Simplified Guide on How to Register with KPRA in 2025: KPRA is now sending notices to various businesses to register and file monthly sales tax returns. Some businesses fall under the mandatory registration category under KPRA, which have already received verification notices. Most people want to know whether registration is mandatory for every business in Khyber Pakhtunkhwa? What steps are required after registration? And what are the possible consequences if the return is not filed? Answers to all these important questions are included in this article.

Who is required to be registered with KPRA

If a person whether an individual, firm or a company provides a service from his office or place of business in the province on which tax is applicable shall be required to register under this Act. In other words, if provides taxable services then such business must be registered themselves with KPRA.

Taxable service:

A taxable service is one that is listed in the FIRST SCHEDULE Taxable Services KPRA to the Khyber Pakhtunkhwa Sales Tax on Services Act, and which is provided by a registered person from his office or place of business, or through which he carries out economic activities.

Place of business

If a person rents, shares or otherwise uses a place in the province, and carries on his business or provides services from there. This activity may be complete or partial. It also includes those who are not physically present in the province but provide their services within the province.

If a person carries on his business or services in the province through someone else, such as an agent, franchise, branch or office, etc. Whether that other person lives in the province or not.

Economic activity

Means any activity carried out by a person, whether permanent, regular or occasional, and the purpose of which is to provide services to another person. It includes:

An activity carried on in the form of a business, such as a profession, employment, trade or any other kind of work, whether for profit or not;

The provision or letting of property (movable or immovable) by way of rent, lease, licence or any other similar means;

Any one-time commercial venture, transaction or matter having the nature of a business or trade.

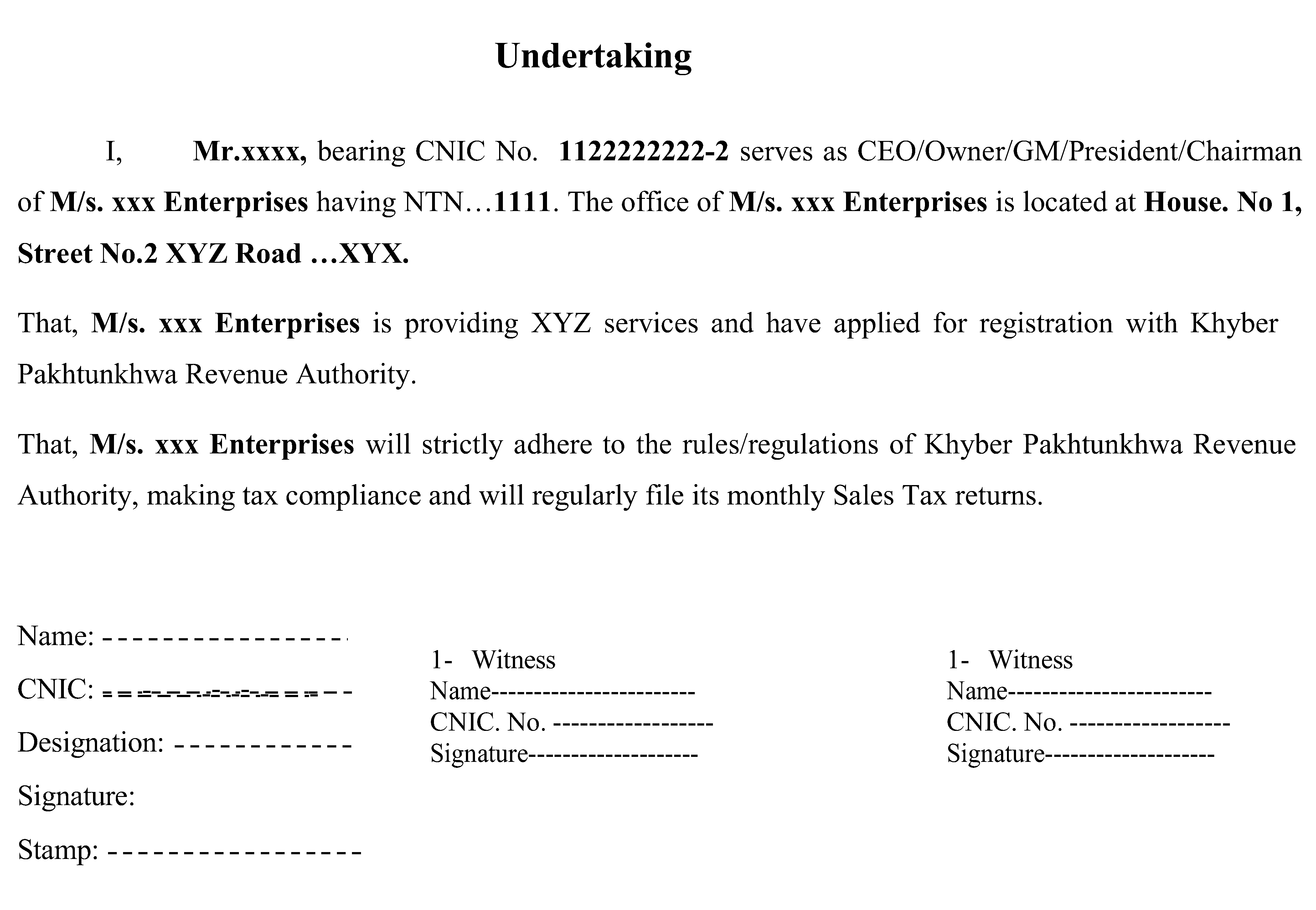

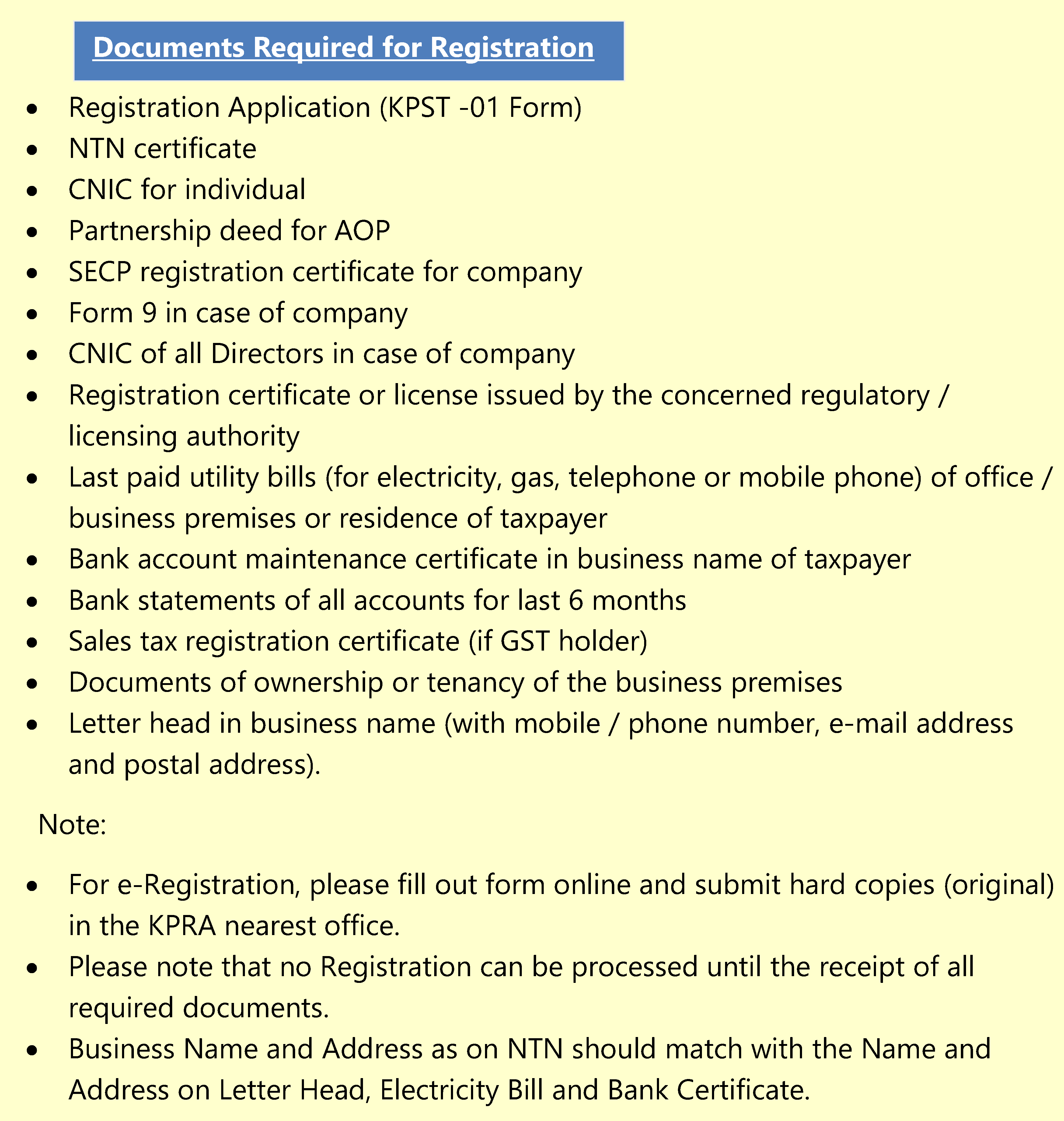

Simplified Guide on How to Register with KPRA in 2025: Documents Required for KPRA Registration

General Requirements

The following information must be provided whether an individual, firm or a company

- NTN Certificate

Business Letterhead - Authority Letter (if sending a consultant or representative instead of yourself)

- Utility Bills (Electricity or Telephone, not more than three months old and paid)

- Bank Statement (not more than three months old) or Bank Maintenance Certificate

- The business address should be the same as that mentioned in the NTN, given in the bank, utility bills and letterhead. The address should be the same everywhere.

- Affidavit in case of Business location is outside Khyber Pakhtunkhwa but registration is mandatory is due to legal compliances.

Partnership Firm

For registration of a firm, Form “C” or “H Form”, NTN Certificate, and Authority Letter from all partners will be required.

Company

Updated Form A and 9 are mandatory, which contain the details of the directors and shareholding pattern.

If the company has been registered for less than 16 months, Form 1 will be used instead of Form 9. The certified true copies are also required which are issued by the SECP at the time of filing of these forms.

Compulsory registration

If the officer is satisfied that a person should have been registered under this Act but has not applied, the officer may register him by order in writing. In such case, the person shall be deemed to have been registered from the date on which registration was compulsory for him.

But no person shall be registered under force without notice. Such persons shall first be given an opportunity of explanation or hearing.

Additionally, a person who is required to register but fails to do so may be fined up to Rs. 100,000.

Simplified Guide on How to Register with KPRA in 2025: What You Need to Do After Registering with KPRA

After registration, it is mandatory for you to file sales tax returns regularly every month. Whether there is NO business or any sale or purchase, it is mandatory to file at least one NULL or NILL return. But most people are unaware of this responsibility.

Otherwise, a minimum penalty of Rs. 9,000 will be imposed and also additional surcharge shall be payable for delay per day.

It is important to understand that some individuals or entities register with KPRA only to fulfil legal requirements, even though they do not actually provide any taxable services.

A common example of this is participating in government tenders, as KPRA registration is mandatory for submitting tenders.

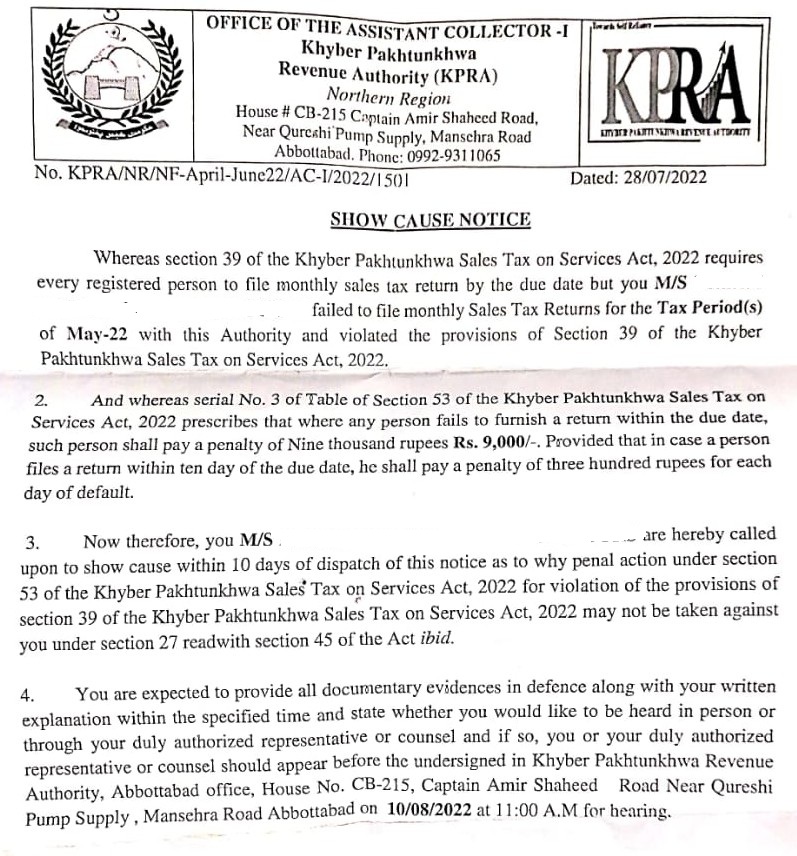

What Consequence Will Be Faced If Don’t Not File KPRA Monthly Returns

If the taxpayer does not comply within the stipulated period, a Show Cause Notice will be issued by the KPRA office, detailing all the months for which returns were not filed. The taxpayer will be asked to explain through this notice why the required returns were not filed on time.

If the taxpayer does not respond to this notice within the stipulated time, a penalty order will be issued against them.

Failure to comply with the direction may result in fines, and that if the fine is not paid, more stringent legal action may be taken which may include arrest or forced recovery of fine by the police.

Summary:

- Businesses providing taxable services must register with KPRA. Registration requirement for Individuals are NTN, bank statements, utility bills, and an authority letter.

- Firms and companies must provide certified copies of specified forms.

- Registered taxpayers must file monthly returns, even NIL ones.

- Non-compliance results in fines up to Rs. 100,000 and penalties.

If you need any further information about Simplified Guide on How to Register with KPRA in 2025 please get in touch with us through our website by filling out the Contact Us form, or reach out via our social media accounts.