7 Essential Steps to Avoid Penalties After Receiving an FBR Notice: Receiving any correspondence from the FBR regarding income tax is a common occurrence in Pakistan, but unfortunately, most people become unnecessarily panicked in this situation. The fact is that receiving a Letter does not mean that you have committed any tax fraud or illegal act. Every year, thousands of notices are issued by the depatment, the main purpose of which is simply to clarify, verify or complete information.

7 Essential Steps to Avoid Penalties After Receiving an FBR Notice: Receiving any correspondence from the FBR regarding income tax is a common occurrence in Pakistan, but unfortunately, most people become unnecessarily panicked in this situation. The fact is that receiving a Letter does not mean that you have committed any tax fraud or illegal act. Every year, thousands of notices are issued by the depatment, the main purpose of which is simply to clarify, verify or complete information.

The real importance is that you understand the notices, know the reasons and respond appropriately.

First Reaction to Receiving a FBR Notice

The first and most important thing is not to panic when receiving a notice.

It is not correct to assume that a notice necessarily means committing a crime. Most of the time, FBR correspondence are issued for information gaps, data inconsistencies or simple clarifications.

Take the notice seriously, but do not be afraid or confused. If you are able to understand the letter and respond appropriately, the process is easy and manageable.

Reasons for Receiving FBR Notices

There can be several reasons for the department to issue a notices. Below are the main reasons that usually lead to the issuance:

Bank Transactions Difference

The department receives details of your bank accounts from various sources. If the amount of deposits or disbursements in your accounts is more than your declared income, the FBR may ask you for an explanation.

Undisclosed Property or Assets

If you have purchased a property or vehicle and have not disclosed it in your return or wealth statement, the department may issue a notice based on the data received from Excise or NADRA.

Withholding Tax Record

If a company or institution has deposited withholding tax under your CNIC but you have not disclosed this transaction in your return, then this is also a common reason for a notice.

Name in audit selection

Every year, the department selects a few taxpayers for audit through an automated system. If your name is included in this list, you will receive a notice.

Data Mismatch

If the information received by the FBR does not match your filed return, for example, differences in salary amounts or sales and bank deposits, then a notice is also issued in this case.

Types of FBR Notices and Related Sections

FBR notices are issued under different sections, each of which has a different purpose. The important sections are explained below:

