Essential Guide How to Get Tax Refund from FBR in 2025

Income tax refund means that if you have paid more taxes than your actual liability to the FBR, then that excess amount paid is refundable.

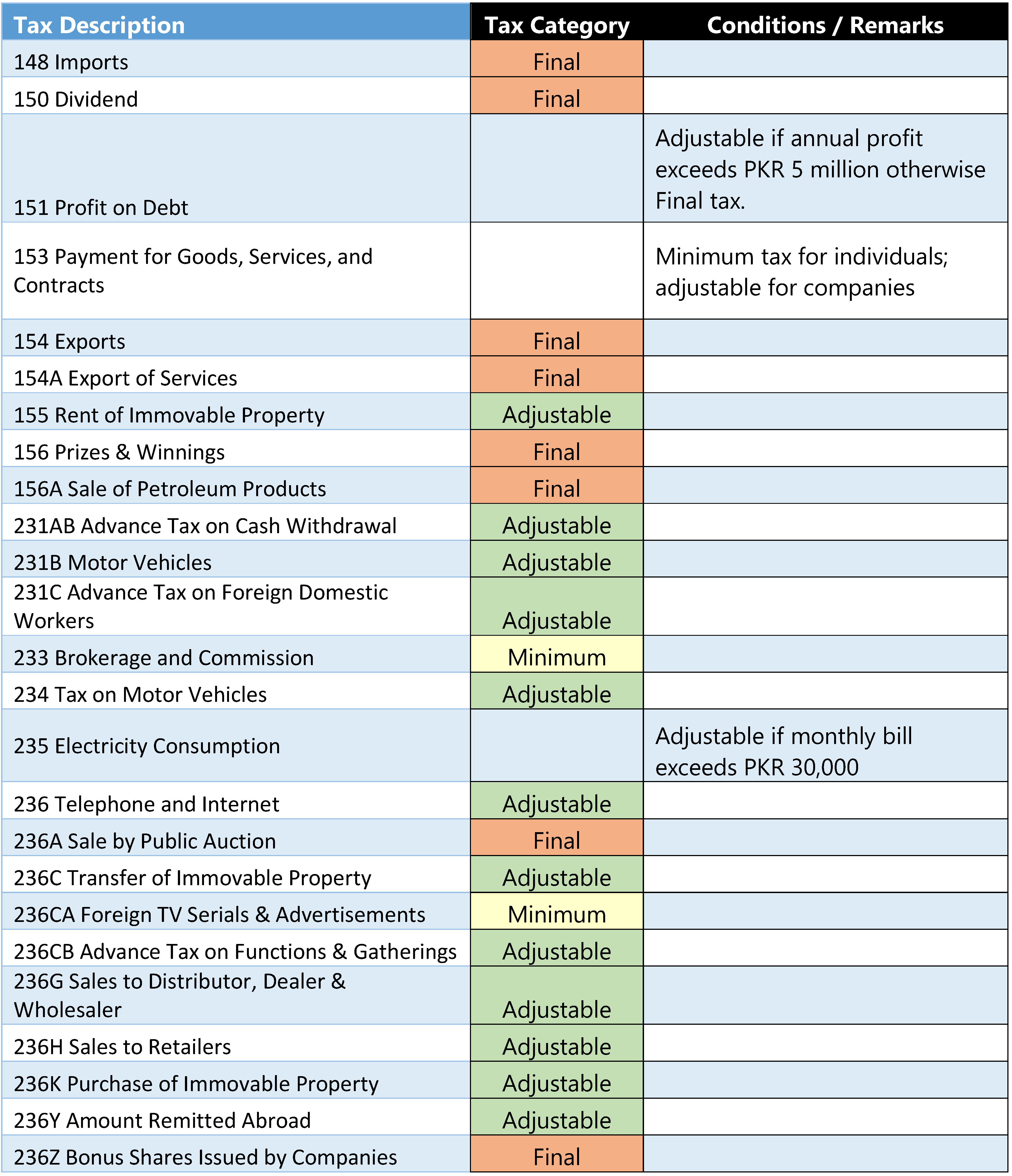

Taxes is usually deducted in various ways, such as on mobile phone balances and bills, bank cash withdrawals (ATM), internet and phone bills, and property transactions. The question arises, can all this deducted taxes be refunded?

