Do Overseas Pakistanis Need to Be Tax Filers 3 Essential Benefits of Filing: It is necessary for overseas Pakistanis to remain filers or not, and whether they should become filers, whether they are residing in any country outside Pakistan, such as UAE, UK, US or any other country. Are there any disadvantages of not being a filer in Pakistan or not?

Should the holders of the National Identity Card of Overseas Pakistanis, who have the National Identity Card of Overseas Pakistanis, become filers or not.

Who is an overseas or non-resident Pakistani?

First, understand the difference between resident and non-resident.

Resident Person:

If a person is present in the country for 183 days or more in a year, he will be called a resident Pakistani.

Non-Resident:

And if a person is resident outside the country for 183 days or more in a year he will become non-resident for the year.

In which cases is it not necessary for overseas Pakistanis to become filers?

If you are not earning any income in Pakistan, have no business, no job, and no intention to buy or sell any assets (property, etc.) in Pakistan, while all your income is from abroad and you only send money to Pakistan to support your family, then in such a case there is generally no need to become a tax filer in Pakistan.

Under what circumstances is it financially beneficial to become a filer?

But if you have a business in Pakistan, or are earning any kind of income from here, for example, you are getting profit on a bank deposit, you have a property on rent from which you are receiving rent, or you intend to do any kind of financial transaction in the future, then in such a case becoming a filer becomes very necessary and beneficial.

Tax difference between filer and non-filer

The biggest advantage of being a filer is that the tax rate on your income is reduced, whereas in the case of being a non-filer, you have to pay double, and in some cases even triple, the tax. For example, if a person makes a property transaction as a non-filer, he has to pay many more tax than a filer.

So if you have income, investments or financial transactions in Pakistan, then becoming a filer is both legally necessary for you and financially beneficial.

Common mistakes of overseas Pakistanis

Pakistanis often make the mistake of not filing tax returns, while every year they regularly send their savings to Pakistan. Later, if they make any investment with this money, it becomes difficult to show in the FBR records the sources of income for this investment.

When they file their tax returns for the first time, they have to declare this amount in their Opening Wealth. And if the amount is Rs 10 million or more, then FBR may ask the taxpayers to explain this opening wealth.

Therefore, it is better for people to file tax returns regularly so that it is easier to prove the legitimacy of their wealth later.

PRC certificates and bank records

Money that remitted from abroad must be sent through banking channels and a PRC certificate must also be obtained. Without these documents, the FBR generally do not accept this amount as foreign remittance.

Moreover, obtaining PRC certificates for the last years, collecting bank statements and preparing their complete working becomes a very difficult and time consuming task, which is very complicated for a taxpayer.

Simple and safe solution to the problem

The simple solution to this problem is that Non-Resident Pakistanis should file their tax returns on time every year, declare all the savings they send to Pakistan regularly, and keep PRC certificates and bank statements safe.

The advantage of this is that if you make an investment you can easily explain to the FBR this money is properly declared in the tax returns and supporting documents are also provided.

How can overseas Pakistanis avoid 15% tax on bank profits?