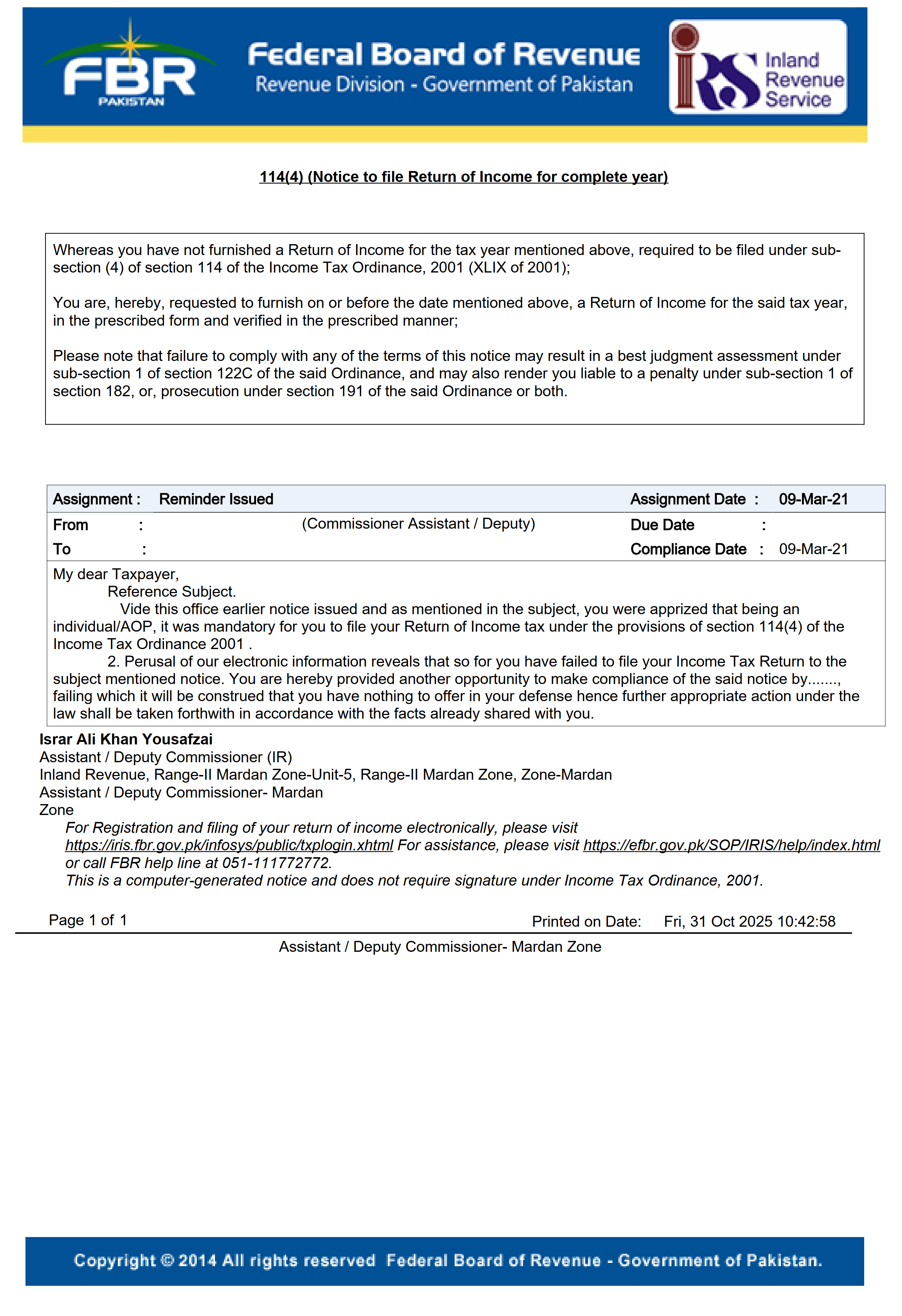

114(4) Notice to File Return:

If a taxpayer does not file an income tax return within the prescribed period, then a notice is issued under this section.

