How to Avoid Double Tax on Bank Profit of more than 5 million: Fixed deposits in the banks are considered the safest investment. In Pakistan, people usually keep their savings in National Savings Certificates, Defence Savings Account or Pension Account after retirement. Today we will talk about how much taxes are applicable on it and what are the ways to avoid the double taxes.

How to Avoid Double Tax on Bank Profit of more than 5 million: Fixed deposits in the banks are considered the safest investment. In Pakistan, people usually keep their savings in National Savings Certificates, Defence Savings Account or Pension Account after retirement. Today we will talk about how much taxes are applicable on it and what are the ways to avoid the double taxes.

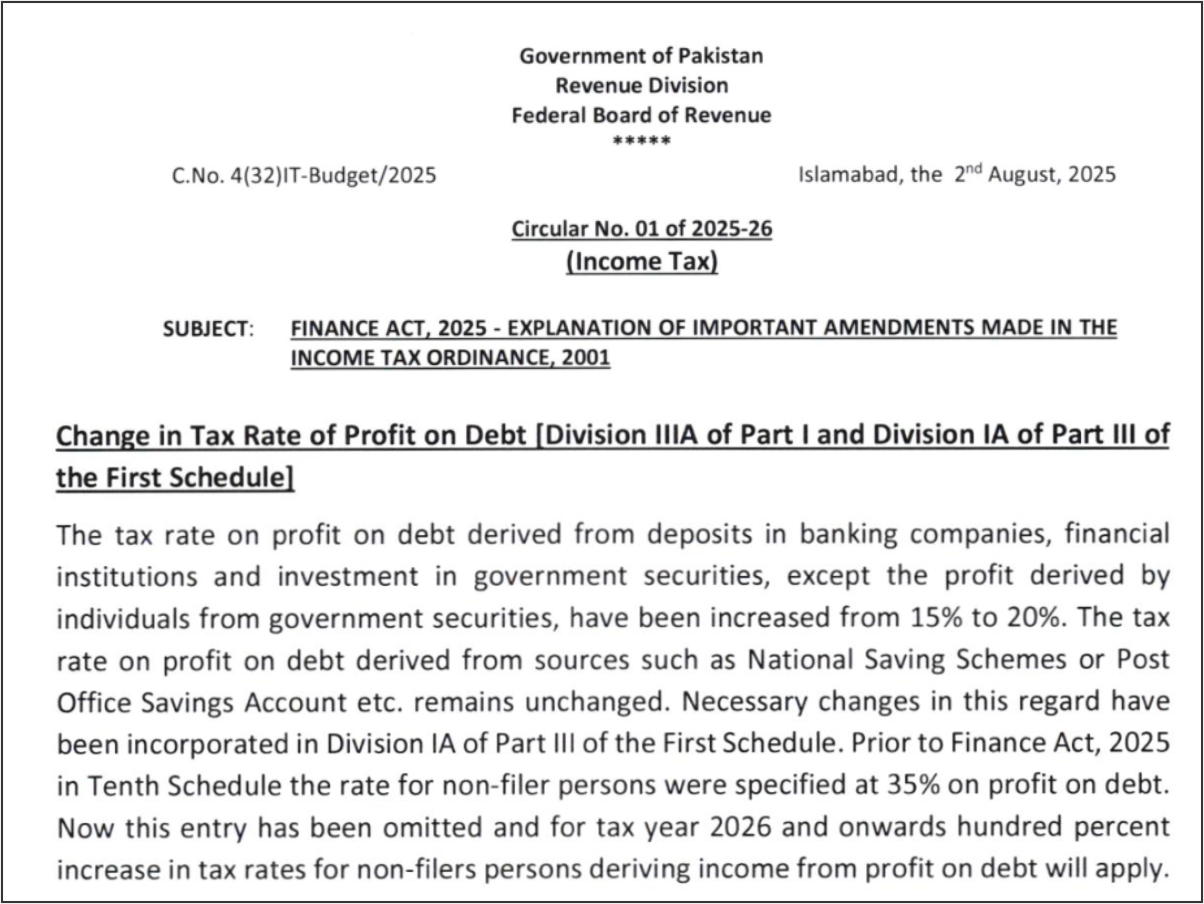

The current rate of withholding tax on bank profits is 20 percent for filers and 40 percent for non-filers, which is deducted directly from the account holder’s bank profits and deposited with the FBR. This amount can be adjusted later against the final liability.

