7 Dangerous Mistakes That Can Get Your Bank Account Blocked Are You Making These Mistakes Too? : In Pakistan, thousands of people’s bank accounts are being closed or blocked every day. I also get dozens of people contacting me every day saying that our bank account has been closed, what should I do now? How to reopen it? Surprisingly, most people don’t even know why their account was closed.

Today I will tell you seven big and dangerous mistakes that cause accounts to be closed. These mistakes are mostly made by overseas, freelancers, shopkeepers and small business owners. You may be making any of these mistakes too, and remember: even one of these mistakes is enough to block your account.

First mistake: Mismatch of Declared Income and Bank Transaction

This is the most dangerous mistake. Most people declare less income in their tax returns while heavy amounts are circulating in the bank account which is more than the taxpayers declared income.

For example, if you have declared a monthly income of 50 thousand in your income tax return while 3 to 4 lakh rupees are deposited into the bank account every month, the bank’s system immediately catches this miss match.

The bank suspects that the source of income is not verified or the amount deposited is from money laundering, due to which the account is frozen and the details are requested from the account holder.

Risk of bank account blocking due to committees

Apart from tracking income, another big reason is that people usually set up committees etc. When a committee is set up, the money of all the members is deposited in the bank account of the same person every month.

For example, if there are 20 members and each person is depositing Rs 20,000 per month to the committee, then Rs 400,000 will come into the account of this one person every month.

Discrepancy between income and committee money

If the actual monthly income of this person is only Rs 50,000 salary but Rs 50,000 to 60,000 is coming into his account every month, then this can become a problem for the FBR and the bank, because this money of the committee is not real income, but the bank can consider it as income and consider it as a suspicious transaction.

The importance of legal cover and records: Preparing a committee agreement

That is why it is important to make an agreement between all the members of the committee in which it is clear that these funds belong to the committee and not income. With this agreement, bank statement and proper documentation, you can easily respond to the FBR notice and can also clear the inquiries of the FIA or other agencies. If you submit this agreement and records properly, your bank account may be saved from being blocked.

Second Mistake: Frequent Cash Deposits

If you deposit large amounts of money into your bank account daily or repeatedly and you have neither recorded it in your tax return nor informed the bank, the bank considers it as high-risk cash activity.

Such activities are linked to fraud, illegal business or tax evasion, so the bank blocks the account and asks for details.

Third Mistake: Making business transactions in a personal or salary account

Many people use their salary account or personal bank account for business.

For example, if you have opened a shop, work part-time, run an online store, do wholesale business or do freelancing, then do not use your salary or personal account for all such business matters. As soon as the bank sees a business pattern, it freezes the account and asks for KYC details.

Fourth Mistake: Taking someone else’s money into your account

Also, you should never ask for money from another person in your account, even if he is your close friend or relative. Even if he insists, do not do so. Because if later it is proven that the money was from fraud, money laundering or any illegal source, then you will also be caught in the case, just because your account was used.

If any illegal money first came into one account, then from there it was transferred to another and then to your account, then an investigation is conducted against all three people. Until the investigation is completed, all these accounts are kept blocked.

Fifth mistake: Link transactions to Forex, Crypto or Gambling

Do not bring crypto, online betting, illegal forex trading, etc. in Pakistan.

If the bank finds that your account is linked to such wallets or platforms, then the risk of blocking the account increases greatly.

Sixth mistake: Not updating KYC/data

Every bank updates the user data after 1 to 2 years:

Address, profession, source of income, CNIC expiry, etc.

If you do not update this information in time, the account gets blocked.

Seventh reason: Benami Transactions

Another major reason is benami transactions.

It often happens that a person’s account suddenly receives a large amount of money for example, 1 crore or or even more. But you does not know who sent the money and why. Such unknown and suspicious amounts are called benami transactions.

When money arrives in your account like this, often the person who sent it later calls and says, “Money has been transferred to your account by mistake, this is our account number, please transfer the money back.”

But you should never do that!

- Do not send them the money back, but report it to your bank immediately.

- Call the bank’s helpline and tell them that an unknown amount has been transferred to your account.

- It is better to also email the bank so that you have written proof.

- Along with this, submit a written request to your bank branch.

These steps are necessary so that if there is an investigation later, the bank’s records can prove that you reported it immediately.

What should you do if your bank account is blocked?

The first thing to do is to immediately contact your bank branch where you have your account. Ask the branch manager or the concerned officer why my account is blocked?

Usually, whenever an account is blocked, you will definitely receive an SMS or notification from the bank.

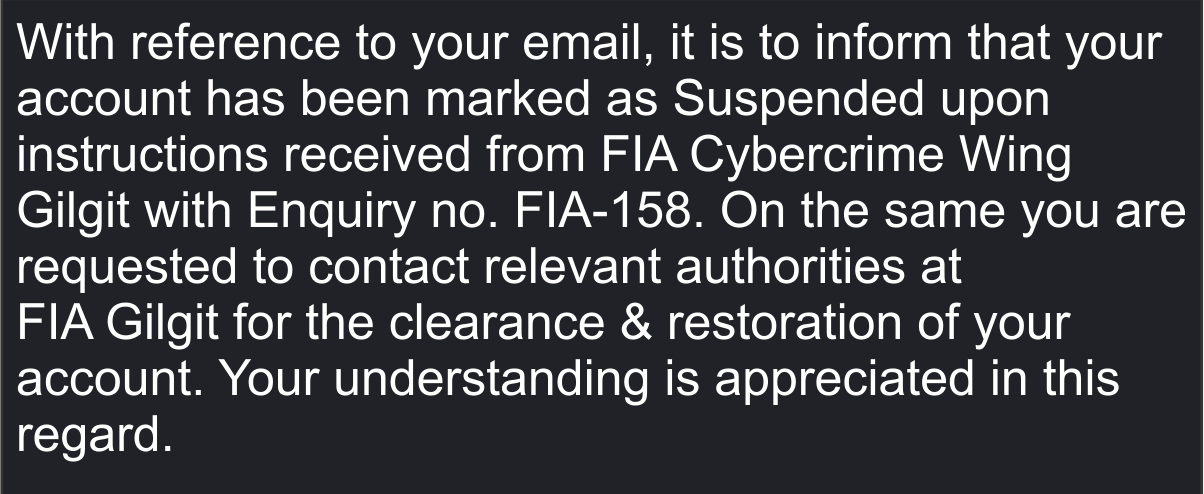

FIA cannot directly block anyone’s account.

It only sends instructions to the bank based on the inquiry, after which the bank closes the account.

When the FIA gives instructions to the bank, the bank receives an official email in which:

Inquiry number

Reasons

And the details of the related case are written. This is the information that the bank can provide to you. Therefore, be sure to get that inquiry number from the bank.

After that, you will have to go to the relevant FIA office and find out on what basis the inquiry has been started against you.

There your documents, evidence and explanation are heard. If you are innocent, your account is restored.

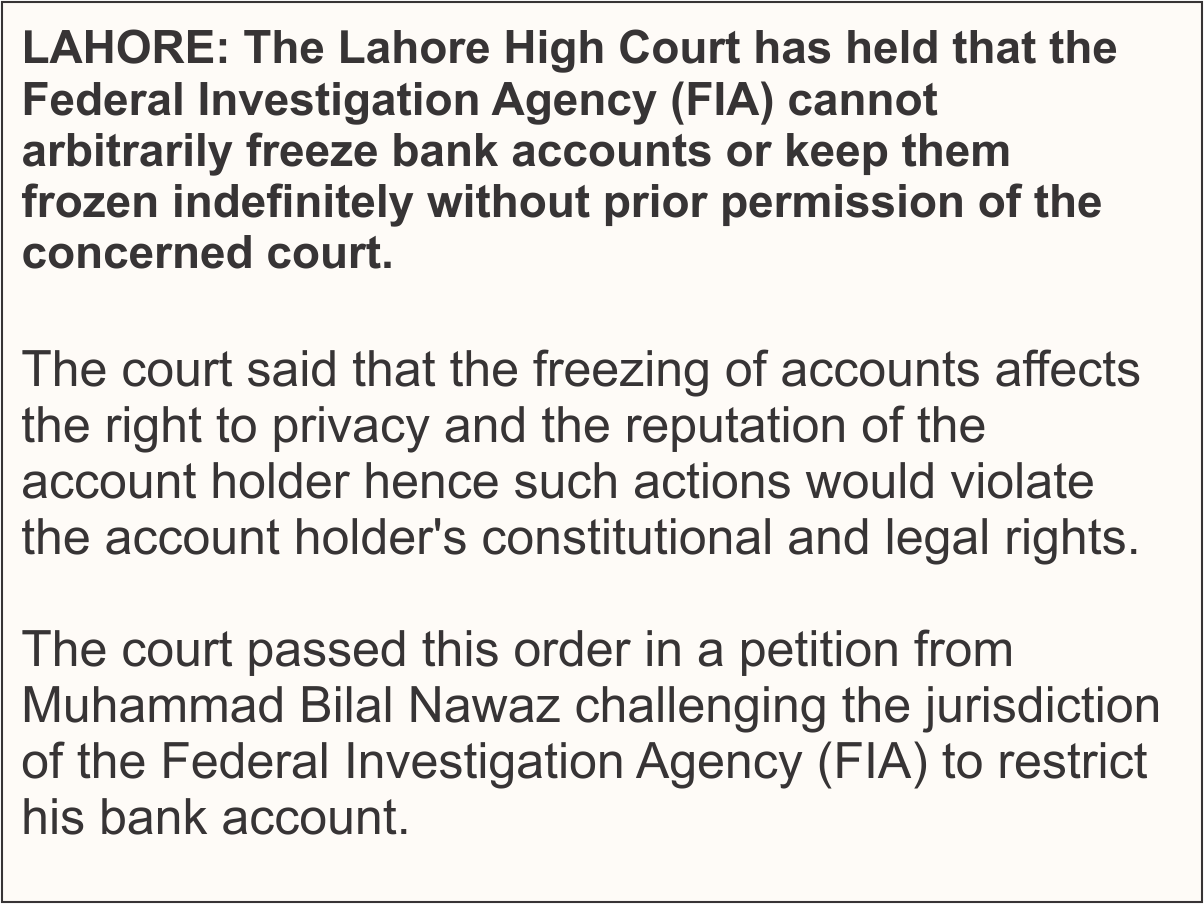

FIA cannot freeze bank accounts without court permission:

FIA cannot block an account without legal permission. According to the different Court decisions including Lahore and Baluchistan High Courts first the FIA has to go to the relevant court and present evidence, and the bank account is blocked only on the basis of the permission or order of the court.

7 Dangerous Mistakes That Can Get Your Bank Account Blocked Are You Making These Mistakes Too?

The most common mistakes include mismatching income and bank transactions, committee money being deposited without records, conducting business transactions in personal or salary accounts, taking someone else’s money into your account, making crypto, forex or online betting transactions, not updating the bank’s KYC information and benami transactions i.e. receiving large unknown amounts of money suddenly. Any one of these mistakes can get the account blocked immediately.

If the account is blocked, first find out the reason from the bank, get an inquiry number and submit your explanation. For further information please contact us please reach out via our social media accounts.