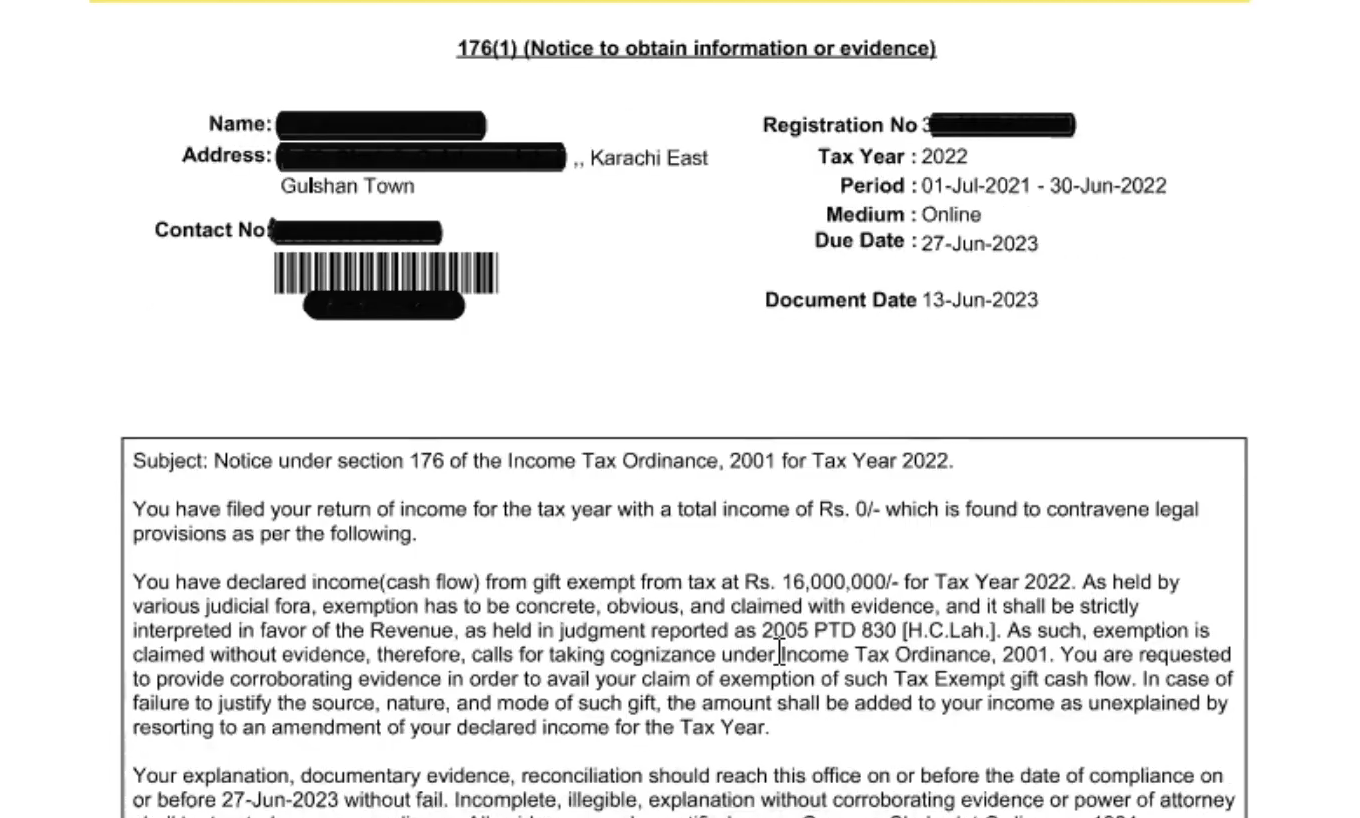

176 Notice to Obtain Information or Evidence:

176 Notice to Obtain Information or Evidence:

This notice comes when the FBR asks you for documents or evidence in a case.

For example:

If you have declared “Gift” in the return, the FBR may ask who the gift giver is, whether he has also filed his return, and where is the gift deed or evidence.

If you have shown “Foreign Remittance”, then bank statement and PRC (Persuaded Receipt Certificate) may be sought.

If you do not provide the required evidence, the FBR may declare these amounts as your “Income” and impose tax on them.

These notices cannot be ignored. If you do not respond, the FBR may take further action and issue a Ex-parte order.

122(9) and (5A) Amendment of Assessments:

When there is a discrepancy between the information in the FBR’s records and the data provided by you, or the FBR believes that you have understated income, made a misrepresentation, or there is any discrepancy in the return, then in such a case a notice is issued under this section to clarify the return you have submitted.

Requirements to Amend assessment

Notices under this section can be issued only within six years of the filing of the return.

Furthermore, the tax officer shall decide or pass an assessment order within one year after the notice is issued.

If the order is issued after the expiry of the prescribed period, all orders issued under this section after one year shall be deemed to be void.

If Notice under section 122(9) has been issued, then the approval of the Commissioner is required to revise the return.