The basic principle is that only tax is refundable that is adjustable.

Taxes deducted in Pakistan are generally classified into three categories (regimes):

Adjustable tax:

The taxes that are deducted under this category can be adjusted against the actual liability due after deducting allowable expenses from your annual income (whether salary or business income) at the time of filing your annual return.

If have paid more than your liability, the excess amount is a refundable.

Minimum Tax

These taxes which are once deducted are generally not refundable. The deducted amount shall be considered as the minimum liability of the taxpayers and if the actual liability is less than the excess amount already deducted is not refundable.

Final Tax

The deducted amount shall be considered as the final liability of the taxpayers. Neither any more can be charged on it nor is it refundable to the taxpayers.

That is, if less tax has been deducted from the taxpayers then the government cannot demand more, and if more has been deducted, the taxpayer cannot claim a reimbursement.

In summary, not all taxes deducted can be refunded, only adjustable taxes are eligible for return or adjustment.

How to Claim Refund

To claim a refund, it is also necessary that you have filed an income tax return.

Apart from that, you can claim a return of excess paid within three years.

For example, if deduction has made in 2023, you can claim a refund up to 2026.

While filing your return, make sure that the amount of excess paid being claimed is the amount correctly reflected in your income tax return.

You will then need proof of all taxes deducted, such as:

Withholding tax statement

CPR (Computerised Payment Receipts)

How to Verify Withholding Deductions?

In the current online system, most of the taxes deducted are automatically shown in the IRIS portal. To verify this, log in to IRIS and go to the “MIS” section or ‘’ Malomaat” and then click Withholding / Payments option and select the relevant year.

It is most effective to regularly check all the tax payments deducted in your name during the entire financial year.

Since the financial year start from 1 July and ends on 30th June, select the relevant year so that all the taxes deducted during the year are reflected.

Tax deduction and payment date discrepancy

Often, the problem arises that a deduction is made before 30th June but the agent deposited to the FBR in July, then the amount in the FBR records goes to the next financial year, even though the deduction was made in the previous year.

In case if there are one or two transactions in which tax has been deducted then the best way is to ask the concerned person or institution to correct the payment date in the CPR and show it as a date before 30th June (e.g. May or June).

Deduction in the year, credit in the second year

As soon as the CPR date is before June 30, that payment will be updated in the system for the same financial year and your problem will be resolved.Remember, if the payment is shown after July as per FBR records, you cannot claim it in the same year but the amount can be adjusted or claimed in the next financial year only.

The Importance of CPR and Payment Confirmation

CPR and Payment Confirmation are necessary because sometimes it happens that tax is collected from you, but that amount is not deposited with the FBR.

When a withholding agent makes any deduction, it is mandatory for him to deposit this amount with the FBR on time.

Why Taxpayers don’t get a refund?

If that amount is not deposited with the FBR, then later you will not get a reimbursement, even if you have a withholding tax certificate.

refund is possible only if that taxes deducted from you has actually been deposited with the FBR on your behalf.

How to verify FBR records?

Taxpayers should verify their deposited amounts by entering their NTN or CNIC in the CPR provided by the withholding agent’s.

In addition, it is necessary to cross-check these payments with the refundable amount in their income tax returns.

Therefore, regular checking and verification of CPR and payment confirmation is very important to avoid any issues or delay in refund.

