5 Powerful Tips to Master Advance Tax Avoid Costly Mistakes: Nowadays, many taxpayers are receiving notices of advance tax under Section 147 and recovery under Section 138. This means that if you have not deposit the amount due, the FBR can take action to recover it, and sometimes there is a phone call from the FBR in this regard.

5 Powerful Tips to Master Advance Tax Avoid Costly Mistakes: Nowadays, many taxpayers are receiving notices of advance tax under Section 147 and recovery under Section 138. This means that if you have not deposit the amount due, the FBR can take action to recover it, and sometimes there is a phone call from the FBR in this regard.What is advance tax?

If you have paid tax on your taxable income in the current year, then next year you will have to divide the same amount into four equal parts and pay one instalment every three months. For example, if you have paid Rs. 100,000 in the year 2024, then in 2025 you will have to pay Rs. 25,000 every three months.Who will pay advance tax?

- Every company, individual, or partnership firm (AOP) has to pay advance tax every three months, i.e. every quarter.

- Individual taxpayers and partnership firms are liable to pay only if their taxable income in the previous year exceeds Rs. 1,000,000.

- However, advance tax is not applicable on salary, bank profits, and dividend income, even if the income exceeds Rs. 1,000,000.

What are the reasons for incorrect advance tax notices being issued to taxpayers?

Notices is actually issued automatically by the system. A common reason for this is that if an individual’s taxable income exceeds Rs. 1,000,000 the system automatically issues a notice to him.However, if the nature of the income is salary, dividend, or bank profit, then no notice should be issued in such a case. But if salary or bank profit is mistakenly entered in the “Other Income”, the system considers it as business income and sends an auto generated notice.5 Powerful Tips to Master Advance Tax Avoid Costly Mistakes: Notices Due to Misclassification

Similarly, if income under the fall under FTR but mistakenly declared under the NTR while filing the annual return of income, this also becomes a common reason for issue of notices.For example:

Suppose a taxpayer has provided services worth Rs. 8 million to a company during the year, on which the company has deducted tax of Rs. 440,000 . If expenses of Rs. 6.4 million are deducted, the net profit of the taxpayer becomes Rs. 1,600,000 on which tax of about Rs. 170,000 is payable as per normal rate. However, since the deducted amount under section 153 (Rs. 440,000) is a minimum tax, and it is more than the normal liability, it shall be considered as final tax.

If this amount was correctly disclosed in the tax return?

If the income is correctly declared under the FTR, the taxable income under NTN becomes zero.But if the taxpayer mistakenly declares the same income as normal taxable income, the system considers Rs. 1,600,000 as taxable incomes which is more than Rs. 1 million and on that basis, notice for advance tax is automatically issued.What should you do if you receive an advance tax notice, but it does not apply to you?

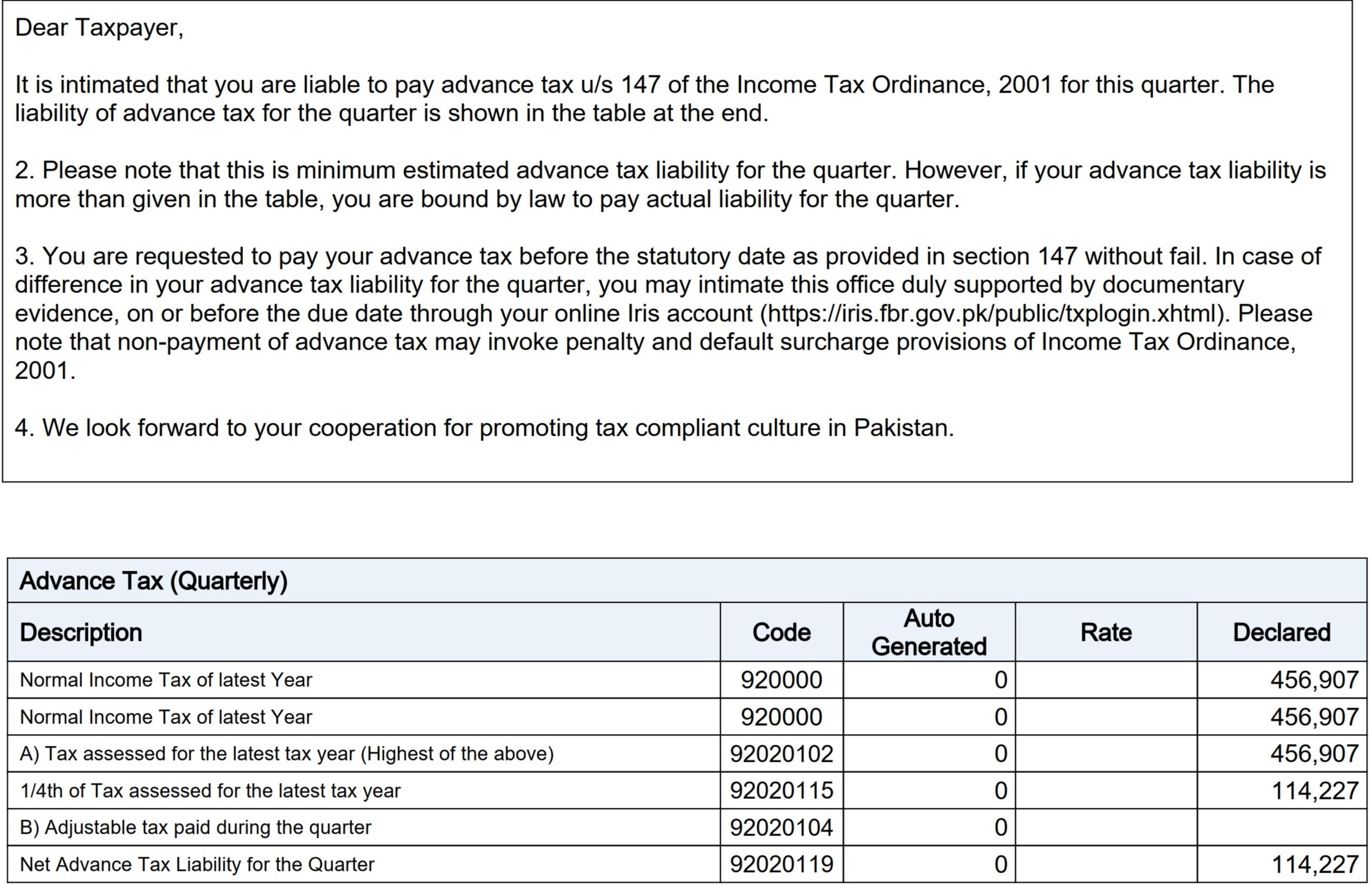

Often, notices are issued automatically due to minor errors in the annual return, even though advance tax is not applicable as per the taxpayer profile.If you have received such a notice and you believe that it has been issued in error, for example, you have mistakenly entered your salary income under “Income from other sources”, then take the following steps:First, correct your income tax return.Then present all supporting documents such as bank statement, salary slip and explain with evidence that the error was unintentional after that The notice may be cancelled.5 Powerful Tips to Master Advance Tax Avoid Costly Mistakes: How advance tax liability is calculated?

For individual

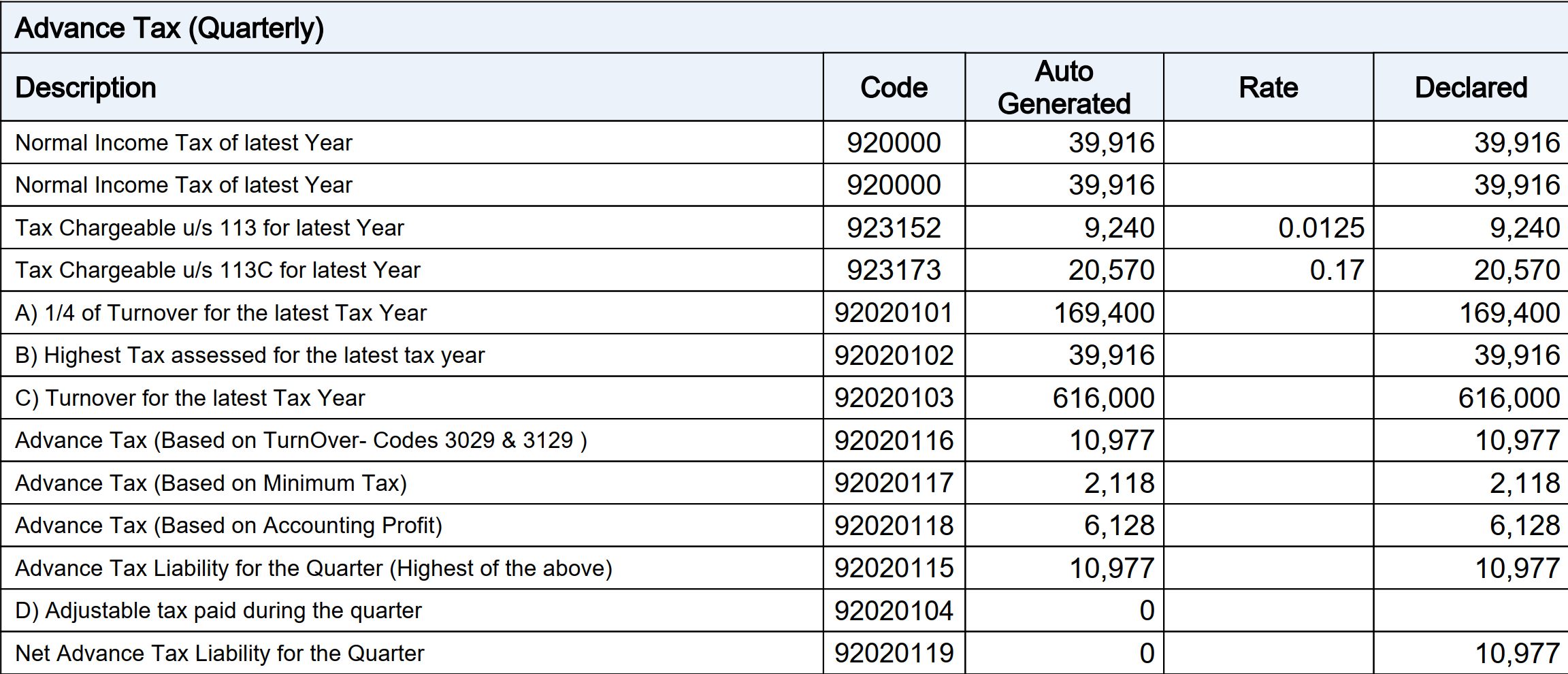

(A/4)-BA= Tax Chargeable for the previous fiscal yearB= Taxes paid during the the quarterFor company

(Ax B/C) – DA is the sales for the quarter;B is the tax Chargeable for the previous fiscal yearC is the sales for the previous fiscal yearD is the taxes paid during the the quarterIf the quarterly not known, then 120% of the sales of the previous fiscal year will be taken as one fourth (1/4).Along with this, taxes under Section 113, 113C and Section 4C will also be included.This law was also made so that taxpayers would pay taxes in instalments throughout the year instead of feeling the burden at the end of the year.5 Powerful Tips to Master Advance Tax Avoid Costly Mistakes: What to do if sales declined?

The advance tax is based on the previous year taxable income, if your business in year is less than the previous year, then the taxpayers still need to pay taxes even if business performance is worse. The taxpayer may file an estimate of his income to the Commissioner at any time before the due date of last instalment and can pay for the current fiscal year accordingly.The estimate of the lower liability shall contain:- Turnover for the completed quarters (filed GST returns)

- Estimated turnover of the remaining quarters

- Documentary evidence of estimated expenses / deductions

- If the Commissioner is not satisfied with the estimate, he may reject the estimate.

Date of advance tax payment?

An individual shall pay quarterly on 15th September, 15th December, 15th March and15 June.A company or an AOP shall pay quarterly on 25th September, 25th December, 25thMarch and 25th June.Penalty and punishment for non-payment of advance tax

Failure to pay amount due may result in- In fine or imprisonment up to one year.

- 12% annual default surcharge.

- If a company or AOP commits an offence, its responsible officers or members will also be guilty of the offence. However, usually only a fine is imposed; imprisonment is very rare.

5 Powerful Tips to Master Advance Tax Avoid Costly Mistakes: Practical instructions for taxpayers

Do not ignore the notices.Earlier, people did not give importance to these notices, but now the FBR strictly follows up on them. As soon as you receive the notice, log in to your IRIS account and check whether your liability is created or not.If your taxes have already been deducted at various places (e.g. imports, services, salary or contracts, etc.), your advance liability may be reduced or even eliminated.- Total Estimated Liability

- Taxes Paid Through Withholding

- Remaining Amount Due