Profit up to Rs 5 million

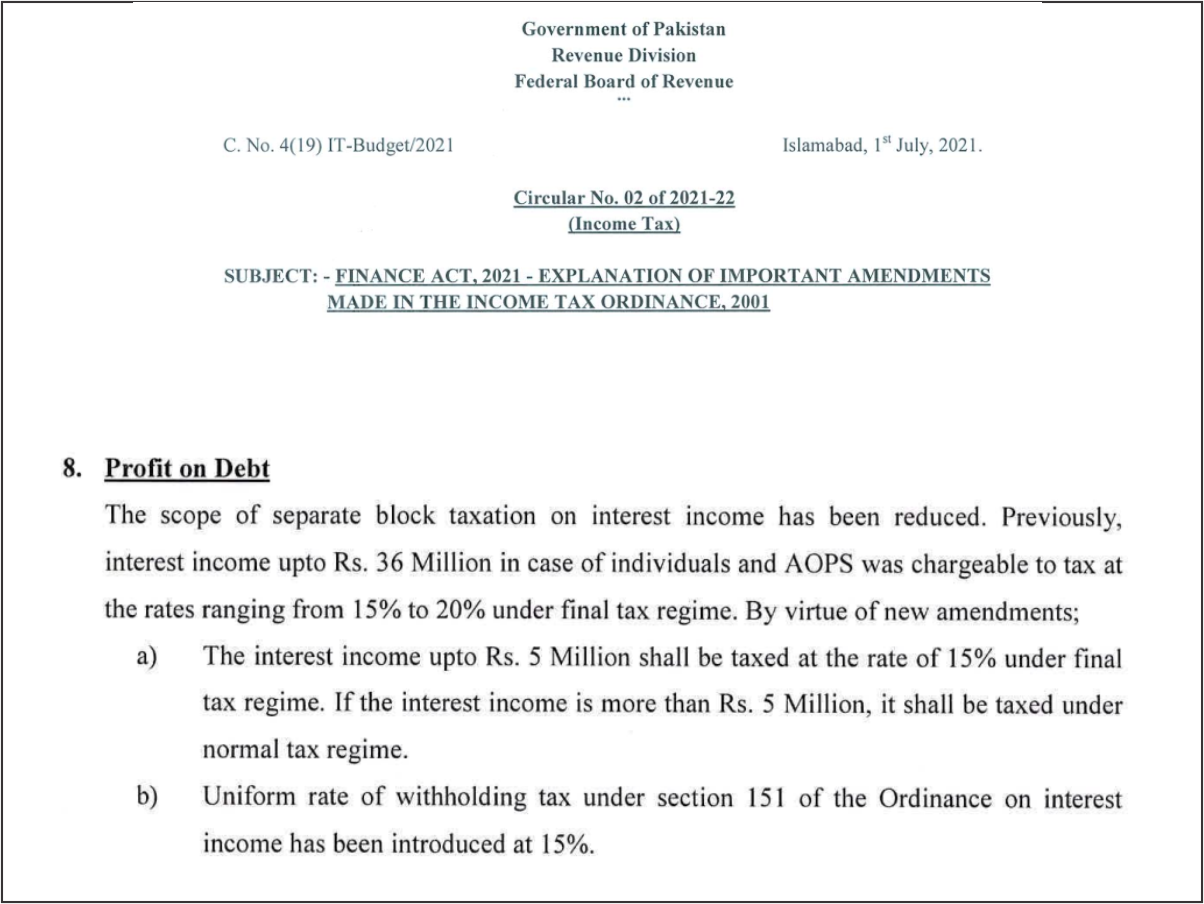

If your annual earnings from bank is less than Rs 5,000,000 then the tax levied on it will be fixed and final (FTR). After this, the FBR cannot demand any more from you.

Profit above Rs 5 million

If the interest income exceeds Rs 5 million, then in this case it will no longer be a FTR but will come under the “normal tax regime” (NTR). This means that normal income rates will be applicable on the entire profit. This was introduced in finance act 2021 the notification of this change is reproduced here.

How to calculate tax payable on bank profit?

If your bank interest is up to Rs 5,000,000 then taxed at the rate of 20% will be 1,000,000.

And if the interest exceeds Rs 5 Million, then the entire income will be taxed at a higher rate and the total liability will increase to about Rs 1.37 Million

| Bank Profit | WHT Deducted 20% | Taxes Charged | Rate Of Taxes |

| 5,000,000 | 1,000,000 | 1,000,000 | 20% |

| 5,001,000 | 1,000,200 | 1,370,400 | 27.4% |

When does advance tax apply?