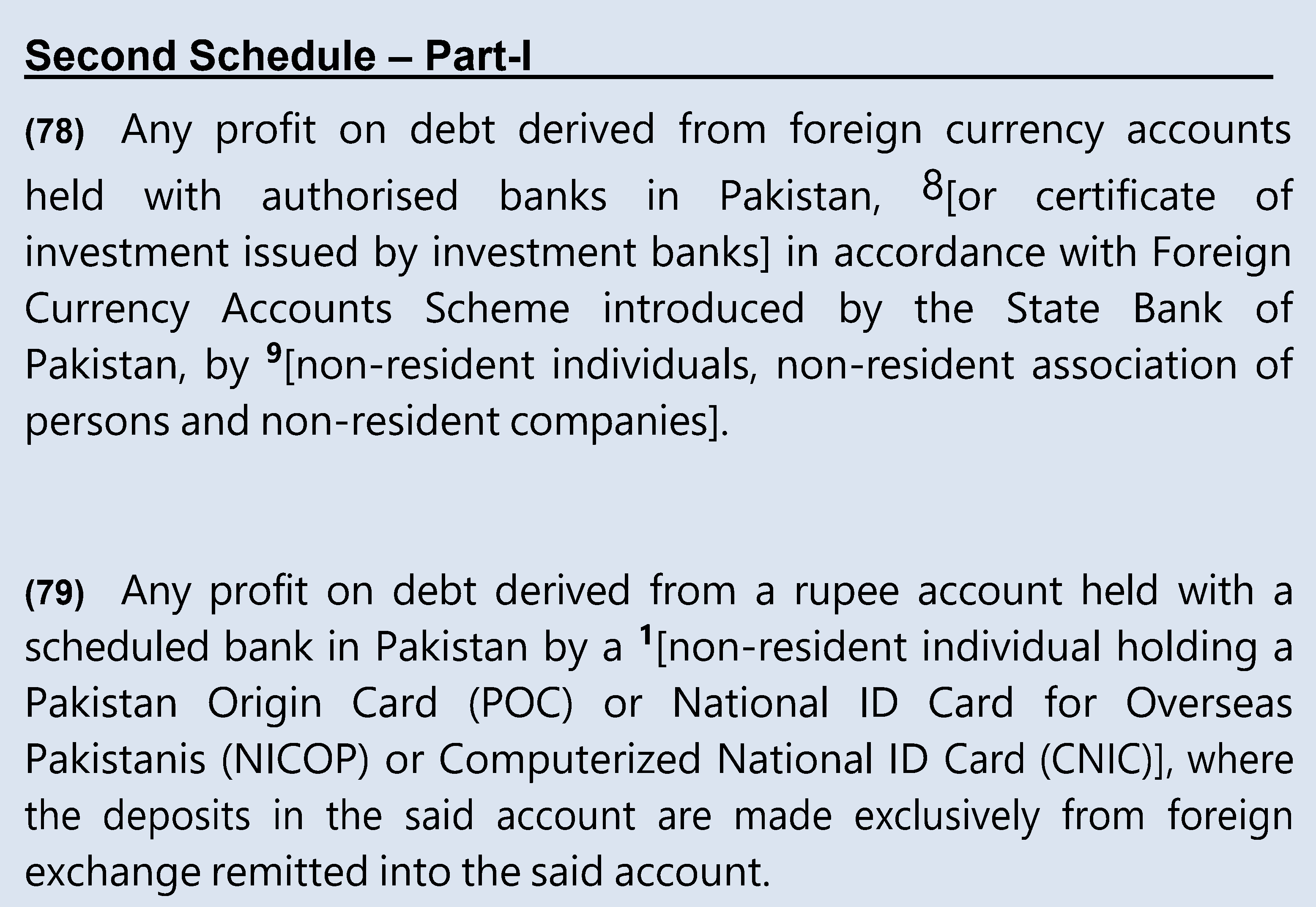

Another important benefit for Non-Resident Pakistanis is that in certain cases they can get complete tax exemption, which is exclusive to overseas Pakistanis only.

If we talk about resident Pakistanis, then the profit earned from the bank (Bank Profit) is taxed at 15% for filers and up to 40% for non-filers. While Non-Resident Pakistanis can save significantly in this regard.

Generally, Non-Resident Pakistanis have to pay 15% tax on bank profit, but under a specific exemption, they do not have to pay even this 15% tax.

The condition for this is that the amount deposited in the bank must be made from remittance abroad and through banking channels.