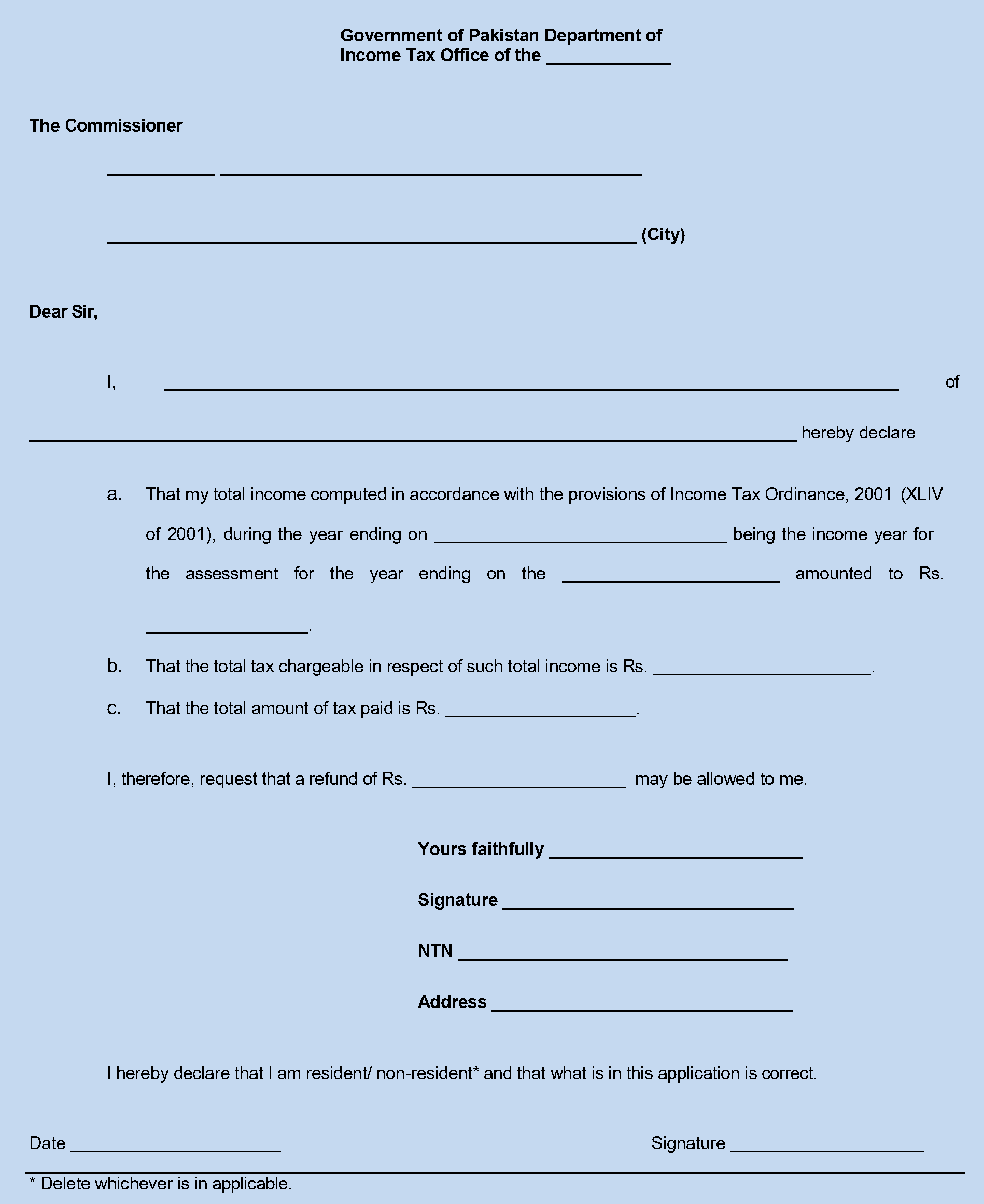

How to File Application for Refund?

To get a repayment, you have to log in to the IRIS portal and file a refund application. The following documents are mandatory to be attached:

CPR (Computerised Payment Receipts)

Tax Deduction Certificates from the withholding agent.

How Long Does It Take to Get a Response on Refund Claim?

FBR is legally bound to decide on the application within 60 days after submission.

If NO decision is not made within 60 days i.e. the application remains in outbox folder of the IRIS portal, then the taxpayers can file an appeal against it for delay.

If 60 days have passed after filing the refund application and there is no progress on the application, then the taxpayers have the right to appeal.

The concerned authority has to decide on the appeal within 120 days (four months).

What Should Be the Next Step If The FBR Does Not Pay the Refund?

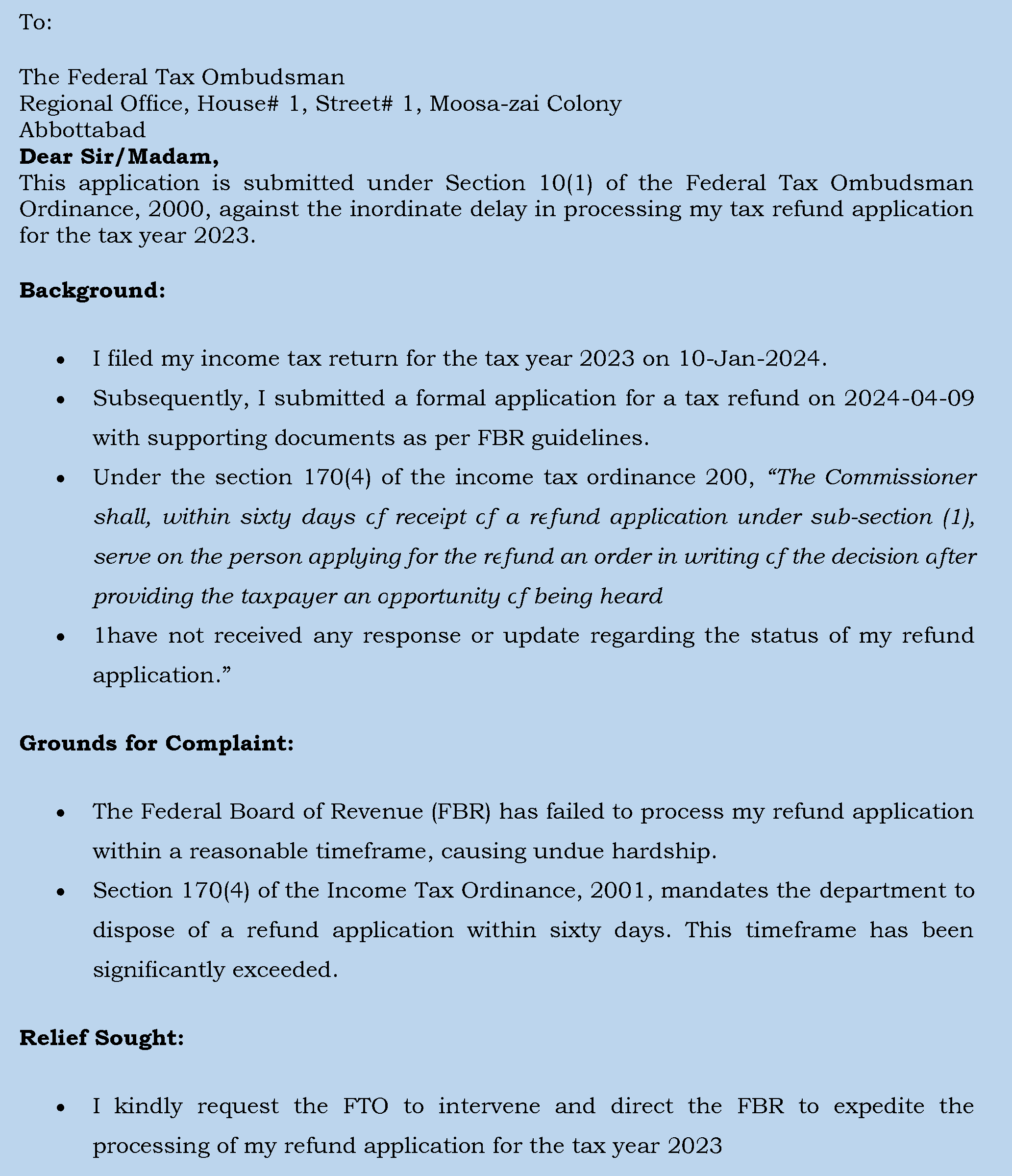

If the case is pending and no decision on refund application then the other forum that can be approach is the Federal Tax Ombudsman (FTO).

For this, the taxpayers can either go to the FTO website and file a complaint online or a manual complaint can also be filed. The mandatory that needs to be attached are:

Copy of Filed Income Tax Return

Application for Refund

CPR (Computerised Payment Receipts)

After a few days, the FTO will contact you and initiate formal proceedings, which will bund the FBR to take a decision.

When your refund application is approved, you will receive a written order, which clearly states that your refund has been approved.

FBR Refund Process: Important Points

A refund is available when the taxes deducted are more than the liability of the taxpayers.

Only adjustable withholding taxes are refundable.

Filing of income tax return and CPR (Computerised Payment Receipts) are required.

Taxes calmed as refund are actually paid to FBR.

Refund application is filed in IRIS under Section 170.

FBR has to decide within 60 days.

If the issue is not resolved, the FTO can be approached.

If you need any further Essential Guide How to Get Tax Refund from FBR in 2025, please reach out via our social media accounts.