Is physical foreign currency brought from abroad tax free? If you are an overseas Pakistani returning to Pakistan and bringing physical foreign currency (cash) with you while traveling? such as Dirhams, Riyals, Dollars, Euros etc. So this amount can also be declared as remittance?

There are three ways to send or receive money from abroad to Pakistan.

Is Physical Foreign Currency Brought from Abroad Tax Free?: Remittance

This is the only legal and formal way to transfer money to your own or someone else’s account. It is generally considered tax-free, but certain conditions may apply. Foreign currency is usually brought from abroad; sent through a bank and converted into local currency there.

Remittance Is Only Exempted from Taxes If Send It Through Bank

- Send money Pakistan through the banking channel. That is, when you send it from abroad to your Pakistani bank account.

- PRC issued by the Bank: The details listed in the PRC issued by the bank include

- Country from which the amount was sent.

- Purpose of the remittance, e.g. household expenses.

- Relationship between the sender and the recipient of the money.

Hundi or Hawala:

The second method is the one through which money is sent from abroad this is the hundi/ Hawala method, which seems to be the most common and easy, but is banned by the government.

In this, the sender gives the foreign currency to a person abroad, and the person’s representative or relative collects the equivalent Pakistan rupees from a person residing in Pakistan.

This method is illegal, it is not considered as remittance and there is no proof of it the transaction is usually in cash.

What if Declare Hundi as Remittance?

If you declare such money as remittance in your tax return, it will not be considered a remittance because there is no proof of foreign transaction. In this situation, the FBR can impose tax on it.

Previously, these payments were made entirely in cash, but the amount transfer to Pakistan through their personal local bank accounts or directly to a relative’s account. Even though the money is coming into the bank, it is not recognized as foreign remittance.

Is Physical Foreign Currency Brought from Abroad Tax Free? : Physical Currency:

The third method is to bring physical foreign currency with you when traveling to Pakistan from abroad.

Is Physical Currency Considered as Remittance?

Suppose you are traveling from the United States and are carrying 10,000 or 15,000 US dollars in cash with you.

- Can this amount also be declared as “remittance”?

- Can this foreign exchange be declared in the income tax return?

How to Declare Foreign Currency?

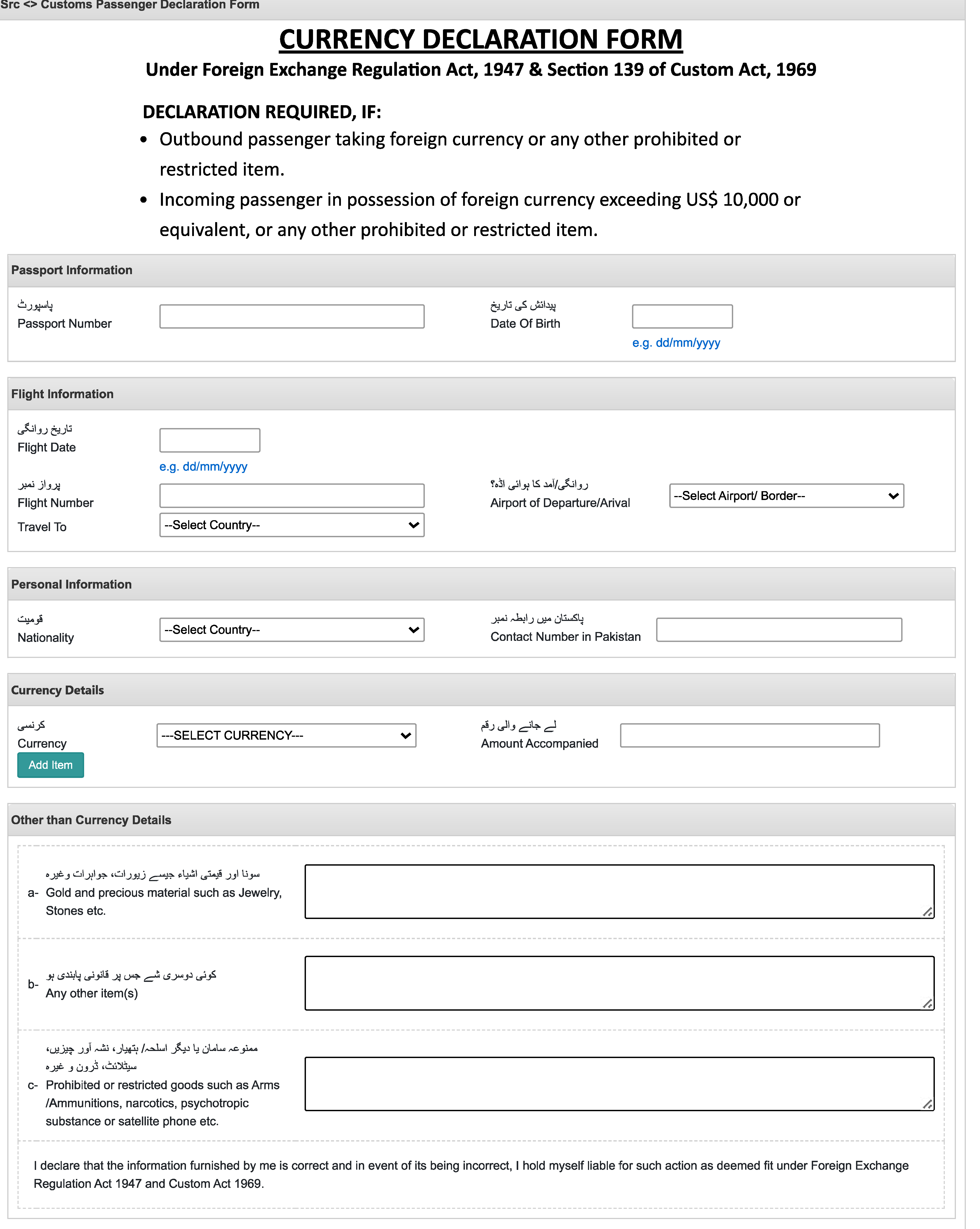

On arrival at the airport in Pakistan, the persons are required to declare the foreign exchange you have brought this can be done this in two ways:

Currency Declaration Form

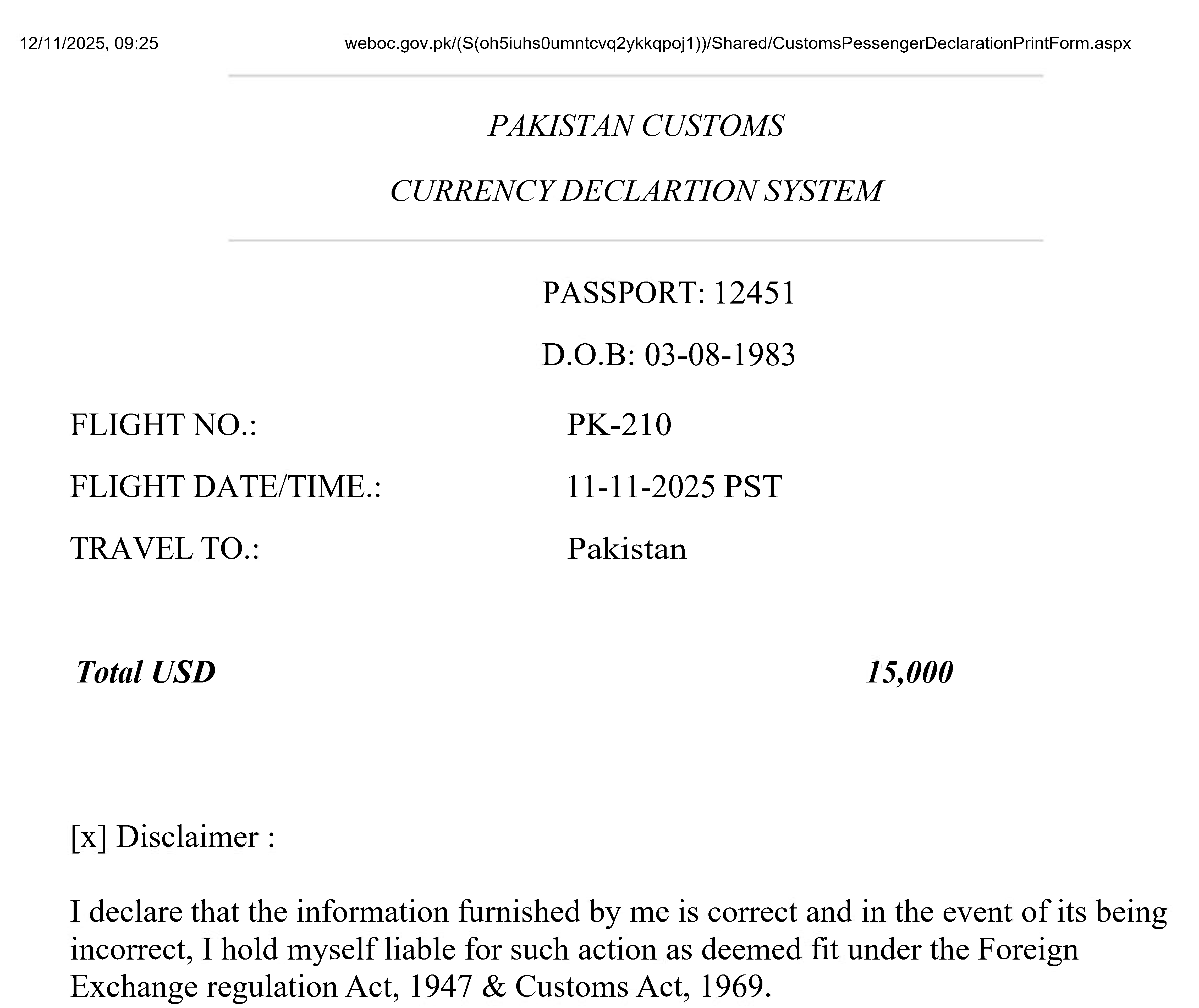

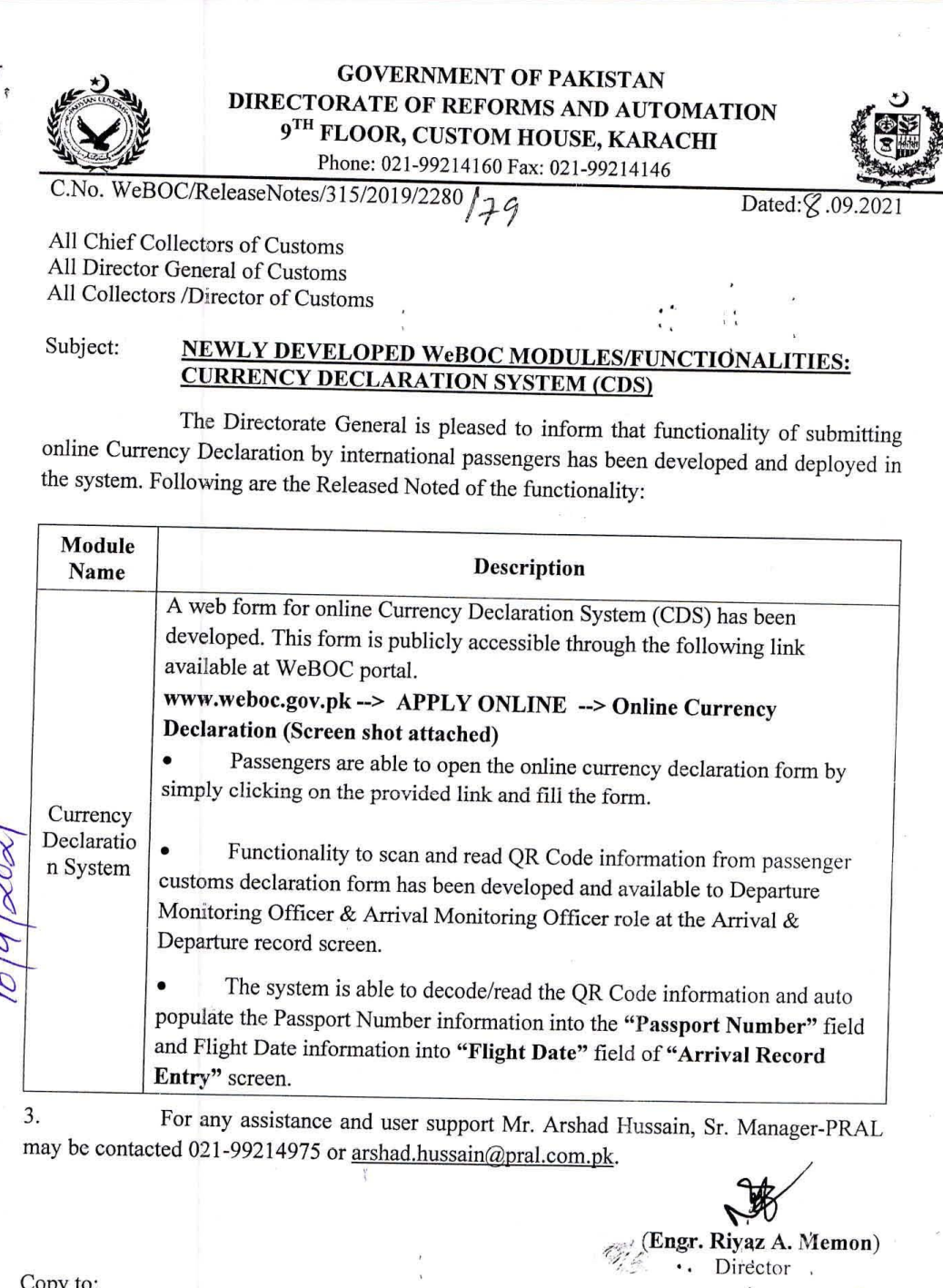

Pakistan Customs has developed new WEBOC modules/features for Currency Declaration System (CDS) and has issued a notification in this regard on 8th September 2021.

Please visit the WEBOC website and fill the “Currency Declaration Form”.

After completing the form, a receipt can be printed which will contain the passport number, date of arrival, flight number and foreign currency details. Keep this receipt safe.

Exchange Currency Through a Bank

- After declaration foreign exchange at the airport you should get your FOREX converted only from a local bank or authorised money exchanger.

- The forex exchanger gives you a receipt on which the amount, exchange rate and date are recorded.

- You can now declare this amount as remittance in your tax return no tax will be levied on you because it legally approved as per the law.

Is Physical Foreign Currency Brought from Abroad Tax Free?

If you do not declare your foreign exchange at the airport, this amount cannot be declared as foreign remittances later when filing tax returns, as it requires a PRC (Proceeds Realization Certificate).

The bank issues PRC only when the money has been remitted from abroad through the bank. If you have physical currency (cash foreign money), the bank does not have any record of it, so it cannot issue PRC. Consequently, such money will not be considered as remittance.

As a result, the FBR will consider this amount as income from undisclosed sources, which can be taxed at a maximum rate of 45%.

Limitation and Requirement of Currency Declaration Form

If a person fails to declare foreign exchange at the airport, here are some solutions and precautions:

First, know that a currency declaration form is required only if the value of the forex is $10,000 or more; this form is not generally used for amounts less than that.

How to Safely Use Undeclared Money

One possible way is to declare the money as personal household expenses that is, make payments or uses that can justify the cash.

But do not make investments (such as buying property) that would attract the attention of the FBR, as the FBR may ask you about the means of purchasing the assets and send notices due to data access to the registry/land records.

Legalizing Money Through Family Tax Returns

Another way is to record the money in small amounts in the names of close family members (father, mother, siblings) on their tax returns; The money can then be transferred to your account via bank transfer and presented as a gift.

This method works best if the family member is filing their return for the first time or their previous returns are less than five years old otherwise, revisions may be required.

Caution and Proof Required for Large Sums of Money

If the amount is large, solid evidence will be required, so use these methods sparingly and cautiously.

In short, after not declaring at the airport, make decisions with caution and evidence; to avoid risk, avoid large investments or actions that are likely to attract FBR notice.

Is Physical Foreign Currency Brought from Abroad Tax Free? :

Currency Declaration Rules and FBR Conditions

This facility is only for non-resident Pakistanis (Overseas Pakistanis) and stayed in Pakistan for more than 183 days.

This from can only use if the passenger has foreign exchange $10,000 or more.

Currency declaration is mandatory at the airport or on the web.

Keep both documents saved for 6 years because maintained records for six years is mandatory.

For more information about Is physical foreign currency brought from abroad tax free? Please contact us through our website by filling out the Contact Us form, or reach out via our social media accounts