Company Wind-up Meaning:

A Simplified Guide to Winding Up a Company with SECP in 2025: Company wind-up means that the name of the company is removed from the list of registered companies or De-registered. After that, that name will become available to the public and a new business can be register with this name.

Since a company is a separate legal entity, the Corporation name remains in existence until it is legally wound up, even if all the directors die. The records remain in the SECP and continues to exist.

Closing a business does not mean the company is winding up.

It is a common misconception that simply closing down business will automatically wind up a company. This is not the case. There is a legal process for winding up a company, and until this process is followed, the organization will continue to exist legally, just as if a person dies but their death is not officially registered, that person will be considered to be legally existing. Similarly, an entity will remain legally “alive” until it is wound up.

Which companies can be for wind-up?

If an entity is not in operation or does not doing any business activities and does not has any assets and liabilities, then this type of entity can apply for the winding up so that his name remove from the list of registered companies.

Why is it necessary to wind up a company?

Many people ask whether it is necessary to wind up a company when business operations are stopped? The answer is that it is mandatory to take legal steps to wind up the company.

As long as the company is name is struck off and remains registered with the SECP, it will have to fulfil its annual returns and other legal requirements. The organization has to submit Form A and Form 29 annually.

In addition, large companies have to file audited accounts. The entity also has to appoint an auditor, a legal advisor (in some cases) and has to pay fees to the government and consultants to complete all filings as well.

Fines and Penalties:

Until the company is deregistered, its name remains in the FBR records, and it is mandatory to file returns even the company is doing business.

If the company’s annual tax returns with FBR are not filed a fine or penalty may be imposed by the FBR.

And if there is no money in the organization’s accounts and the fine is not paid, then this penalty can be collected from the personal accounts of the directors.

What is the Easy Exit Scheme?

Companies that want to wind up can apply under this scheme. The biggest advantage of this scheme is that if you have not filed any annual returns Form A and 9 in the previous years which are mandatory to file, then you will not have to file those returns. You can apply for wind up even without doing any previous filing.

However, if there are any arrears, penalties or fees payable to SECP, then you cannot benefit from this scheme.

The advantage of the Easy Exit Scheme

The important advantage of this scheme is that you do not have to pay the government fee for the annual filing of previous years. For example, if you formed a company 10 years ago and its annual returns was not filed, then in case of adopting the normal method, you will have to submit all the filings of the last 10 years and also pay their fees as per the current rate, which can be many times higher.

Similarly, you will also have to pay consultant or filer fees, while all these additional costs can be avoided under the scheme.

Which companies cannot benefit from this scheme?

The Easy Exit Scheme is not available to the following companies:

Outstanding Liabilities

- Has obtained loan from a bank or financial institution

- Any taxes or utility bills

- Any private parties’ payments

- Has involved in any kind of fraud activities

- Pending case in any matter in court / department/authority or forum

- Deals in housing, real estate development or real estate marketing

A Simplified Guide to Winding Up a Company with SECP in 2025: How to apply for wind-up?

There are two methods for wind-up: online application and manual (physical) application.

1) Online Filing

- The fee for online filing is Rs. 5,000.

To apply online, you must have a SECP user ID and password.

Log in to the SECP website (LEAP portal) and fill the relevant form online. - If you have an authorized person already appointed, then the same person will sign the form, whether it is the Chief Executive or the Director.

- If an authorized person has not been appointed, first submit the Authorized Representative / Profile Update form online. You will not be able to submit the form until the authorized officer is appointed.

- If you are filing the statement/form online, then a colour scanned copy of both the front and back sides of it must be uploaded.

2) Manual or Physical Application (Offline / Manual Filing)

- The fee for manual filing is Rs. 10,000.

- For this, the relevant form is downloaded from the SECP website and filled completely.

- The signature of the authorized officer (e.g. CEO or Director) is mandatory at the end of the form.

- After the form is completed, it is attested by a Notary Public.

- This form is printed on a stamp paper of at least Rs. 100.

Where to submit the application?

- Manual application is submitted to the CRO (Company Registration Office).

- RO offices in Pakistan: Quetta, Lahore, Faisalabad, Peshawar, Islamabad.

- To know which CRO you fall under, check your Incorporation Certificate, your relevant CRO is written on it.

- The form can be printed and submitted to the relevant CRO through the court or manually.

