What is company conversion?

A Simplified Guide How to Convert a Company Status in 2025: Company conversion means changing the current status of a corporation, i.e. converting a private limited company to an SMC or converting an SMC back to a (Pvt.) Ltd. or converting a (Pvt.) Ltd. to a public limited company.

Generally, you can change three basic conversions:

- Private Limited – Public Limited

- Private Limited -Single Member Company (SMC)

- Single Member Company (SMC) – Private Limited

This process is not just a change of name, but many things including the legal structure of the business, documents, shareholding, directors and bank records change.

How is the number of directors adjusted during company conversion?

A (Pvt.) Ltd. company must have at least two directors, while a single member company can have only one director. A public limited or listed company must have at least three directors.

When the status of the corporation is changed, the number of directors will also have to change. For example:

If a single member company becomes a private limited company, the number of directors will have to be increased.

If a private limited company is converted to a single member, only one director will be retained and the rest will be removed.

Minutes of Meeting Extra Ordinary General Meeting

First of all, an extraordinary meeting will be called in which it will be decided that the status of the entity is being changed.

If the company is to be transferred from a Private Limited Company to a Single Member Company (SMC) Pvt Ltd.

The summary of this will be that the current status of the corporation is being changed from Private Limited to (SMC) Pvt Ltd.

It will be clarified that how many shares are being transferred by the existing shareholders and the full details of the name of which single person these shares have been transferred will also be given.

For example:

If there are three shareholders/members in the corporation and the total number of shares of the entity is 10,000, and each member transfers his 2,500 shares to the name of the same person, then the total number of shares transferred and the details of each transferring member will be written.

If the company is to be transferred from a Single Member Company (SMC) Pvt Ltd.

To Private Limited Company

Similarly, in this corporation status conversion must also specify the names of the incoming directors, their number, and the details of the shares to be transferred to them. Since there is only one director in a (SMC) Pvt Ltd, it is necessary to provide complete information about the admission of new directors and the distribution of shares when the corporation reverts to private limited status.

For example:

If Mr. A holds 10,000 shares and three new directors are joining, it will be explained how the shares will be distributed among these new directors the details of the transfer of shares and the shares to be received by each new director will be clearly recorded.

Share capital increase and related requirements

If the share capital is being increased, for example, the existing share capital is being increased from one lakh to one million, then details of this will also have to be written. In this case, an additional form-7 will have to be filed with the SECP for filing along with additional fees.

Affidavit

An affidavit will be issued from the Chief Executive of the entity stating that the status of the company is being changed, all the information provided is correct and nothing has been concealed. The value of the stamp paper will be 100 Rupees.

Modification in Articles of Association and Memorandum of Association

Whenever a fundamental change is made to a corporation whether it is a change of address, a change of name, or a conversion of the company’s status the entity constitutional structure (MOA and AOA) must also be amended.

Since the Memorandum of Association (MOA) and Articles of Association (AOA) contain the basic information of the entity, necessary amendments need to be made to them.

First in this process:

If the name of the corporation is being changed, it will be corrected in the MOA and AOA.

If the share capital or authorized capital is to be increased, its amendment will also be included.

The Last Page of MOA and AOA Cannot Be Changed

It is important to note that the last page of the both articles and memorandum cannot change the number or names of the existing directors because the last part is remains the same in the entire life of the entity.

For example, if a (Pvt.) Ltd. Corporation previously had four directors and now has only one, the last page will continue to mention four directors.

However, the remaining amended articles and memorandum will be provided as per the new name and status, and the corporation name will be corrected above.

Appointment of a Nominee Director

Whenever a (Pvt.) Ltd. is converted into a (SMC), it is necessary for the SMC to appoint a nominee director. This is so that if the director dies or resigns for any reason, the nominated deputy can take his place.

For this, it is mandatory to enter the details of the nominee director, which includes a copy of his CNIC and creating his user ID in leap. This is required only when the conversion is taking place into a SMC.

If a SMC is being converted into a (Pvt.) Ltd, the details of the nominee director will be deleted.

Steps to complete the process of Convert to Private (Limited by Shares)

The process of transferring shares is not completely online. Some processes are online and some are manual. It is better to process online wherever possible and complete the rest manually.

01 File for Special Resolution in Leap

Form 26 has to be filled up for Special Resolution. A scanned copy of the special resolution must be attached and a summary of why the conversion is being done must also be included.

02 File for Change in particular of directors and officers in LEAP

Form 9 must also be filed, which is used for change of directors or officers. If new directors or officers are to be added, their front and back copies of CNIC must be attached. The directors to be removed must also be listed in the form.

03 File Change in shareholding/ membership/ voting rights in LEAP

After this, the Form 3 will be filed, which will include details of changes in shareholding and share transfer.

04 Generate Manual Challan for Conversion -Convert to Private (Limited by Shares)

Finally, a monthly challan has to be generated and the fees incurred have to be paid. After this, the entire process will be complete.

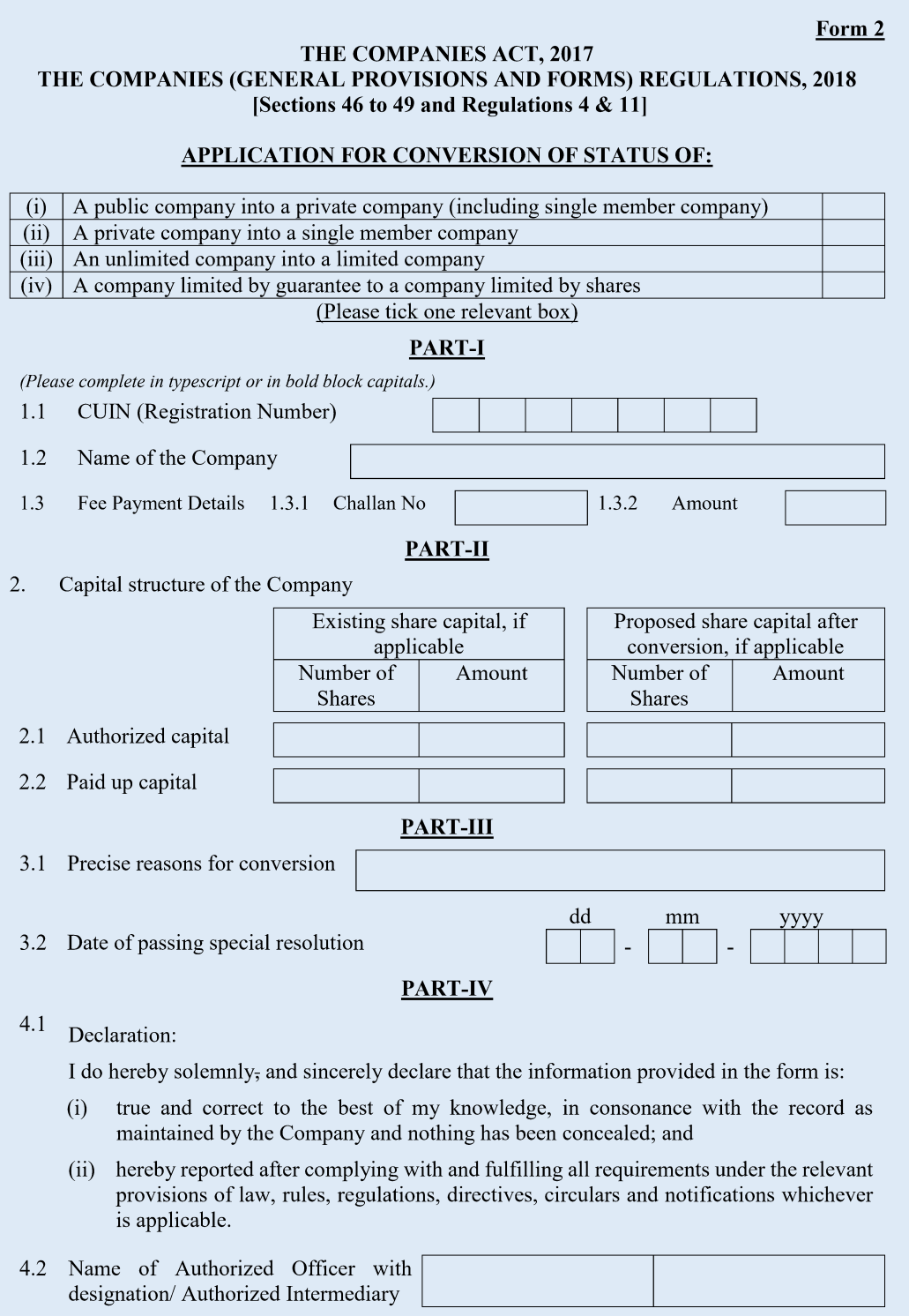

05 Fill & Attach Application for conversion

All the forms to be filed will require the attachment of some mandatory documents. These include the scanned original copy of the special resolution, signed by all the directors and printed on the organisation letterhead.

Similarly, it is mandatory to upload both the front and back sides of affidavit and it must be attested by the notary public.

If the company is being converted from a Pvt Ltd to a (SMC) Pvt. Ltd, then a copy of both the front and back sides of the National Identity Card (CNIC) of the nominee director will also need to be attached.

06 Submit Application for conversion of status, Paid Challan and LEAP Processes ID in Concerned CRO office

After this, the conversion application will be filed manually. the authorized officers will sign the application. A fee challan must be generated manually and submitted to the bank.

Finally, the printed copies of all the forms filed and all the original documents will have to be submitted to the concerned SECP office in person, or through post/courier.

Fee

As mentioned earlier, the company conversion process is not entirely manual. Some forms can be filed online while some must be submitted manually.

If you file the entire process manually, you will have to pay double the fee. However, if you submit the forms that are available online and file the remaining forms manually, you will only have to pay a small additional manual fee and courier charges.

Company Conversion: Why is online filing preferred?

The advantage of online filing is that the fee is less and the status update of each form is also available immediately. If any objection is raised in any form, it is also known at the same time. Whereas if you get the entire work done manually, in case of objection in any form, the file will be sent back to you from the SSP office, and then you will have to resubmit it.

Details of online and manual fees for various forms

| Online | Manual | |

| Alteration in Memorandum/Articles | 5,000 | 10,000 |

| Application for conversion of status | 2,500 | 5,000 |

| Form-9 | 1,210 | 1,815 |

| Form-3 | 1,210 | 1,815 |

| Form -26 | 1,210 | 1,815 |

| 11,130 | 20,445 |

Final Thoughts

Conversion of a company is the process of changing the existing legal status of a entity.

During the conversion, the number of directors, shareholding, statutory documents (MOA/AOA), and bank records are also changed.

For this, an extraordinary general meeting is held, shares are transferred, new directors are appointed, and documents are amended.

Special resolutions, Forms 3, 9, and 26 are filed, an affidavit is filed, and all documents are submitted to the SECP online or manually.

And finally after the approval of application a certificate of conversion is issued.

For more information about A Simplified Guide How to Convert a Company Status in 2025please contact us or reach out via our social media accounts.