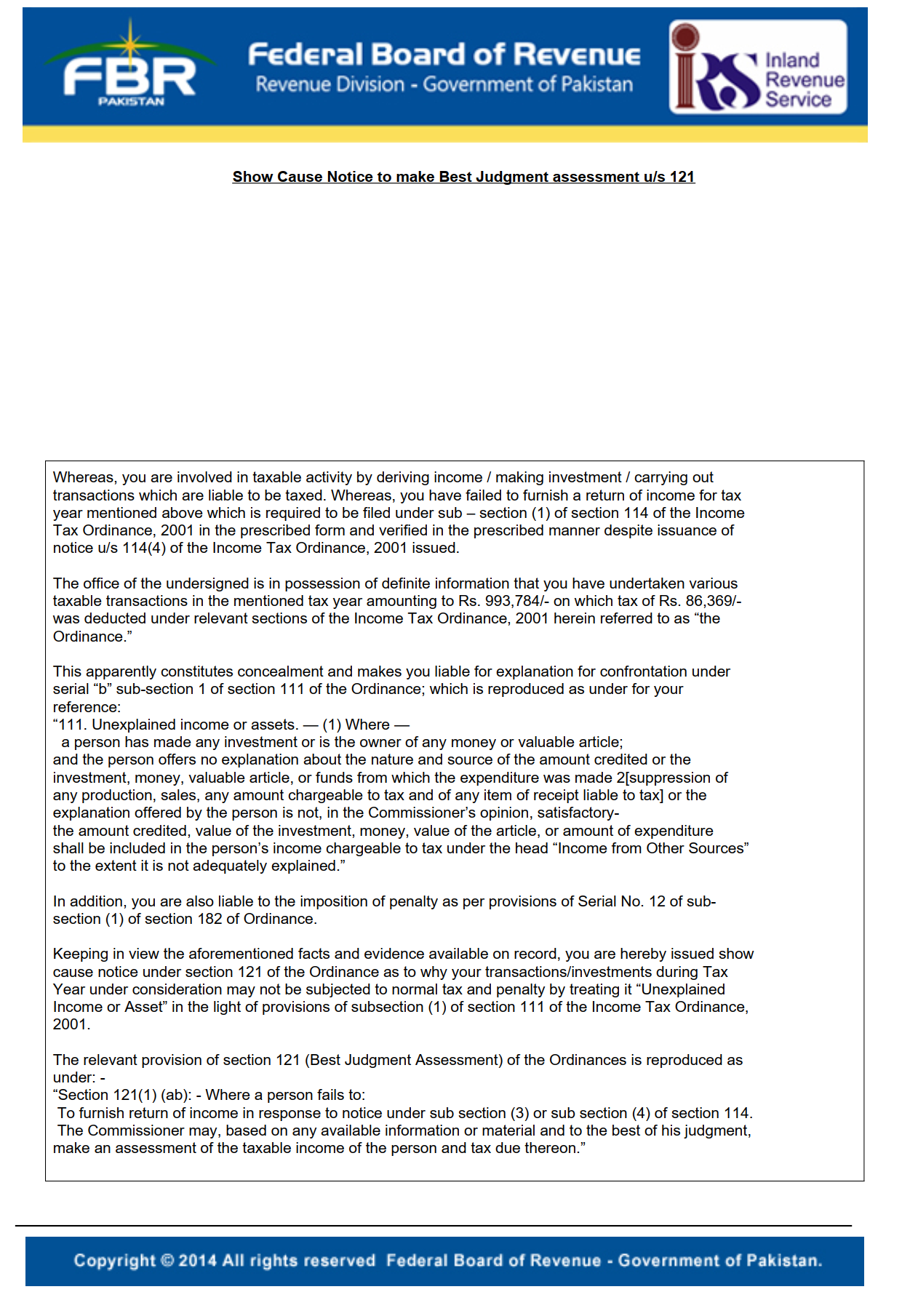

111 Unexplained Income or Assets:

These notices are issued when the FBR has clear information that shows that you have not properly disclosed your income, sales, assets or hide anything.

For example:

If you purchased a property worth Rs. 2 million during 2025 but did not mention it in your return, the FBR may ask you where this money came from.

If you cannot explain, the FBR will consider this amount as your “Unexplained Income” and will impose tax on it.