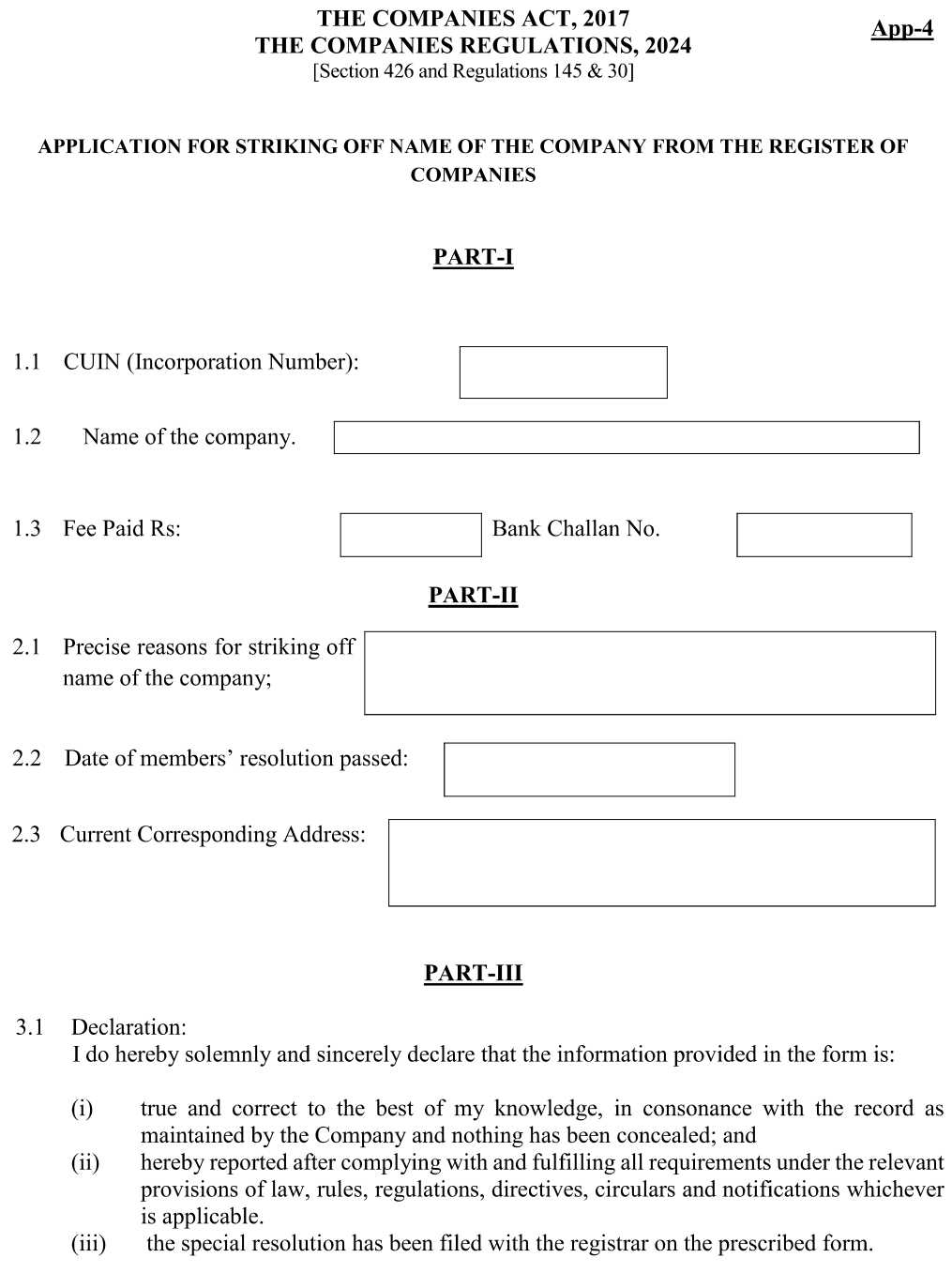

Application for Striking Off Name Of The Company From The Register Of Companies

In the application, you will first state the reason on the basis of which you want to wind up your company.

After this, you will write the reference of the meeting of the members in which the resolution of wind up was passed, and also enter the date of this resolution.

Current Correspondence Address

Finally, you will write your current correspondence address. This is very important because all the correspondence, objections and the final order issued by the SECP will be sent to this address.

If your current address is the same as the one already registered with the SECP/FBR, then it is not necessary to provide a new address. But if the address has changed, then it is mandatory to provide a new address. In case of incorrect address, the final letter is returned, and then you have to visit the CRO and collect the order yourself.

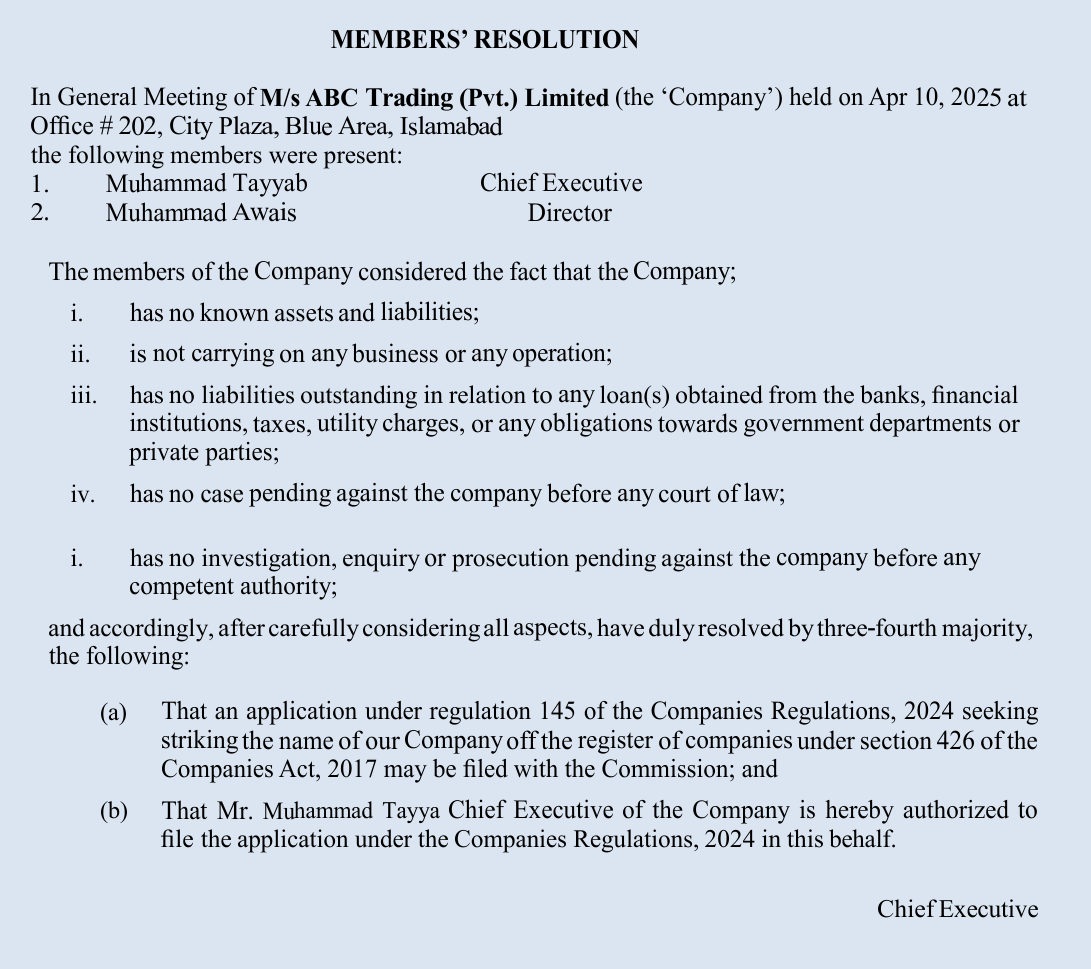

Board/Members Meeting and Resolution

A board or members meeting is held to wind up a company in which a decision is made to wind up the organization.

The format of this resolution is prescribed in law and cannot be changed.

For a wind-up resolution to be passed, three-fourths (3/4) of the members must vote in favour of it.

For example, if the number of members of the company is four, then at least three members must vote in favour of the wind-up.

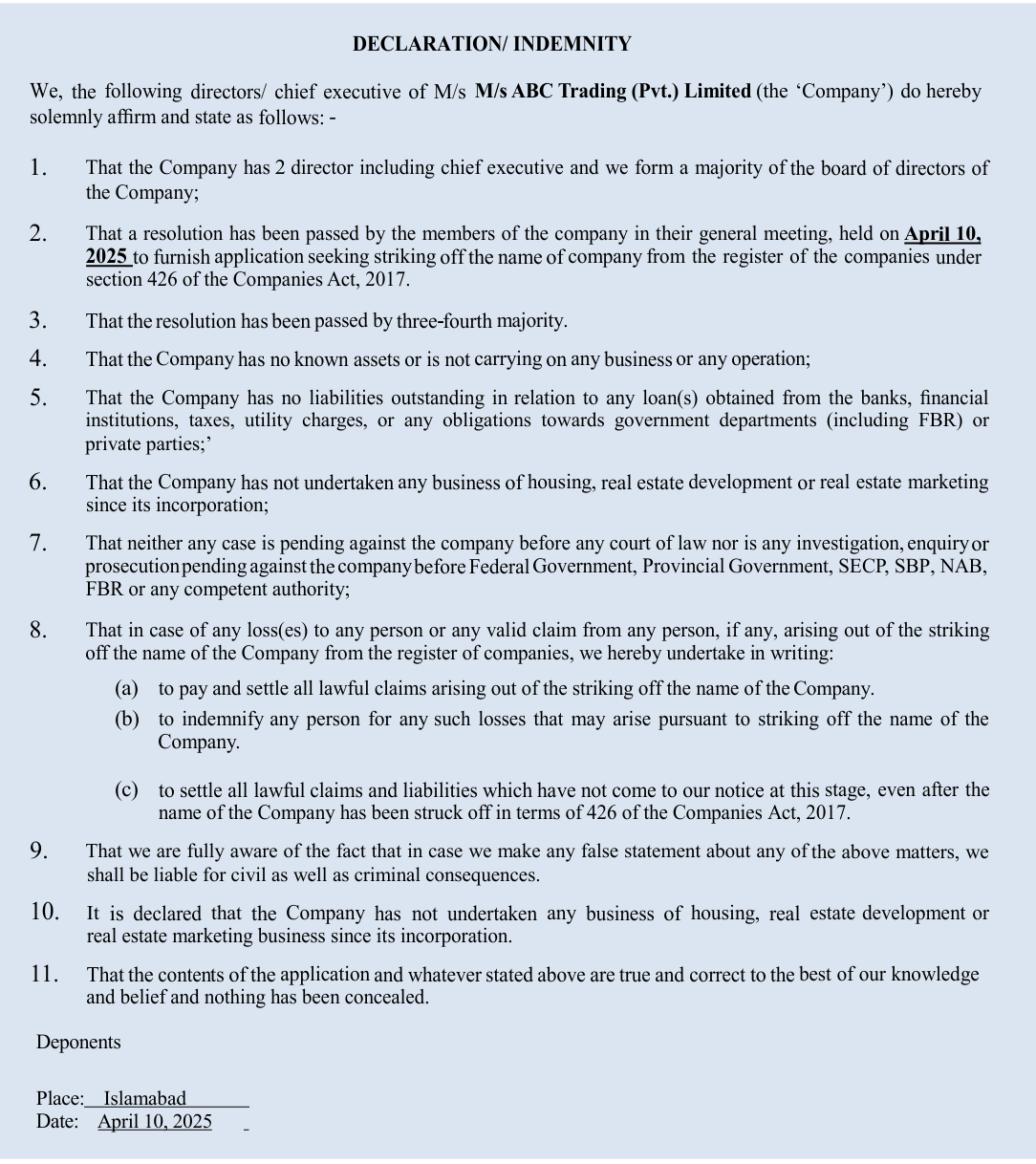

Declaration/ Indemnity On Stamp Paper of Requisite Value 100

- The Company does not have any assets, business or operations, nor does it have any outstanding debt or liability to any bank, institution, government department or private party including FBR.

- The entity has not carried on any housing, real estate or marketing business, and there is no suit, inquiry or investigation pending against the entity.

- The Directors undertake that they will be liable for any legitimate claim or loss arising out of the removal of the name.

- Here is the better rewritten sentence:

- There is no case pending against the company in any court, nor is there any inquiry, investigation or proceeding before the federal or provincial government, SECP, State Bank, NAB, FBR.

Auditors’ Certificate

And finally, after all the operations are completed, an auditor’s certificate will be required, which will be issued by a third-party auditor. The certificate may be cross verify by the SECP.