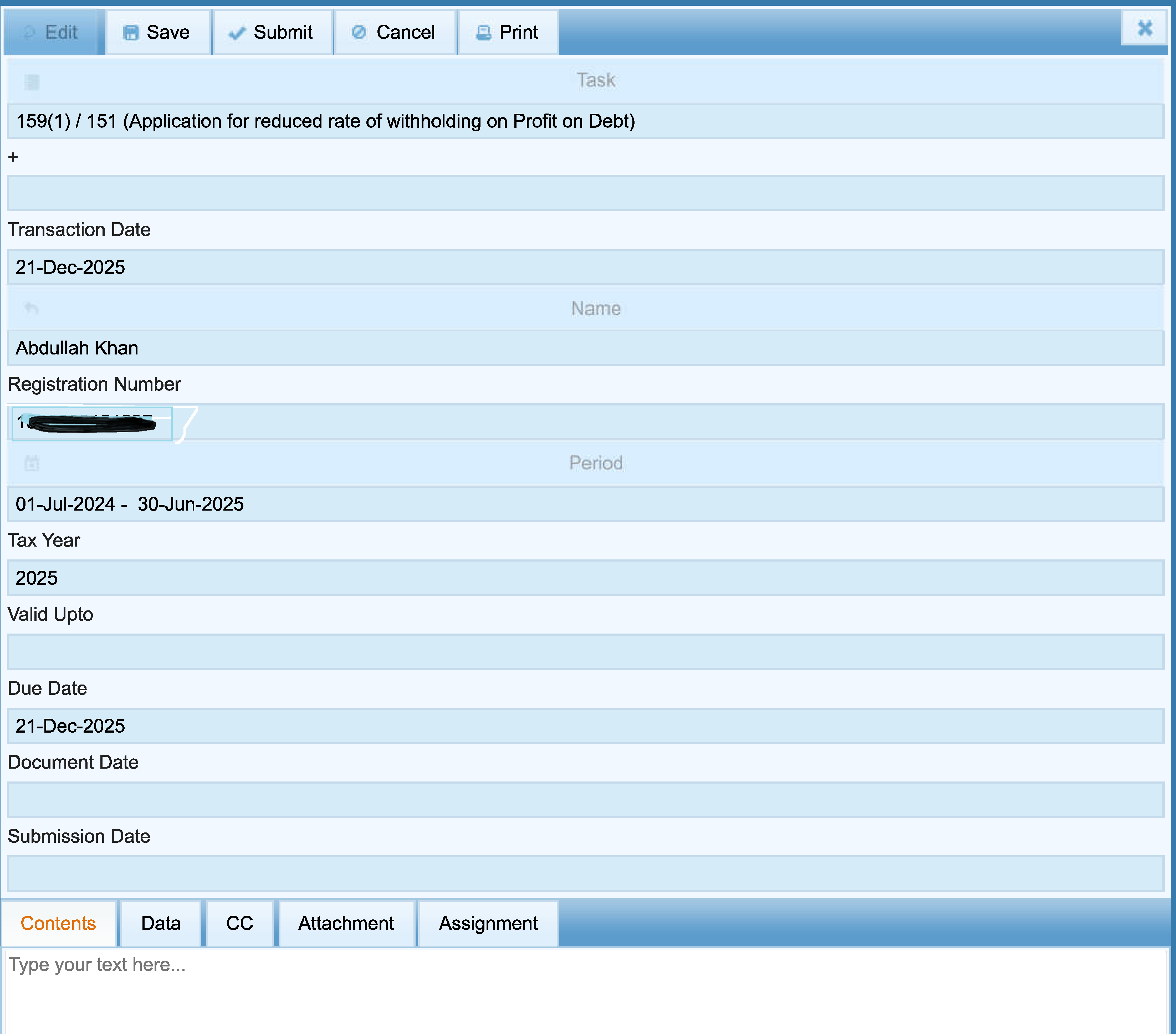

Bank Profit Tax Exemption for Overseas Pakistanis: Procedure

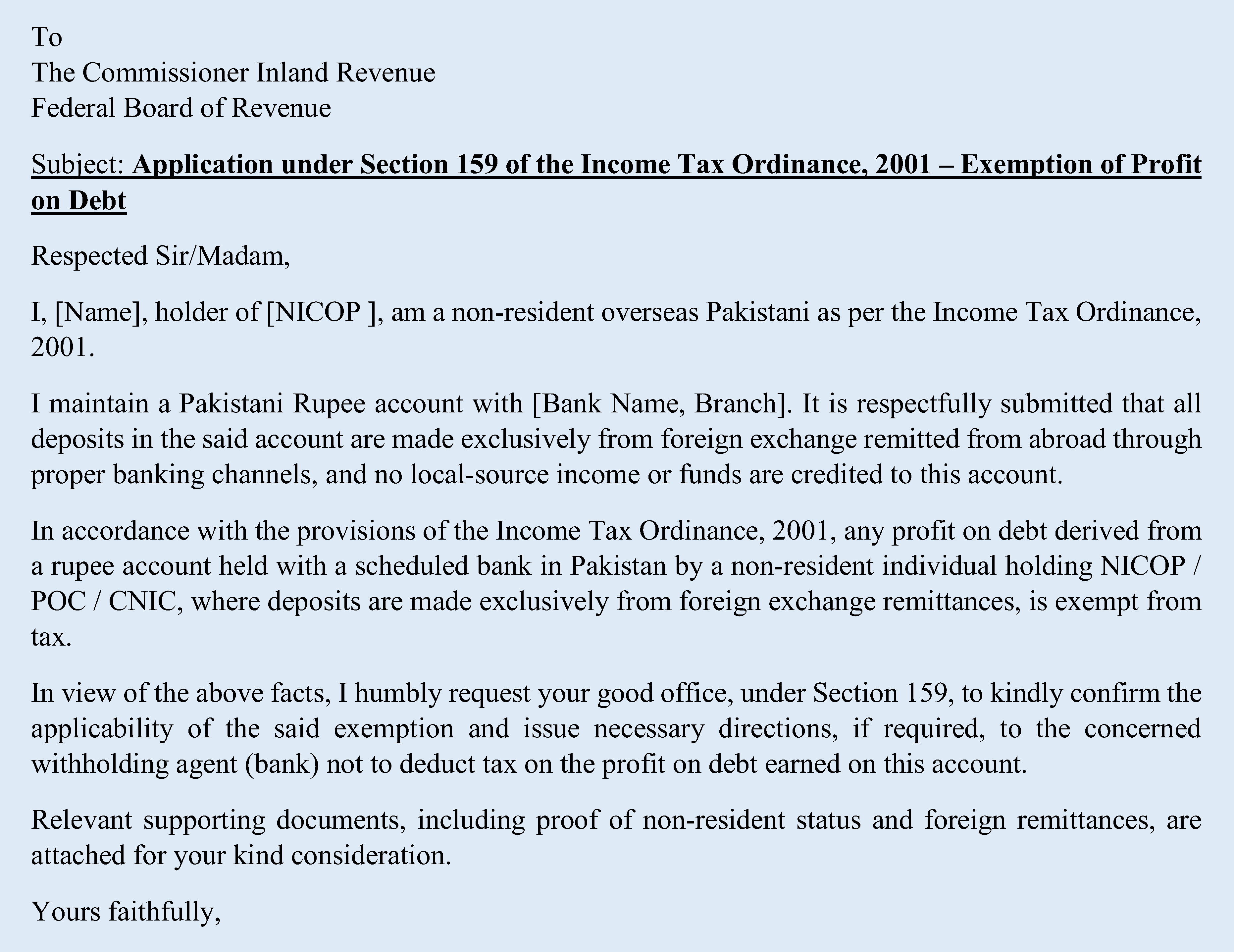

For this exemption, you have to log in to the IRIS system and apply. Proof of Non-Resident (NICOP or Passport), bank certificate, and proof of remittance from abroad (PRC) must be attached with the application.

You can get full tax exemption on bank profits after applying online with all required documents.

A sample Application under Section 159 – Exemption of Profit on Debt (Overseas Pakistani) is as under.

Do Overseas Pakistanis Need to Be Tax Filers 3 Essential Benefits of Filing

- Filing taxes is not mandatory for overseas Pakistanis, but it can be very beneficial in some situations.

- If an Non-Resident Pakistani has no income, business or assets in Pakistan and only sends money to his family, then it is generally not necessary to become a filer.

- However, if the intention is to have bank profits, rent, property or any financial transaction in Pakistan, then becoming a filer is legally and financially beneficial.

- Being a filer reduces the tax rate, while non-filers have to pay double or triple the tax. Filing regular tax returns makes it easier to prove the sources of investment and can avoid future problems with the FBR.

Contact us for further guidance and consultation.

If you need any further information Do Overseas Pakistanis Need to Be Tax Filers 3 Essential Benefits of Filing please get in touch with us through our website by filling out the Contact Us form, or reach out via our social media accounts.