially in same year the tax will be 15%.

For example, if someone bought a property two and a half years ago and has now sold it, in such a case, the capital gains tax is often reduced or refundable.

The applicable rates of capital gain for the fiscal year 2025 are as under.

Scope of Exemption

The Exemption Certificate is valid only for the specific property for which it is issued. It is not applicable to any other property. If you purchase any other property during the year, a fresh Exemption Certificate is required for the same.

Principle of Deduction and Refund

Even after obtaining exemption, you get the same tax deduction benefit as a filer. Remember that the tax deducted at the time of purchase and sale is actually refundable.

How to get a refund?

To get a refund, you first have to file your income tax return and maintain filer status. Only then can you submit a refund application.

Common Mistakes and Precautions

Most people do not maintain their filer status after obtaining an exemption certificate, resulting in the loss of tax deducted from them.

Moreover, those who buy and hold property and do not sell it are not subject to capital gains tax thus, they also miss out on a refund of the tax deducted.

Tax Saving Calculation

A non-resident Pakistani bought an open plot for 2,500,000 in July 2025, constructed a house on it at the cost of 5,000,000 and then resell at 15,000,000 in October 2025.

Case 1:

| Property Tax Calculation on Sale/Purchase | Amount (PKR) |

| Sale Price of House | 15,000,000 |

| Purchase Cost of Open Plot | 2,500,000 |

| Construction cost | 5,000,000 |

| Total Cost | 7,500,000 |

| Gain on Sale of House | 7,500,000 |

| Capital Gain Tax @15% | 1,125,000 |

| Advance Tax Paid on | |

| Purchase of Immovable Property [Sec 236K @1.5%] | 37,500 |

| Transfer of Immovable Property [Sec 236C @4.55%] | 675,000 |

| Total | 712,500 |

| Gross Capital Gain Tax | 1,125,000 |

| Less: Advance Tax Paid | 712,500 |

| Net Capital Gain Tax Payable | 412,500 |

Case 2:

Suppose a tax filer bought a same property in 2023 and sold it in 2025.

| Amount (PKR) | |

| Sale Price of House | 15,000,000 |

| Purchase Cost of Open Plot | 2,500,000 |

| Construction cost | 4,000,000 |

| Total Cost | 6,500,000 |

| Gain on Sale of House | 8,500,000 |

| Capital Gain Tax @7.5% | 637,500 |

| Advance Tax Paid on | |

| Purchase of Immovable Property [Sec 236K @3%] Aug 2023 | 75,000 |

| Transfer of Immovable Property [Sec 236C @4.55%] OCT 2025 | 675,000 |

| Total | 750,000 |

| Gross Capital Gain Tax | 637,500 |

| Less: Advance Tax Paid | (750,000) |

| Net Tax Refundable | (112,500) |

Conclusion:

- There are three basic taxes applicable on property in Pakistan: 236K (Buyer), 236C (Seller), and 37 (Capital Gains Tax).

- Non-resident Pakistanis can obtain an Exemption Certificate by proving their status through POC, NICOP or CNIC.

- Payment for the property must be made from FCVA or NRVA (RDA) account.

- Exemption Certificate is effective only for the specific property, a new certificate is required for a new property.

How Non Resident Pakistanis Save Property Taxes in 2025

- Tax deducted on purchase and sale is refundable, provided that filer status is maintained and returns are filed.

- Property purchased after July 1, 2024 will be subject to 15% flat rate CGT, however, non-filers have higher rates.

- The government has granted double taxation exemption to overseas Pakistanis to avoid unnecessary financial burdens.

Non-resident Pakistanis can save significant tax on property purchases and sales if they follow the right approach maintain filer status, pay through RDA, and obtain an exemption certificate.

If you need any help regarding How Non Resident Pakistanis Save Property Taxes in 2025 please contact us through our website by filling out the Contact Us form, or reach out via our social media accounts.