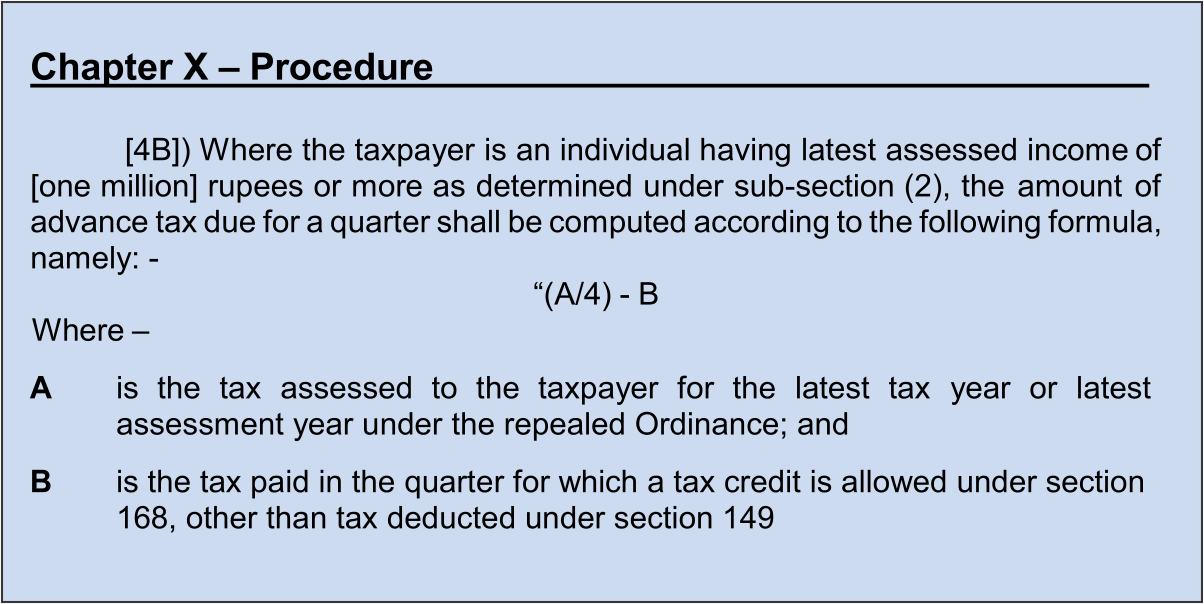

In addition to paying double taxes under NTR, if the taxpayer’s taxable annual income exceeds Rs 1,000,000 he will also have to pay advance tax every three months in the following financial year.

in the following financial year.

As the annual income is more than Rs. 50 lakhs, the advance tax will be calculated as follows

How to Calculate Advance Tax Payable?

Calculating advance levy is very easy. The formula for this is to divide the net tax liability of the previous financial year by 4. This means that the same amount you paid last year will have to be paid in four equal instalments next year.

For example, if your total liability previous financial year was Rs. 1,370,400, then the amount payable in each instalment will be:

1,370,400 ÷ 4 = Rs. 342,600

Explanation of advance tax and final tax system

If your profit is less than Rs 50 million, you fall under the Final Tax Regime (FTR) and no advance levy is applicable on you.

However, if your interest income exceeds Rs 5 million, the taxpayer will not only have to pay additional taxes as per the NTR but will also be required to pay advance fiscal payment, which will double the overall fiscal obligation.

The quarterly fiscal payment is adjusted later when you file your annual return and can also be refundable. But the refund process is quite complicated and difficult, it has to be applied for separately and it also takes time.

It is no longer possible to save taxes by showing low profits.

Earlier it was possible to save taxes by showing less profit in the Fiscal return, but now it is not possible because the banks data is directly linked to the FBR.

If someone shows less income, after some time the FBR will issue a notice through the system.

In this case, penalty and outstanding taxes will also be recovered. Similarly, distributing the money among different banks will not make any difference because the entire system is centralized.

Payment of Advance Tax:

If you are subject to advance tax, you will have to pay it every three months based on your chargeable income. Whether or not you make a profit later, or whether or not your income is taxed at the end of the year the advance fiscal liability is still required to be paid, as it is assessed based on the payments made in the previous year.

For example: If your bank profit in the year 2024 was more than Rs. 50 million then you will also be liable for advance taxes in 2025.

Example:

Suppose you withdraw that bank profit in full in 2025 and buy a property with that money and now have no profit or taxable income. In such a case, to get the this liability waived off, you will have to apply to the Commissioner and prove that you have withdrawn the profit and there is no taxable. The Commissioner can cancel this after reviews the all evidence and supporting documents.

When The Bank Deducts Tax On Bank Profit and You Also Pay Advance Taxes What Is the Solution?

The second important point is that the bank also deducts withholding tax on the profit, while you are also paying advance tax to the FBR separately.

Thus, you are apparently double taxed.

The method of adjustment is that the taxpayer submits an application to the bank, with which proof of payment and details of the bank’s deductions are attached.

Since the bank acts as a tax agent, the withholding tax deducted by the bank can be adjusted against your advance tax.

How To Avoid Double Tax On Bank Profit Of More Than 5 Million

Keep only profitable investments up to Rs 5,0000,000 in the bank and invest the excess somewhere else, for example:

Mutual funds, Shares or other investment schemes but beware these are considered as risky investment but also give high return on investment as compare to fixed deposits.

Divide the money in the names of different family members. For example:

Keep Rs 5,000,000 in your account

Keep Rs 5,000,000 in a separate account for your wife or children

In this way, both will be taxed separately and the overall financial liability will be reduced.

Who will be affected?

The current bank interest rate is between 8 and 15 percent. If a taxpayer earned annual interest income of 50 lakh at the rate of 15 percent, then an investment of at least Rs 33 million or more is required.

This means that the common people will not be affected by this, but only those people who have more than Rs 30 million in investment will be affected.

For more information about How to Avoid Double Tax on Bank Profit of more than 5 million please get in touch with us through our website by filling out the Contact Us form, or reach out via our social media accounts.