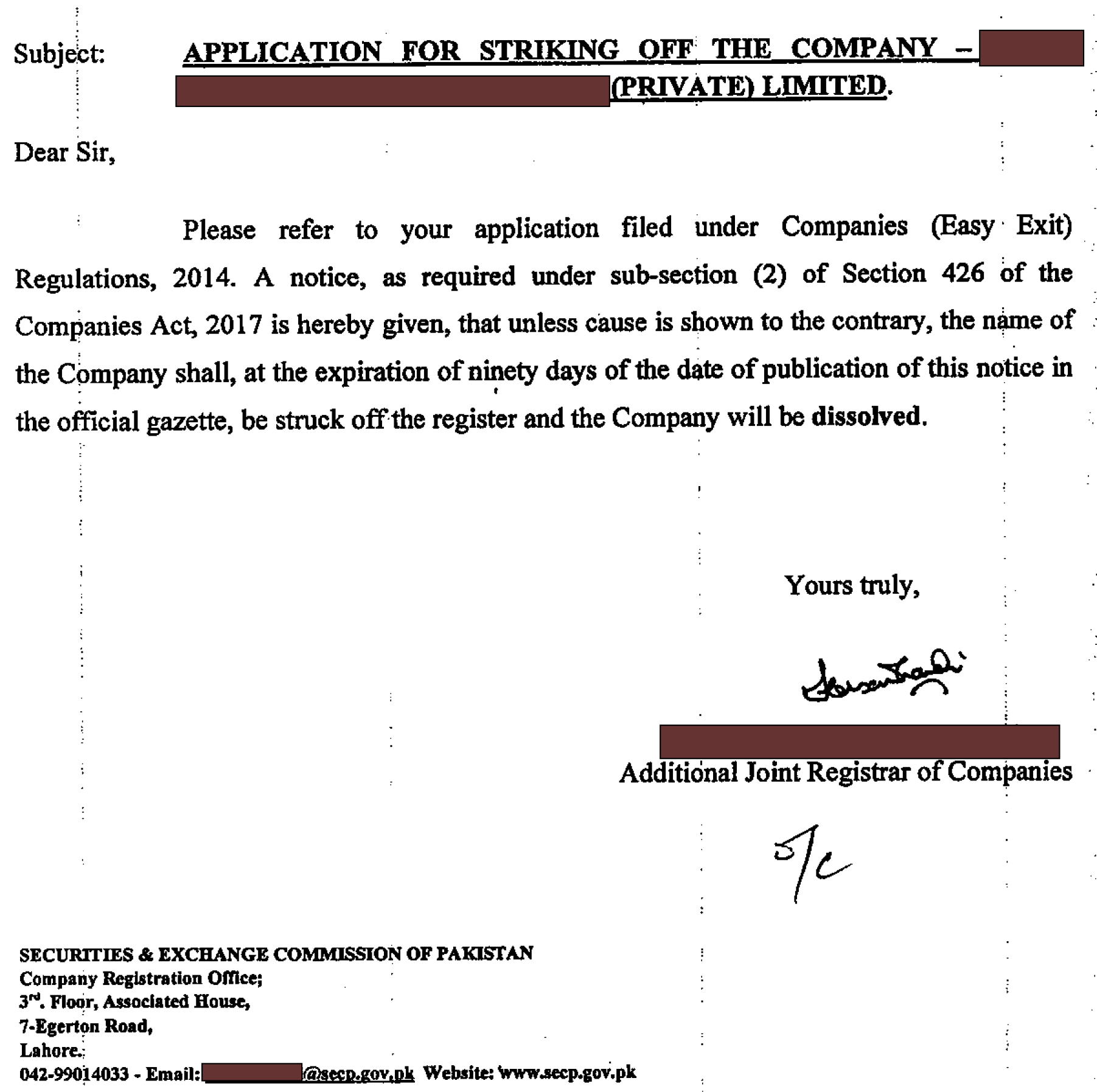

Approval of Application and Issuance of Final Letter

Once your application is approved and all the processes are completed, a letter will be issued by the Additional Joint Registrar of Companies SECP at the end. A sample letter is attached herein.

Final Thoughts

- Winding up a company means removing the name of the company from the list of registered companies so that it no longer exists legally.

- If the company has no business, assets or liabilities, it can apply for winding up, through SECP’s Easy Exit Scheme.

- The wind-up application can be submitted online or manually. It requires a resolution of the members, current address, declaration, and necessary documents.

- If you need to more about A Simplified Guide to Winding Up a Company with SECP in 2025 Please contact us through our website by filling out the Contact Usform, or reach out via our social media accounts