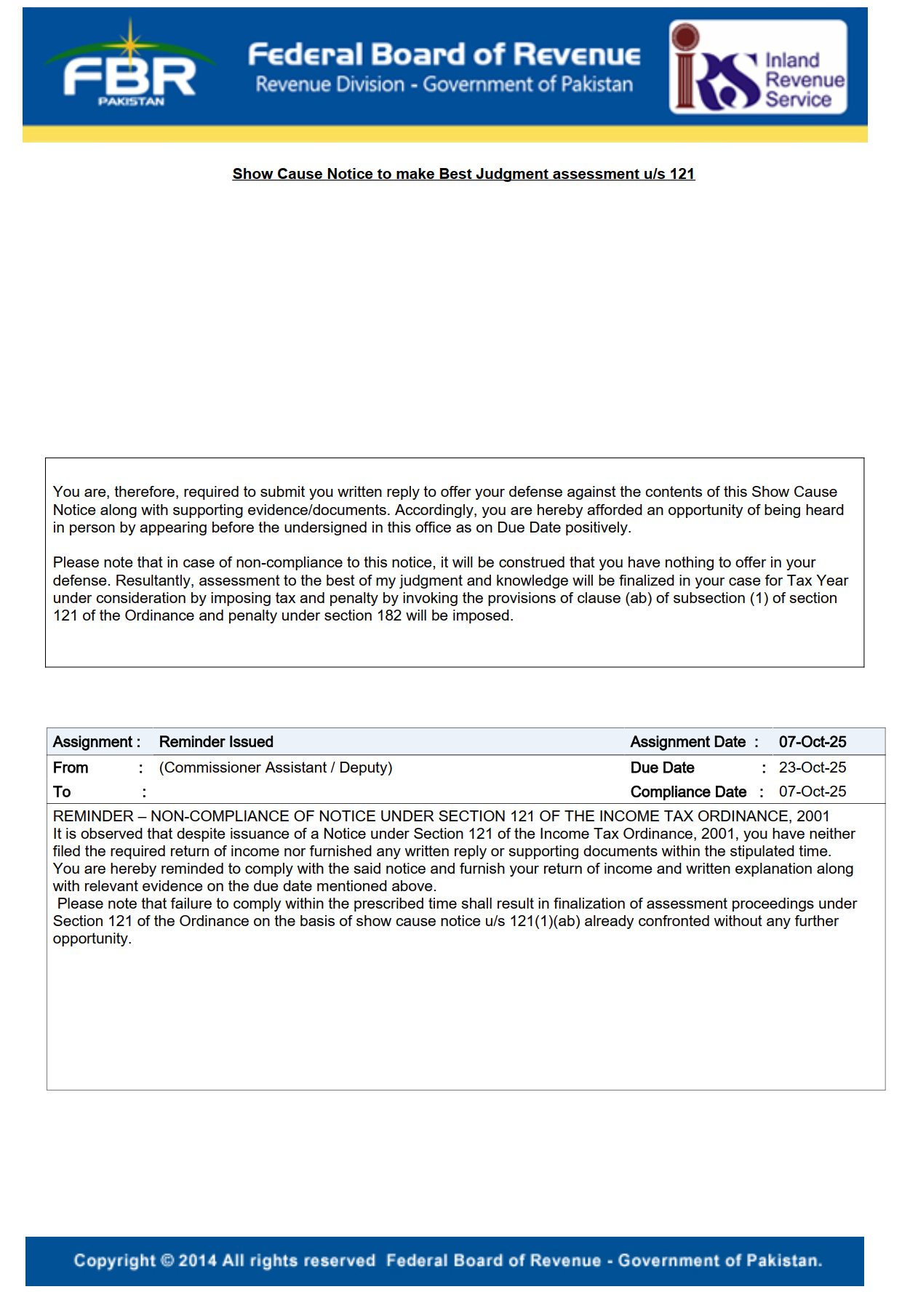

Audit Notice (Section 177 or 214C):

This notice is issued when your case is selected for audit.

In this, the tax department can ask you for all records, invoices, bank statements, proof of purchase and sale, salary records, etc.

If you ignore the audit notice, then the authorised officer issues an Ex-parte Order, which may impose additional tax demand.

Action Plan after receiving the notice

7 Essential Steps to Avoid Penalties After Receiving an FBR Notice: The most important step after receiving the notice is to respond to it in a timely and correct manner. The following steps should be taken step by step:

Check the section number and text of the notice

The notice usually clearly states under which law or section the FBR has issued it. First, read and understand this section carefully so that you know exactly what the FBR is asking you to do. Moreover, the text of the notice details what information, documents or explanations the FBR wants to provide. If the content of the notice is simple and understandable, you can prepare a proper response to it yourself.

Check the deadline

Each notice gives a fixed period for response, which is usually 15 to 30 days. It is very important to respond on time.

Consult an expert

If the nature of the notice is complex, or it involves legal aspects, seek help from a qualified tax consultant or chartered accountant. A wrong or inaccurate response can be detrimental.

Submit a timely response

In case of ignoring the notice or late response, the FBR may automatically estimate your income under Best Judgment Assessment and impose tax and penalty.

Common mistakes that should not be made while responding to notices

Most of the time, taxpayers make some mistakes while responding to notices which later prove to be harmful for them. Pay special attention to the following points:

Never ignore the notices

Ignoring the notices means putting yourself in trouble. The FBR system is automated, which takes action without human intervention.

Do not provide false or fake explanations.

The FBR has complete information from NADRA, banks and other institutions. Don’t provide false receipts or false statements

Do not try to hide income or assets.

All financial transactions are automatically recorded in the FBR records through your National Identity Card (CNIC). Therefore, you cannot hide assets like property or a motor vehicle, especially when they have been acquired recently.

Understanding the modern system of FBR

The FBR is now working under a modern digital system that includes artificial intelligence and a mutual data sharing system of various institutions.

This system automatically receives information from NADRA, banking channels, excise department and other sources and after analyzing the data, selects suspicious cases for notices. It should be remembered that the data received by FBR is about 99 percent accurate. Therefore, do not take any notice for granted, but clarify or correct it accordingly.

7 Essential Steps to Take When Receiving an FBR Notice

The last of 7 Essential Steps to Avoid Penalties After Receiving an FBR Notice : to avoid easily is to file returns with transparency, accurate data, and on time.

If you honestly disclose all your income, assets, and transactions, responding to any FBR correspondence will not be difficult.

- File your annual return on time.

- Submit your wealth statement correctly.

- Maintain consistency in bank transactions and returns.

- If you receive a notice, respond in a timely and authentic manner.

- Preserve all records for at least six years.

Summary:

A notice from the FBR is not a punishment but an opportunity for clarification. If you handle the matter with prudence, timely response, and accurate information, the process remains easy, orderly, and loss-free.

The purpose of the tax system is not just to promote collection but also transparency and that is also our duty as a responsible citizen. If you need more about 7 Essential Steps to Avoid Penalties After Receiving an FBR Notice please contact us through our website by filling out the Contact Us form, or reach out via our social media accounts.

176 Notice to Obtain Information or Evidence:

176 Notice to Obtain Information or Evidence: