Not Declaration All Assets

7 common mistakes to avoid when filing income tax returns with FBR here is the first big mistake is that people do not declare all their assets. They think that if you declare assets, you will have to pay tax. The fact is that you have to pay tax only if you have created more assets than your income. Assets are not created in a year, but over time, so you must declare all your assets.

Failure to Check All Bank Transactions

The second mistake is that people only write down the bank balance but do not take out a bank statement. In fact, it is important to check every transaction. If there is a large or unusual transaction, the source of it has to be found. For example, if a teacher suddenly gets Rs 15–20 lakh in his account, it is important to see where this money came from did his son send it, did he borrow it from a relative, or did he receive a gift from someone? All these transactions must be declared clearly.

Non-Disclosure of Complete Income Sources:

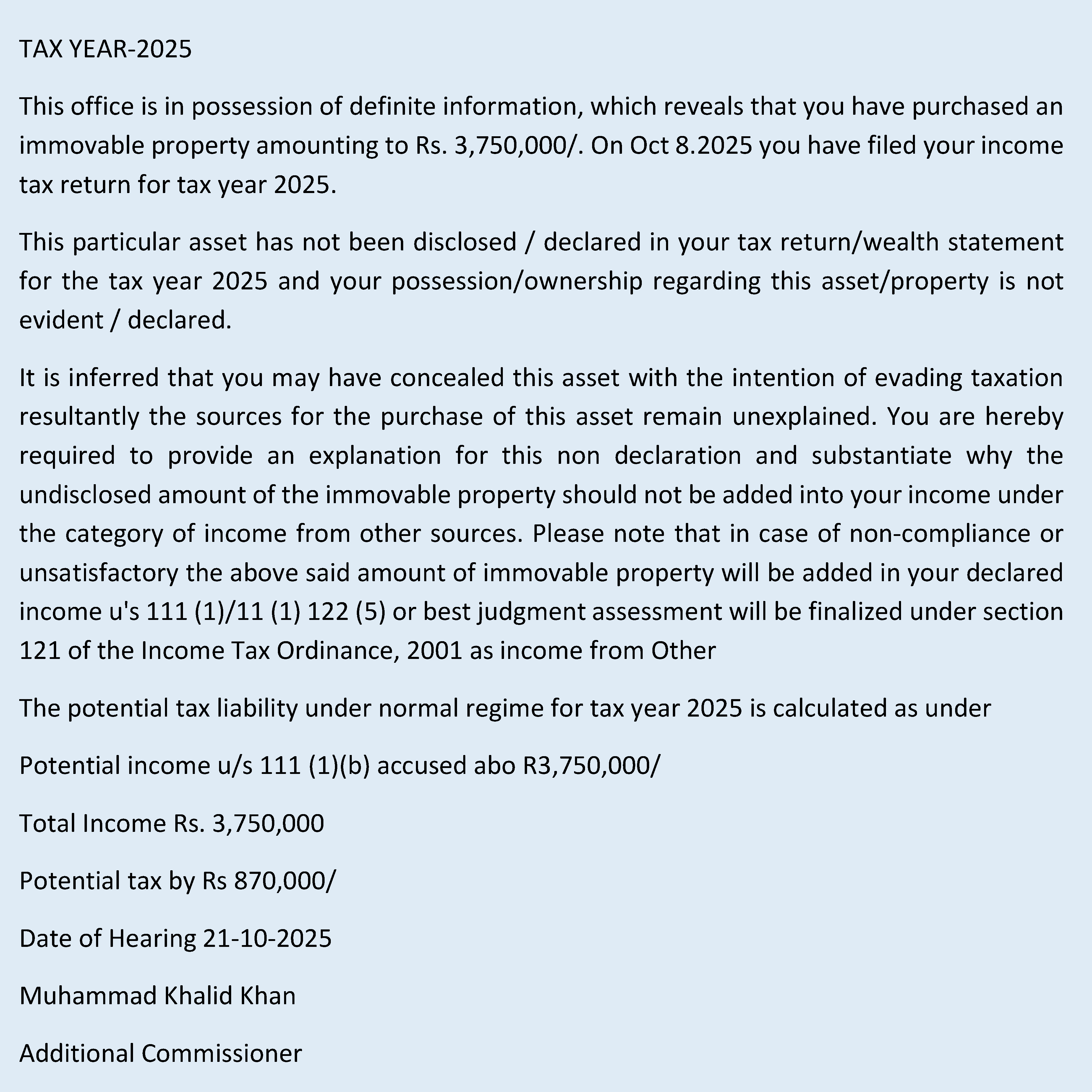

The third of 7 common mistakes to avoid when filing income tax returns with FBR is not disclose their entire income or only disclose a portion. This can lead to problems in the future because the FBR already has the information. Later, when you buy an asset, The FBR may send a show cuase notice under section 111 of the income tax ordinance 2001 and asked taxpayers to explain it to the authority and provide a money trail for that asset.

If you cannot provide a money trail, you can be taxed, which is usually very high.

Here is the text of show cuase notice under section 111 which has sent to a taxpayer.

Undeclared Expenses:

Undeclared Expenses:

Similarly, another common mistake is not declaring expenses properly. Nowadays, purchases and other payments made from shopping malls are made from separate bank accounts or credit cards, the reporting of which reaches the FBR in real time. Later, the details are also obtained from the banks and shared with the FBR, on the basis of which you can be caught. If your expenses are more than your declared income, it can be easily proven that you have hidden your income. For example, if you have declared that your annual income is only Rs. 700,000, but your expenses are more than Rs. 10 to 12 lakh, this may immediately come to the notice of the FBR.

7 common mistakes to avoid when filing income tax returns with FBR: No Caution Is Taken in Risky Transactions:

No Caution Is Taken in Risky Transactions

It has often been seen that the transaction is reported but its evidence is not retained. This can lead to three to future problems. These include gifts, foreign remittances and loans and also not Keeping Complete and accurate records.

PRC Not Obtained for Foreign Remittance.

For example, if you have foreign remittance in your account, then it is mandatory to get a PRC. If the amount is more than 5 million, then the source of income of the sender must also be mentioned. If it is less than 5 million, then the FBR will not ask, but if it is more than that, the source must be mentioned.

Gift

Similarly, if someone has given or received a gift, both have to be declared in their respective tax returns. Gifts can only be given to blood relations, giving to anyone other than family is not permissible according to tax laws. But most people give gifts to their friends or take them from them and do not have any proof of it. For example, if someone is gifted a car or jewellery, then it is mandatory to make a gift deed for it and all legal requirements must be fulfilled. Otherwise, this gift amount may be taxed.

Loan

Similarly, if someone is given or taken a loan, both parties have to declare it in their respective tax returns. For this, it is necessary that this transaction is done only through banking channels, cash transactions are not allowed. An agreement should also be made along with it so that it can be presented to the FBR as evidence in the future.

Requirements to Be Fulfilled for These Risky Transactions

The fifth of the 7 common mistakes to avoid when filing income tax returns with FBR is When loan or gift is received, it is essential that the legal requirements are met. The most important condition is that the money is received through a banking channel i.e. crossed cheque, demand draft, pay order or bank transfer. Cash payment is not acceptable. Payment through banking ensures that the identity of both the giver and the recipient can be proven.

What are the consequences if the transaction is not done through a bank?

- If the payment is made in cash instead of in a bank or if the records are unclear:

- The amount can be included in the recipient’s income and taxed.

- For example, if Rs 2 million is received during the year in cash rather than bank the tax that will be payable is Rs 290,000.

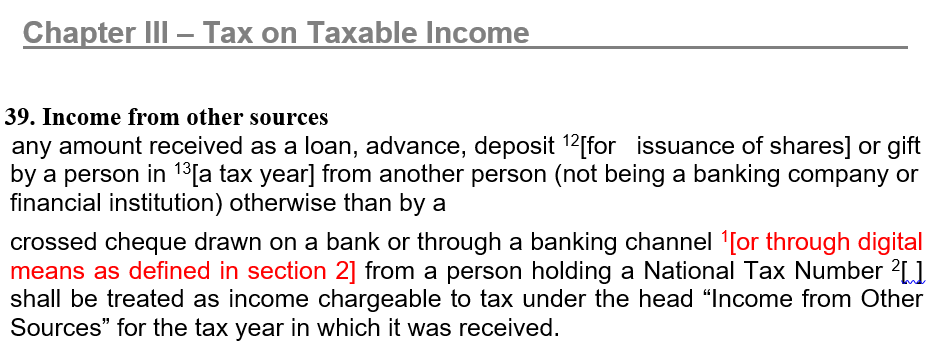

- Here is the original text of section 39 (Income from other sources) of the income tax ordinance 2001.

The risk of transferring to a third party account

7 common mistakes to avoid when filing income tax returns with FBR is Sometimes, instead of transferring the money directly to the beneficiary’s account, people first transfer it to a third party’s account, and from there it also goes to the account of the actual beneficiary. The disadvantage of this is that it becomes difficult for the intermediary (through whom the money was passed) to prove later where the money came from and why it was sent. As a result, the transparency of the transaction is affected and legal complications can arise.

Others Transparency Requirements for Loan or Gift

- If the loan or gift is legally properly disclosed for example, by drawing up a loan agreement, showing the amount in a bank statement, and both parties entering these matters in their tax returns then the bank’s requirements will be met and the case may be cleared. But remember:

- The giver will also have to prove where they got the money and show it on their tax return.

- Just keeping the recipient’s records accurate doesn’t make the matter completely clear the giver’s records also need to be transparent.

7 common mistakes to avoid when filing income tax returns with FBR: Filing Tax Returns from Non-Professionals

A big mistake is that people get their tax returns filed by an inexperienced or unprofessional person just because of the low fee. It may seem cheap at first but it can prove to be harmful later. It is better to always get your tax returns filed by an expert professional so that your records are correct and you also get the right guidance.

To get more information fill out the Contact Us form on our website or connect with us through our social media accounts.

Undeclared Expenses:

Undeclared Expenses: