5 Effective Tax Credits That Help Salaried Persons Save Tax in 2025: If you are a salaried person, you may not be aware that you can save a lot on your taxes.

According to Pakistan’s Taxation laws, when an employer deducts tax from your salary, they also have to adjust the taxes from your salary which you already paid such as from property, cash withdrawals, or other sources.

For example, if an employee’s annual salary is 3.2 million, the tax due on it is 346,000.

Suppose he has already paid 100,000 in tax on the purchase and sale of property, the total liability would be 244,000 instead of 344,000.

What Is Best Way to Claim Excess Tax Paid?

Since salaried individuals have already paid income tax on their salary, the only way available for them to get their tax refund is to claim a refund after filing their return at the end of the year.

But this process is time-consuming and often the government is unable to make payments on time due to financial reasons.

How to Get Tax Adjustment in Your Salary Tax?

You can get the taxes paid adjusted in your salary itself. When you provide your employer with proof of taxes paid (e.g. bank challan), he will make the appropriate adjustment. This way, you can adjust the excess amount paid immediately.

For this, go to your FBR IRIS Portal, select the MIS tab, and select the relevant tax year (e.g. 1 July 2025 to 30 June 2026). There you will get the details of all taxes paid such as mobile, bank withholding, property, etc.

The best way is to make these adjustments regularly every three months so that the burden is reduced at the end of the year.

Taxes that can be adjusted against payroll taxes?

Taxes that can be adjusted against payroll taxes?

All adjustable withholding taxes can be included as a reduction in the income tax deducted from your salary. Although the list is quite long, here are some common examples of Withholding taxes:

Cash Withdrawals from The Bank

Property Sale / Purchases

Transfer or Registration of a Motor Vehicle

Mobile Phone and Internet Bills

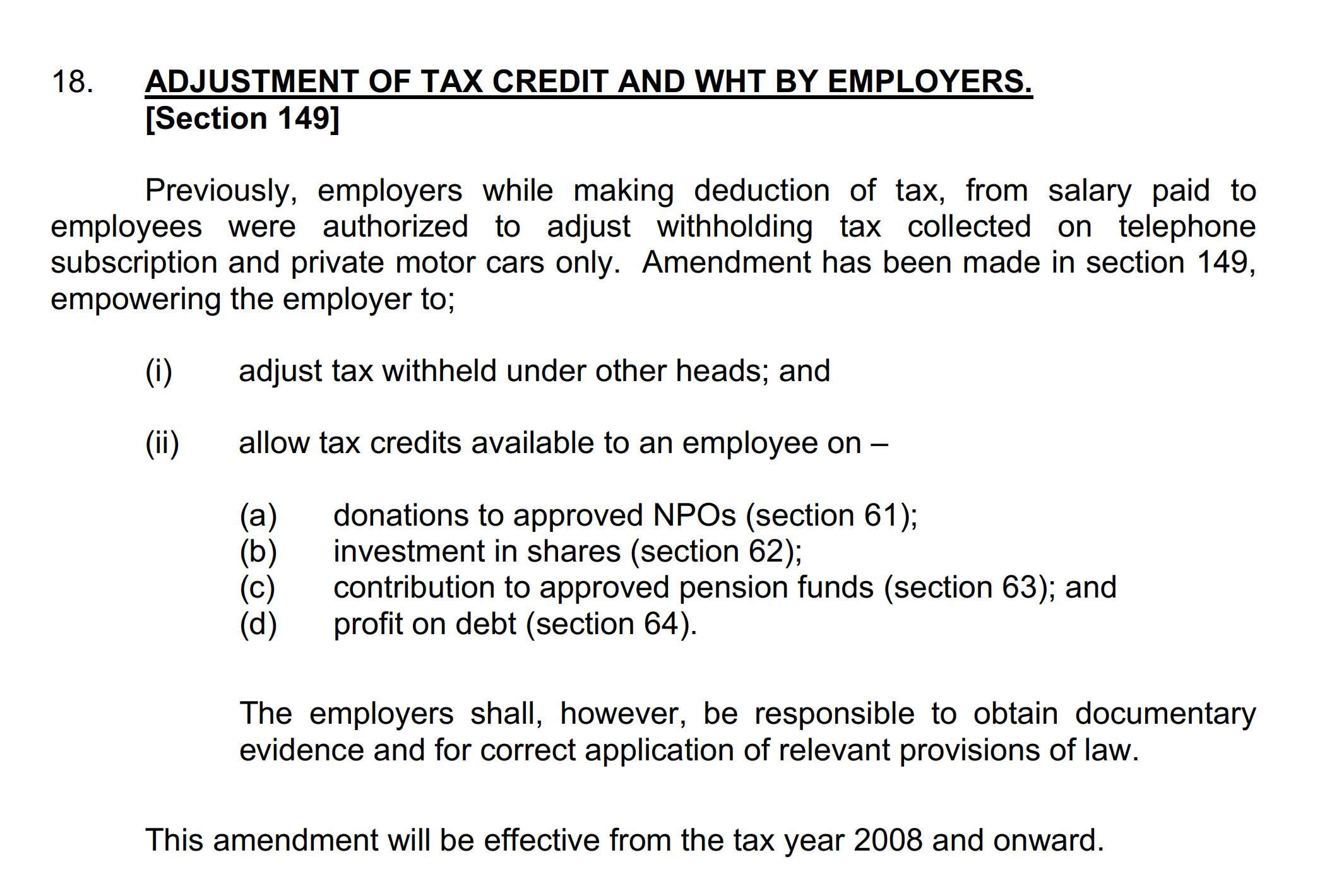

A circular issued on adjustment of tax credit and wht by employers from the FBR on 1 July 2007 is attached here.

Charitable Donations

Charitable Donations

Any person who makes any payment of any amount during the fiscal year by way of donation, voluntary contribution or subscription is entitled to a tax credit.

This exemption applies to donations made to the following institutions:

Any board of education or university

Any educational institution, hospital or relief fund established or operated under the federal, provincial or local government

Any non-profit organization.

How to Calculate Tax Credit on Charitable Donations?

The formula is: (A/B) * C

A is the amount of estimated tax

B is the person’s taxable income

C is the lesser of the total amount of the person’s donations including the fair market value of any property given or thirty per cent of the taxable income

For example:

A = Tax payable on salary = 346,000

B = Salary income = 3,200,000

C = Minimum amount: Contribution paid 60,000 or 30% of taxable income (3,200,000 × 0.3 = 960,000)

Now the tax credit will be calculated as:

(346,000 ÷ 3,200,000) × 60,000 = 6,488

Contribution to Pension Fund

If you are contributing to an approved private pension scheme, you can also get a tax credit. The formula is same as Charitable donations described above only difference is that maximum credit is up to 20% of your taxable income.

The government has given this facility so that private sector employees can also create a safe investment for their retirement.

Reduction for Teachers and Researchers

A 25% reduction in tax rate is available for full-time teachers or researchers working in HEC approved institutions this reduction is only available up to the fiscal year ended 2025.

The below mention deductions are also available to salaried and other persons as well such as business individuals.

Deduction of Zakat

If Zakat is given to an organization that is approved under the Zakat and Ushr Act, then full tax deduction can be obtained on the amount paid. For example, Zakat deducted through a bank or paid to Pakistan Baitul Mal.

Medical Allowance and Facilities

If free medical treatment to an employee?

If an employee is provided with treatment, hospitalisation or both by or under the auspices of an employer, or the medical or hospital expenses of the employee are paid by the employer, and this facility is in accordance with the terms and conditions of employment, such provision or payment shall be deemed to be a benefit provided that the NTN of the hospital or clinic concerned is furnished and the employer verifies the bills to which this provision applies.

If free medical treatment not provided?

If the terms and conditions of employment do not include free treatment or payment of hospital expenses, a medical allowance not exceeding 10% of his basic salary shall also be deemed to be admissible.

Deductible Allowance for Education Expenses

Every individual is allowed a deduction allowance on tuition fees paid during the fiscal year, provided his taxable income is less than 1.5 million.

The deduction allowed will be limited to the lower of the following three:

- 5% of the tuition fee paid

- 25% of the taxable income

- 60,000 per child

Example:

If a person’s annual income is 12,00,000 and he has paid 2,80,000 as tuition fee for 4 children, the calculation will be as follows:

5% of tuition fee =14,000

25% of income = 300,000

Per child 60,000 × 4 = 240,000

Since the lowest amount is 14,000, the allowable education allowance will be 14,000.

5 Effective Tax Credits That Help Salaried Persons Save Tax in 2025: Essential Guidelines

All important and supporting documents must be preserved for at least six years from the date of filing the tax return.

Avoid cash payments as much as possible; for example, pay Zakat or funds through the bank and keep the bank challan or receipt as proof.

Similarly, keep receipts for all types of payments such as school fees, etc.

For more information about 5 Effective Tax Credits That Help Salaried Persons Save Tax in 2025 Please contact us through our website by filling out the Contact Us form, or reach out via our social media accounts

Taxes that can be adjusted against payroll taxes?

Taxes that can be adjusted against payroll taxes? Charitable Donations

Charitable Donations